What will you tell your grandchildren about Bitcoin?

One of things I remember most vividly is growing up and listening to my parents and grandparents talk about their investment opportunities. Both taken and those missed. I’m sure many grown adults can relate with this.

We’re usually good at describing history in hindsight, with a rear view mirror. But making big calls in the moment is difficult and requires courage. It’s easy to point back to events and say I could have done that or should have done that. But the most rewarding thing is saying I did.

This has been a guiding principal for the since I decided to leave the corporate world and embrace entrepreneurship. I never wanted to live with regret, particularly after becoming a father at age 26. I had to overcome the fear or failure and embrace mistakes as part of the journey.

Mistakes are just feedback opportunities to improve your existing process. My investment losses have taught me a lot about who I am and who I’m not. I’m not perfect, but I have improved. I now know what doesn’t suit me — for example, picking stocks is too hard.

One of the things I learnt about myself is my strength in picking long term macro themes. These are trends like growth of online shopping, rise in commodity prices, social media (I bought Twitter early) and when to buy and sell real estate.

And now we’re on the cusp of what I believe is the largest investment trend in my lifetime — blockchain and decentralised transactions.

Bitcoin is the real deal

In January I published a note about how I changed my mind on Bitcoin after years of bashing it and thinking its all bulls**t. I was wrong, I want to be able to look at my children in 20 years time and tell them I was initially wrong but mature enough to change my mind and embrace the opportunities that followed.

Buying Bitcoin today is like buying a house in a great area for $100k. I’ve heard so many stories of family and friends who look back at premium real estate markets in Sydney and Melbourne and lament on how they could have purchased something for 5-10% of its value today.

I really think in 20 years time we will look back at the Bitcoin and crypto revolution in hindsight and see opportunities at 10-20x (or more) what they were today. It doesn’t mean everything will go up. Many things will collapse and disappear.

But the trend is real and evolving very quickly.

