We could be at a tipping point for carbon conscious investments

One of the things I’ve been keeping a close eye on is the momentum behind environment, social and governance impact investing and how quickly investors are adjusting their investment allocation around these metrics. I mentioned in my note last week how some of the world’s largest investors, such as Blackrock, are moving away from coal quite explicitly and there is no turning back now given the gravity of this move.

Most of the stocks on large global markets such as the United States, UK, Europe and Australia are actually held by Exchange Traded Funds (ETFS). The volume going into ETFS is exponential. Blackrock is one of the biggest ETF providers, so when they make decisions about investments they won’t hold, it trickles down into individual stocks, boards, management teams and eventually products and services pretty quickly.

I’ll come back to the price of traded carbon credits a little later.

The US securities regulator just made some important comments

Not only are large investors voluntarily making these decisions, but regulators are also moving fairly quickly to impose rules on what companies need to disclose around their environmental and social impact results.

According to Reuters, The U.S. Securities and Exchange Commission (SEC) may require public companies to publish data on a whole range of new areas, including greenhouse gas emissions, workforce turnover and diversity, as its new chairman looks to enhance the SEC's disclosure regime.

Gary Gensler, SEC chair, told a financial services industry audience during the annual London City Week he has also asked staff to consider potential requirements for companies that have made "forward-looking" climate commitments and have significant operations in foreign jurisdictions with required climate-related targets.

This is huge and will signify a tipping point. No longer can companies just rely on their financial reporting and voluntary environmental and social scores, but they may need to disclose all when reporting results.

Hell have no fury like a CEO about to release poor results to the market. CEO’s will scramble to get on top of their environmental and sustainability reporting before the disclosure rules are imposed.

Carbon credits come into play

The thing about companies is that to date, they haven’t had to measure their carbon footprint in most countries (Europe is an exception). When regulators and large investors start to require a company to disclose, the first step will be to measure.

Once they have measured their footprint, companies will be under pressure to offset by:

1) Genuinely trying to minimise their carbon footprint and implement minimisation strategies over the medium term; but

2) In the short term, there will also be pressure for them to purchase carbon credits to offset the short term

