Will the Americans do the right thing?

The US is on the brink of economic collapse…again. But like many times in the past, there is a high chance that everything gets sorted at the 11th hour and the debt conversation gets pushed down the road. As Winston Churchill once said, “You can always count on the Americans to do the right thing after they have tried everything else.”

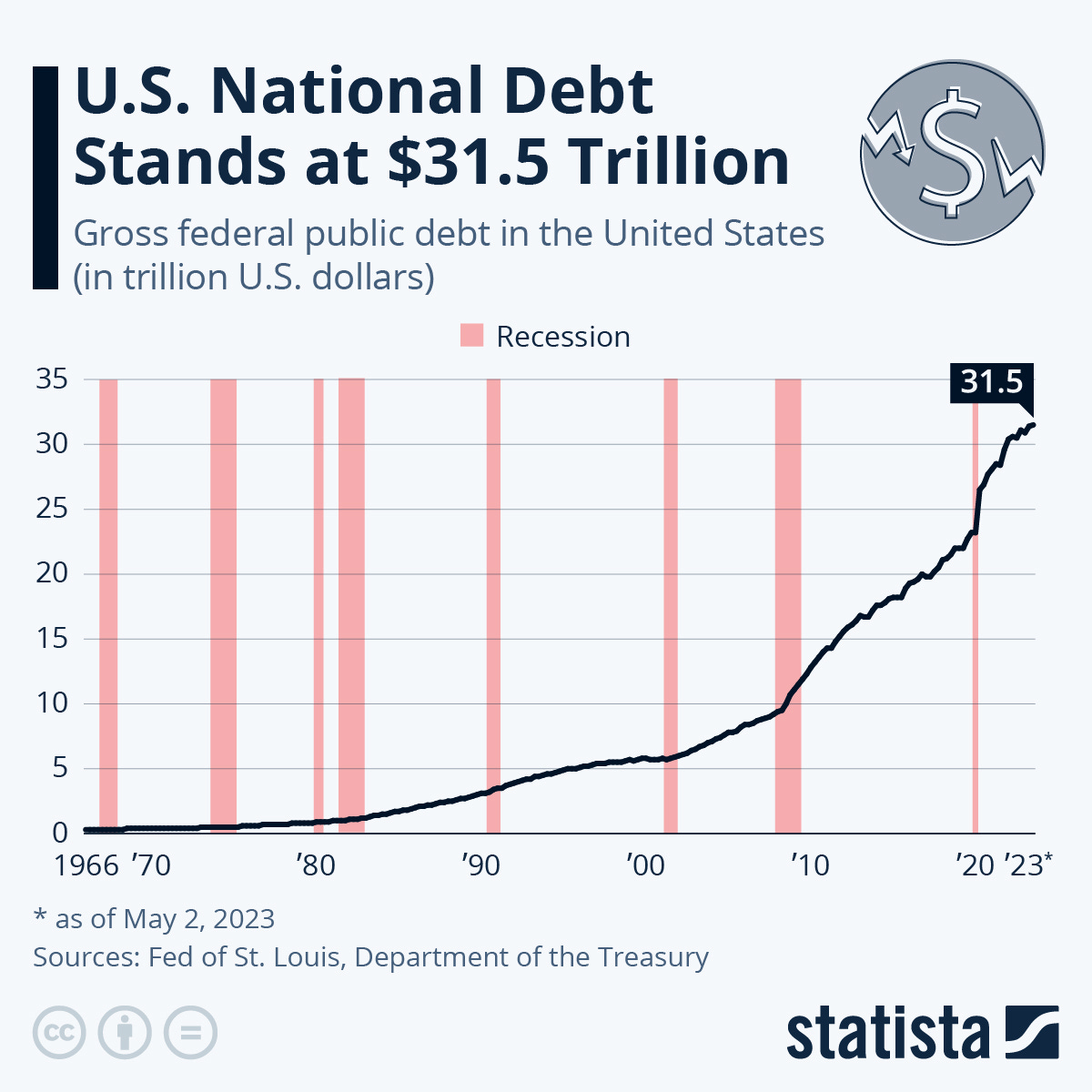

The extension of the debt ceiling though is not necessarily the right thing. It’s the least painful option today. Increasing the debt ceiling without addressing the underlying fiscal problem in America is like a gambling addict getting a personal loan extension so they can pay next week’s rent.

We compared America’s fiscal situation to France in our note last week (French resistance a warning to everyone else), the underlying premise being that at least the French are doing something about their fiscal situation today.

I’m focusing on the US debt ceiling this week, not because I have any clear view on the outcome, but because the outcome is the single most important factor to drive any asset or economic outcome in the near future. It is life or death for investments.

There is a chance that the US defaults, even if it’s 2-3%, it’s still a chance. We know that markets are very bad at predicting political outcomes, so the magnitude of the number doesn’t mean much. What we do know is that if a default occurs, it will be a huge disruptive shock.

We also know that a ceiling increase deal could come with some significant fiscal measures attached. That’s the real meat on the bone and what I’m watching.

As Nassim Taleb wrote this week “As the debt ceiling haggling shows, politicians produce better outcomes under severe adversarial pressures; they can cancel one another's flaws. Every politician can be nefarious yet the outcome can be good. This scale transformation is similar to markets under competition.”

I’ll be back next week with the outcome (life or death) and any significant fiscal measures that could impact the macro environment.

Peter Esho is an economist and Founder of Esho Group. He has 20 years of experience in investments and markets.