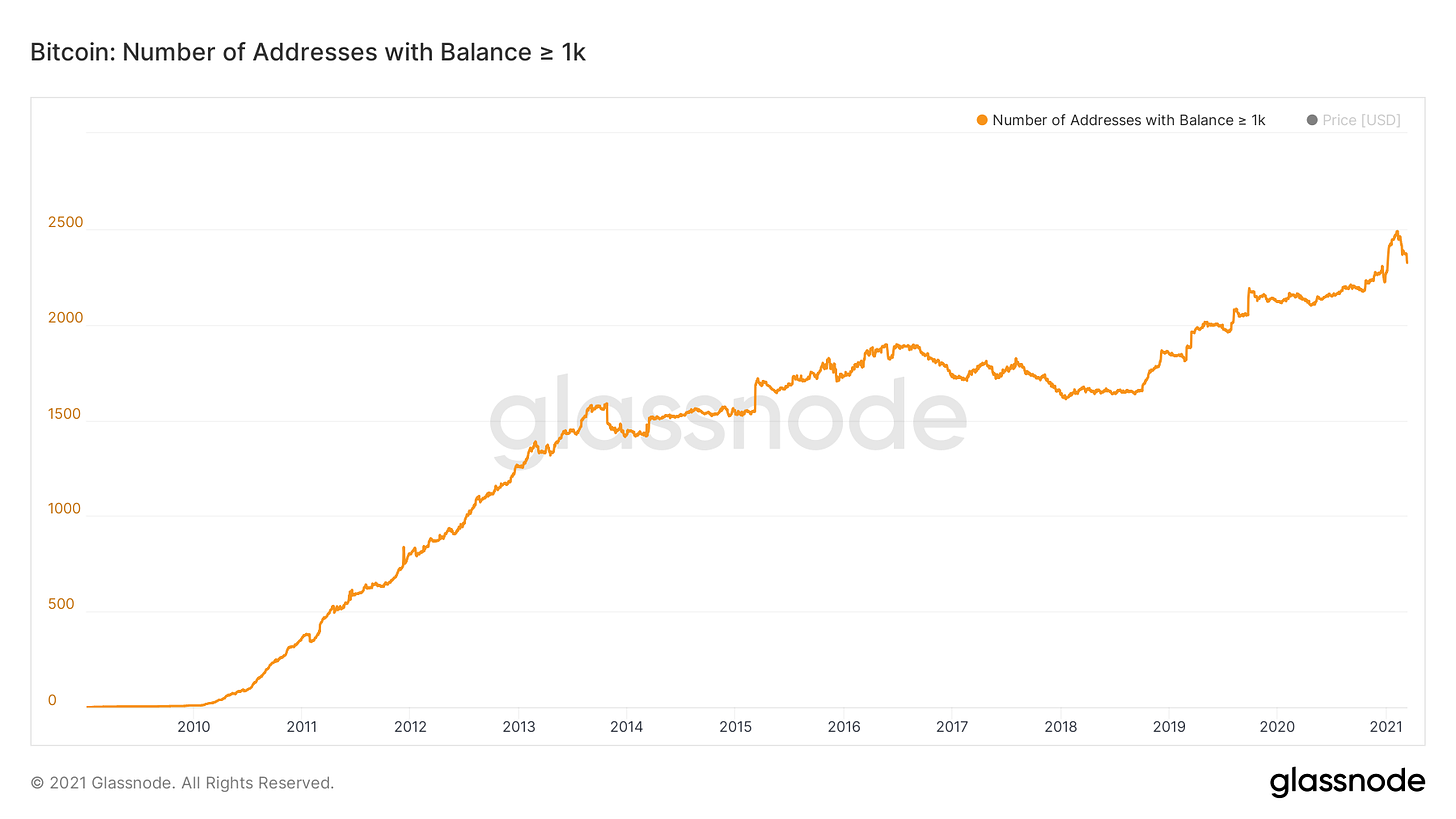

The number of people holding 1000 or more Bitcoins (around US$60m as of the time of writing) has grown steadily in the past 10 years and now at around 2,500. This will grow as more institutional investors enter the market. We have to remember something important — people with US$60m aren’t stupid. They might not all be geniuses, but it’s equally unlikely that they are all stupid.