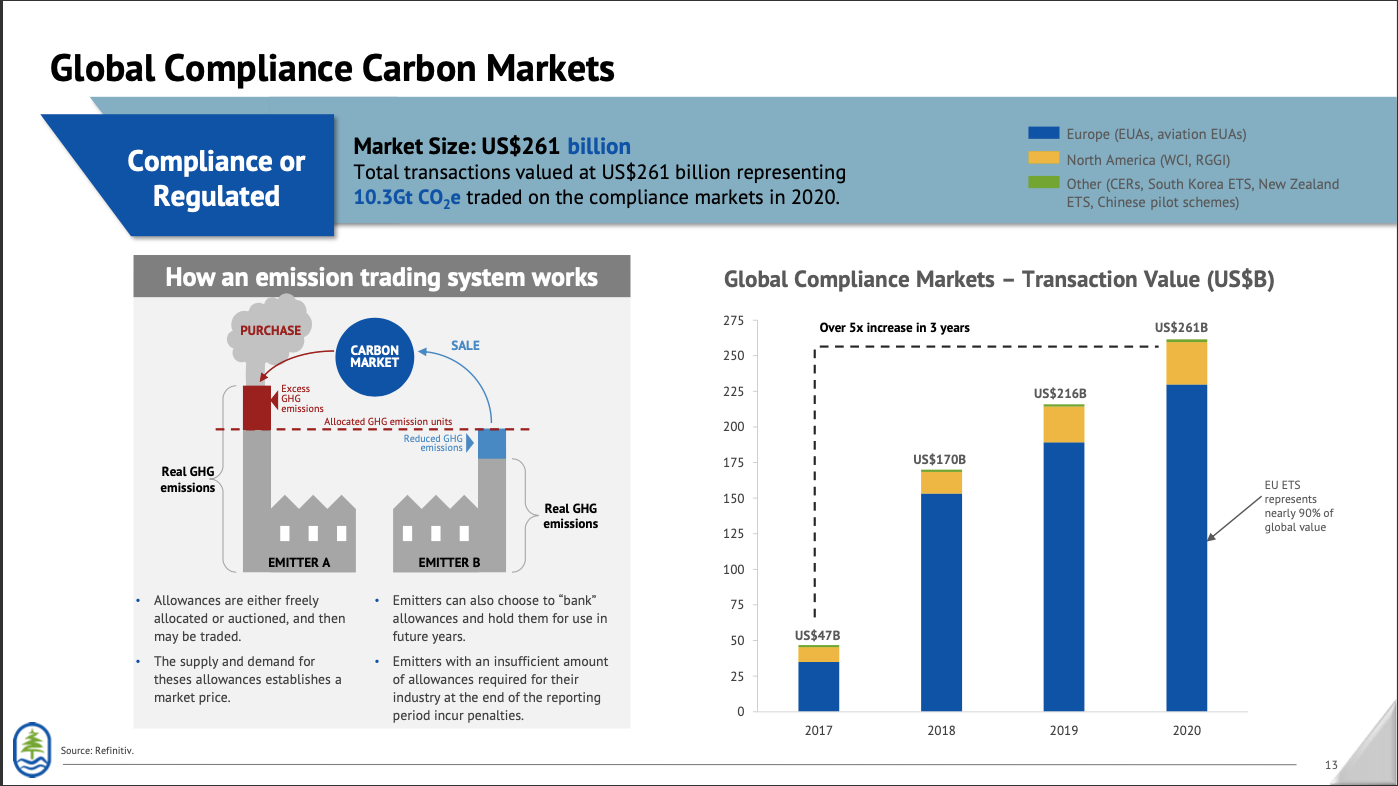

I found a really good slide from a junior Canadian resource company which explains called Carbon Streaming Corp which shows how they, as entrepreneurs, see the growth in demand for carbon credits.

Emissions trading systems see companies purchasing carbon credits to offset their deficit balances. Refinitiv estimate a total of US$261bn traded on markets last year, the lion’s share in Europe. But this number will explode if the US government, regulators and investors start to impose the same framework on US companies.

A socially responsible investment opportunity

There are a few different options for individual investors looking to invest in the trend towards a carbon positive future. The first is to invest in companies or funds who act as the picks and shovels to this mega trend. During the gold rush of the mid 1800s, the companies who did best weren’t those who mined the gold, but those who sold the picks and shovels to the miners.

There will be more companies in the coming months and years who build businesses that create carbon credits, through carbon positive projects, which meet certain verification requirements. There will also be funds that invest in these businesses, but they are generally only open to sophisticated investors. The ecosystem will grow quickly, so it’s worth keeping an eye on this space .

Individual investors can also buy carbon credits themselves from platforms such as Pachama or The Gold Standard but if you’re expecting to on-sell or trade these as a speculator, it still might be too early to tell how that part of the market will pan out.

