Why the real etate forecasters keep getting it wrong

Markets are hard to predict. When the pandemic started in 2020, most major forecasters and experts came out and said property prices were going to crash. But they didn’t. At the beginning of the year, the same experts started upgrading their forecasts for prices to rise by 15-20%. Again, they didn’t.

As interest rates started rising, the media started printing negative headlines again. Most people started to assume that prices will fall. That’s kind of half true. Prices in Sydney and Melbourne have come down around 10-15% already, but different markets are behaving differently.

The point here is that in reality, nobody really knows what will happen. You can make all the guesses, estimates, assumptions, calculations that you want. But history teaches us that complex things are difficult to predict.

That doesn’t mean we don’t research and buy or sell blindly. Instead it that we need to always go into the market with an open mind and focus on the data, not the predictions or wizardry.

I haven’t written to Wealthi clients and subscribers for some time. I saw it’s important to reach out to you today and share with you what data is catching our eye.

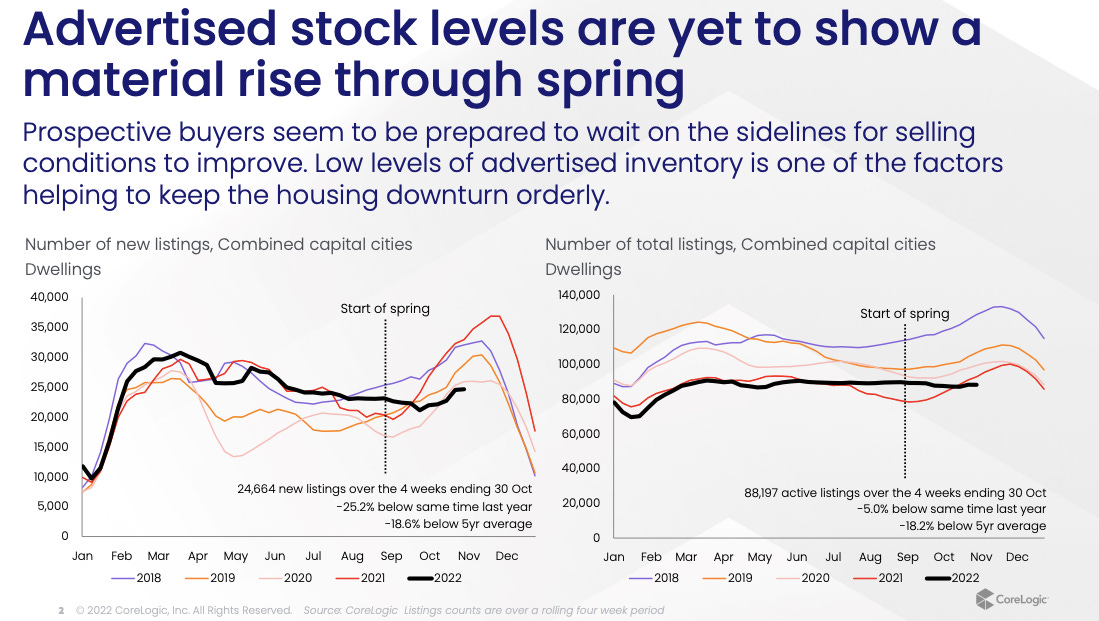

One of the most unexpected moves in recent weeks has been the huge fall in available supply on the Australian property market. Everyone was expecting a flood of property to come onto the market as home owners rushed for the exit. But this hasn’t happened. Here’s some evidence.

According to research firm Corelogic, listings (the supply of property for sale) are down around 25% compared to the same period last year. This is an average, some areas will have more listings that others. But the general theme here is that home owners are holding out.

Why? For two reasons.

First, most people don’t want to sell in a down market and if they can, they will hold out until rates stop rising. Not everybody can afford to pay a higher mortgage, but it seems the data is suggesting many can. People will usually sell their homes at last resort. They’ll cut back on other things first. Also remember that unemployment is at historically low levels. People still have jobs and salaries are rising.

The second factor is due to affordability. If you borrowed $500k to buy a house two years ago, chances are that if you sell and re-buy, you’re going to find it hard to qualify for the same $500k loan. Higher interest rates means lower borrowing capacity. We estimate that each 1% rise in interest rates impacts borrowing capacity by aroound 10%. So 2% increases in rates will mean that you’re borrowing capacity is down 20%. That means even if you sell and buy something that has fallen by 15%, you could be worse off.

Herein lies the point. Prediction is difficult. The world is complex. There are so many moving parts to the market and you shouldn’t trust someone who thinks they can predict what happens in such a complex world, especially if they are using round numbers. Nobody knows if the market will rise by 10% or fall by 20%.

Especially not your neighbour, friend or uncle at a family bbq.

What we do know is that everything is becoming more expensive. Food, fuel, living costs. You name it. Everything in almost every country around the world is rising in value. Turn on the news and you will see riots in developing economies like Ghana, Sri Lanka, Lebanon and even large nations like Brazil and the UK. Why? Because the cost of day to day life is skyrocketing.

So it doesn’t make sense that one of the most valuable things in our lives — homes — will fall in value and stay there. A home today is becoming so much more expensive to build. Speak to any builder or friend in the construction industry and they will tell you that raw material prices aren’t coming down. Things are still expensive.

History also shows is that in rising inflation environments, real estate prices can continue rising and often do.

I’ve written about the outlook for housing in more detail last week in my note here. Its a good breakdown of how housing impacts the economy. Give it a read if you want more breakdown.

My bottom line this week is this — its always a good time to invest in quality assets. You make money when you buy, not when you sell. If you buy well, you will never need to sell. The media will continue to publish headlines that get clicks, so they can sell more ads.

Can property prices continue falling next year? Yes. Will they? I’m not sure. If supply remains tight and building costs continue to rise, I don’t think we’ll see bigger falls. But where real estate prices go in the next 6 months doesn’t matter. It’s the wrong question. It’s like asking a personal training how do I get in shape in 6 weeks. They’ll tell you to change your way of thinking.

You should be thinking about where real estate prices go in 6, 12, 18 or 24 years.

Imagine being back at 1998, when the Asian economies were in crisis and Australia had just come out of an economic slump. Higher interest rates were fresh in people’s minds.

The government wanted to introduce new taxes. There was a lot of uncertainty. But in hindsight, we all wish we invested in real estate back then. Now think forward to 2046 and think how will you look back at 2022?

Peter writes a weekly research note for Wealthi Research in their seperate publication. It is republished here for your convenience.