Where to invest in a crazy world

One of the hardest things to do in uncertain times is to look forward and visualise. Investing is about making decisions today with the aim of reaping rewards into the future. It’s hard to plan when the future is so unclear. Yet doing the hard stuff is often the most rewarding.

Here are my thoughts on how to invest in an unpredictable world:

Avoid fragility at all costs

My focus is on avoiding the fragile investments - those which can break or blow up with a few bad things occurring, even if the probability is low. I want to avoid things that have the possibility of blowing up and being destroyed. That’s why I’ve avoided stocks and will continue to do so.

Buying the stock market (a collection of stocks) is very different to buying individual stocks. I think stocks are fragile because, with the click of a button, things can change overnight. A CEO can do the wrong thing and instantly, my investment could be down 20-50%.

I don’t mind buying ETF (exchange traded funds) where I get exposure to a wide section of the stock market. This is what I did during the downturn this year. I started buying Aussie share ETF’s on the way down and excited in June when the market recovered. I’ll continue to buy ETF’s if the market comes down again.

Income production is king

The best investments will be those which generate a steady stream of income without the possibility of large blow ups in capital. Stocks can generate nice dividends, but the capital downside is too big. I prefer investments where, if fundamentals change, I have time to get out. Real estate is still my favourite asset class, but it isn’t without risk.

My focus is on quality rental income — not the highest, but the most sustainable. If the market for whatever reason goes against me, I can reposition my asset (turn it into a short term rental, use for storage, grow cucumbers) and look to exit calmly. I avoid real estate investments that have a high yield, the best investments are usually those with the lowest yield.

From my experience, you grow your yield in real estate by working the asset…by adding value. I’ll only buy an asset on high yield assumptions if I’m the one adding value and in control of the yield upside. Otherwise I’m skeptical.

Business is another great way of generating income. The best businesses will be those who can ride out the downturn by helping customers and getting paid for their products/services. Raising money is easy, selling is hard. Businesses which generate sustainable cash and income will remain attractive.

If you haven’t already, try to start a business — a side hustle, anything.

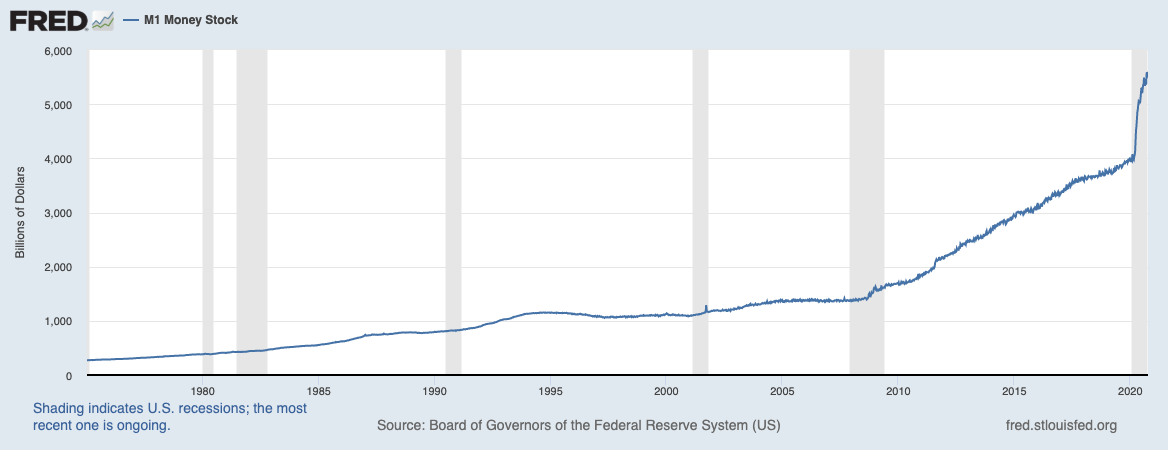

Cash is seriously becoming trash

Governments around the world are printing cash at a rate we have never seen. EVER. Interest rates are at historically low levels and falling even further. Stimulus will continue, debt will grow and it’s very difficult to see how governments will ever be able to pay down the debt they have accumulated.

Here’s a quick glimpse at money supply in the US:

Staying in cash is better than a bad investment, but it isn’t a long term wealth creation strategy. With low rates, income is important. Cash gives you zero income and possibility negative returns in the foreseeable future.

I don’t know when we’ll get inflation, but it’s worth preparing for it. Because when it comes, it will be huge.

Gold and silver; grandma knows best

I’ve recently started buying gold and silver. Without overcomplicating things, I think gold is poised for a nice run up to around US$2600 per ounce over the next year or two — maybe longer.

I’m seeing a lot of consolidation among the gold producers, they’re getting together and preparing for the next rally. It’s somewhat similar to what we saw 10-15 years ago before the last rally.

Gold is a tough one, I don’t buy too much into the demand side forecasts or the silly lunatics talking it up online. Nobody knows what the demand side really looks like, particularly as a currency play.

But it’s better than cash, because gold is a lot harder to mine and increasingly more expensive as mines find it harder to build and deploy commercially viable projects.

Plus my grandma loves it…and if its good enough for her, its good enough for me.

Looking to alternatives

I recently came across a great interview Milind Mehere on the Dealmaker’s podcast. Milind is the Founder & CEO of YieldStreet, a great business which I admire and one which gives investors access to alternative investments. Things like maritime financing — lending money to buy ships that can be scrapped for more than what you paid to purchase.

I think it’s a fascinating space. So many banks have pulled back from certain areas of lending, for whatever reason, and this opens up an opportunity for investors to go in and fill in the gap to help borrowers realise their deals. It’s not for everybody, is risky and uncertainty, but there is a space for alternative investments.

Art? maybe. Probably not for me. I want things that are less fragile. Farms? Maybe.

After all, we’ll living an alternative reality to what we have been taught and what we’ve been used to for most of our lives. When we realise that our human experience is a small blip in our world’s great history (read Ecclesiastes), we can begin to broaden our perspective and see opportunities for what they are.

The most valuable investment

Good health, great friends, a happy family and a growth mindset with an attitude of gratitude. Take care and God bless you all xx.