At

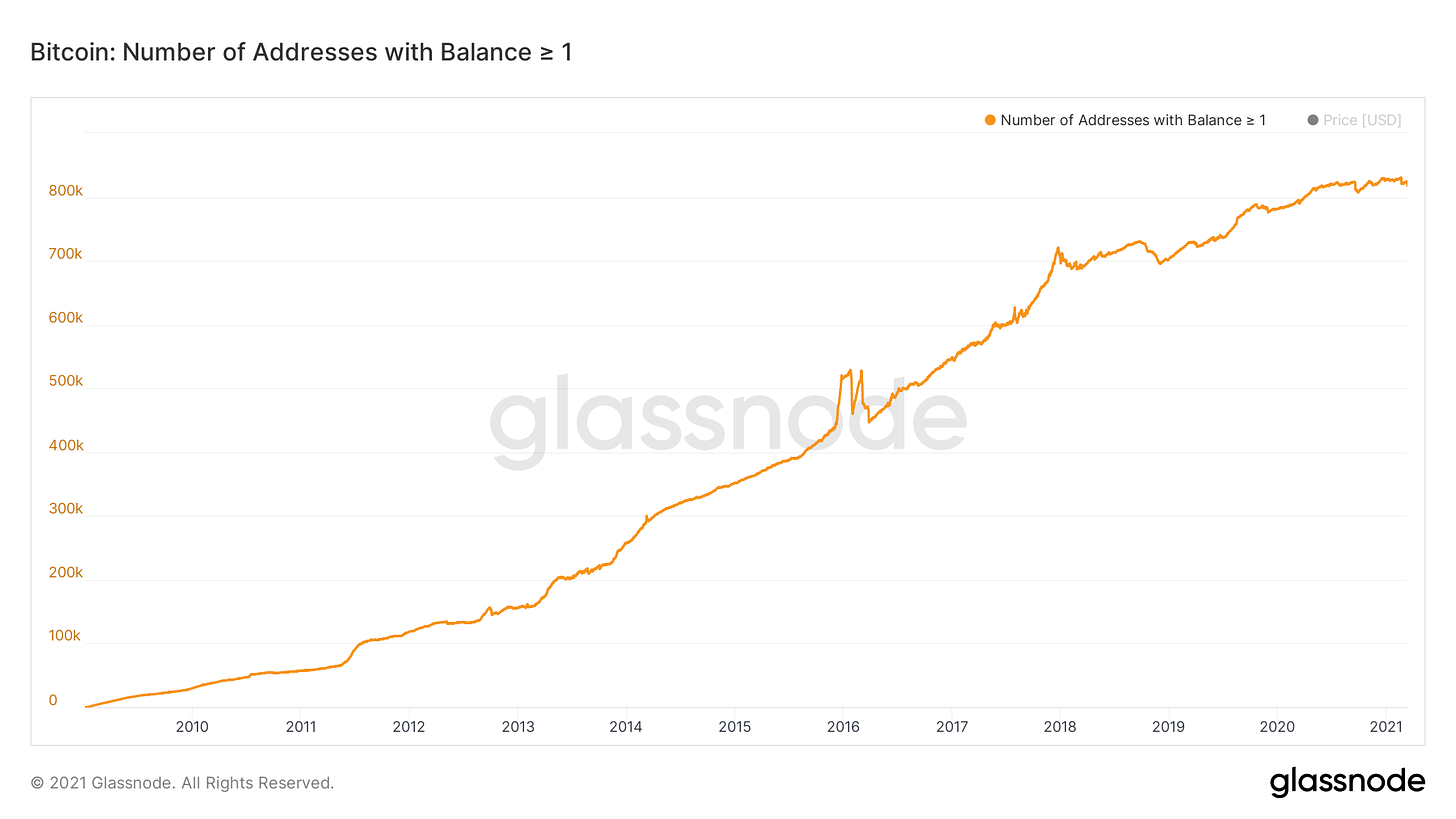

At the same time, people with balances or at least 1 Bitcoin (or US$60k at time of writing) have also grown steadily. There are now around 800k accounts around the world who own at least 1 Bitcoin. As institutions grow and the digitalisation of wealth becomes even more prevalent, a world with 7 Billion people will see more Bitcoin owners.

What I learnt from my children

I’ll look back at 2020 and proudly tell my children that I opened up my mind and acquired Bitcoin. They’ll probably tell me I didn’t buy enough, but thats ok. I’d rather hear that then regret over why I didn’t buy at all.

I’ve also been learning a lot from my children, as they will become the future generation to use and adopt digital currencies in the mainstream. All three of my children play Roblox. If you have children under the age of 15, I’m sure you will be in a similar situation.

Roblox is a gaming ecosystem with its own currency (Robux) which can be purchased with fiat cash and traded for gaming experienced between users. Roblox recently listed on the stock market in the US and its shares are worth around US$40bn.

My kids are teaching me about gaming, virtual real estate and digital currencies everyday. It’s my responsibility as their father to take this trend and invest what’s available to me in anticipation of this mega, intergenerational trend.

It doesn’t matter what happens to the Bitcoin price. The cryptocurrency trend and decentralisation of finance (along with many other valuable industries) is just at the tip.

The way we think about money, art, real estate, music and all other intellectual property will fundamentally change as we embrace blockchain technology and things like non-fungible tokens (NFTs) which are now the talk of the town.

If you’re not willing to buy Bitcoin, I don’t blame you. I implore you though to spend time reading and learning about how these trends will change our lives and how to position yourself, within our means and capabilities, to embrace this huge trend.

Make sure you subscribe to get my weekly notes as they are published. Thanks and have a great week ahead.