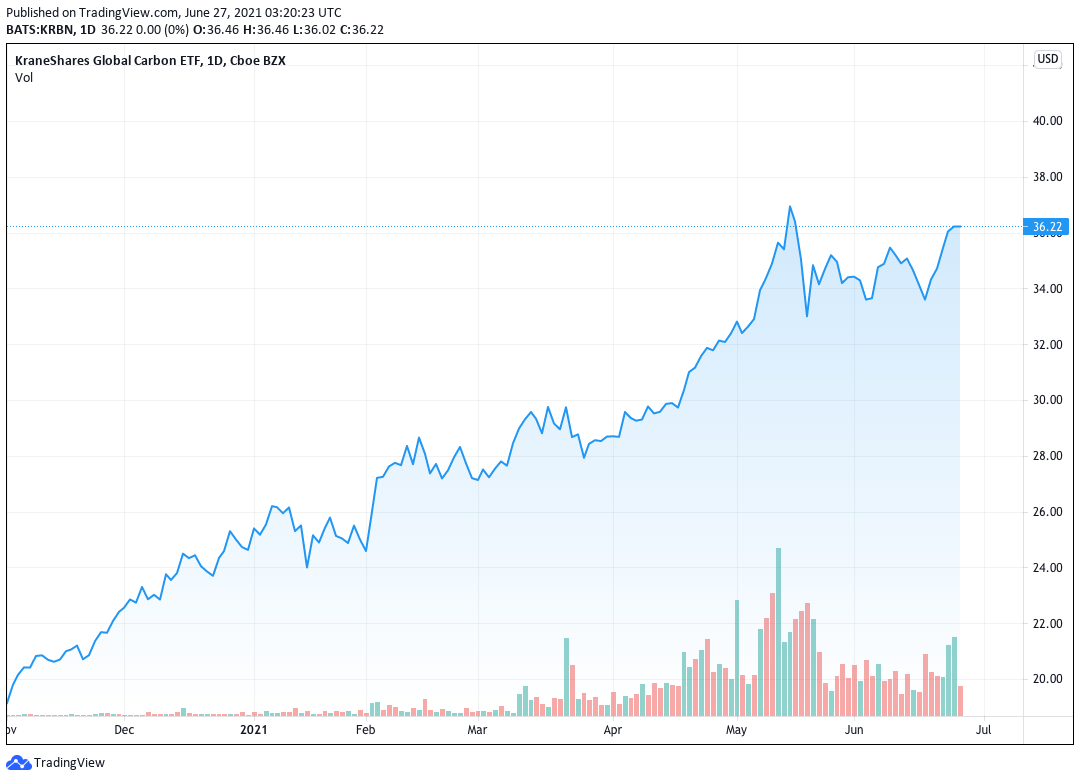

The third option is to invest in stock market related exposures. One of these is an ETF which tracks the price of carbon credits traded in London.

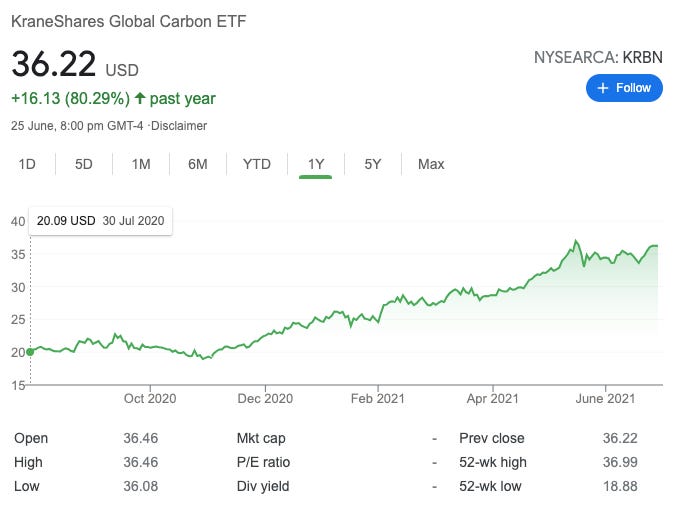

The stock code for this ETF is KRBN, representing KraneShares Global Carbon ETF. The price represents a tonne of carbon offset credits.

The carbon price tracked and traded by this ETF is up 80% over the past year. I’ve added this ETF to a well diversified portfolio and I’ll continue to increase my personal exposure to carbon conscious investments as I learn more and do more homework.

It feels like we’re at a tipping point and while crypto has captured most of the investment community’s excitement over the past year, I felt like I needed to write this note to illustrate another exciting opportunity. Perhaps one which is a lot more important and will shape the way all types of business is done in the future.

Carbon conscious investments are at the tipping point of going mainstream and capture trillions of dollars of global investment. It comes at a time when we need leadership on climate change and sustainable business practices, so I’m happy to go out on a limb and call this trend, even if it’s a bit early.

Subscribe to get my weekly notes in your inbox directly.

Quick Favour: If you come across other credible carbon related startups which I haven’t mentioned, please leave a comment below and share them with myself and readers who regularly read these posts. I’ll have more to write in the coming weeks.

Final Note: A small update on Peloton, which I wrote about in early May. The stock is up around 45% since my note, I continue to hold and see some great news coming out on a weekly basis, including their push into wearable devices. Perhaps more convergence with Apple’s audience?