Banking collapses aren’t new, they’ve been happening since money was created. It’s no surprise to see Silicon Valley Bank (SIVB) and other peers taken over swiftly by regulators this week. Regulators are there for these exact same situations.

The US Federal Reserve has already provided more than US$300bn in liquidity this week through its backstop facility. These are one-year loans to distressed banks in exchange for collateral. We expect the same to continue as more banks fall over in the near future.

What’s emerging though and caught our eye are the unspoken dangers of a banking industry which has slowly been taken over by tech. As tech executives and engineers dominate banking, the absence of basic banking knowledge within the tech industry is a real risk that now dominates our daily lives.

Nassim Taleb wrote in January this year that “Finance run by technologists is just like food cooked by pharmacists, books written by printers, operas composed by sound engineers, and planes flown by mechanics.”

Those words came to roost last week as the technology and VC industry in particular struggled to comprehend the SIVB fallout. The problem with SIVB was due to balance sheet management. The very basics of banking. SIVB purchased long duration assets at ultra low interest rates. It’s not the interest rate part that was necessarily the problem. It was the duration of their investments and the absence of hedging that was the problem.

The longer the duration, the bigger the fall on those securities as interest rates started to rise. SIVB was great at uncovering product market fit, building a strong identity in a crowded market and raising money from a cohort of companies that felt neglected by main street banking.

But as the past two weeks have shown, banking isn’t all about the front end experience. It’s more about the backend and managing risk. A bank’s ultimate function to shareholders is to maintain a spread between assets and liabilities, net of bad debts and operating expenses.

What many in tech have overlooked is the underlying fundamentals behind asset and liability management.

Over-optimisation of the banking industry

Like most global services businesses, banking has been undergoing a radical change over the past two decades. According to Commonwealth Bank in Australia (CBA), 71.5% of all transactions (by value) are now digital, up from 63.9% two years ago. The bank is spent over $1bn in the first six months of trading this year.

The front end has shifted from bricks and mortar to technology enabled experiences. That’s all positive and welcomed. Banks have been closing expensive branches and investing freed up capital in improving their digital assets. Most customers have embraced online banking due to its inconvenience.

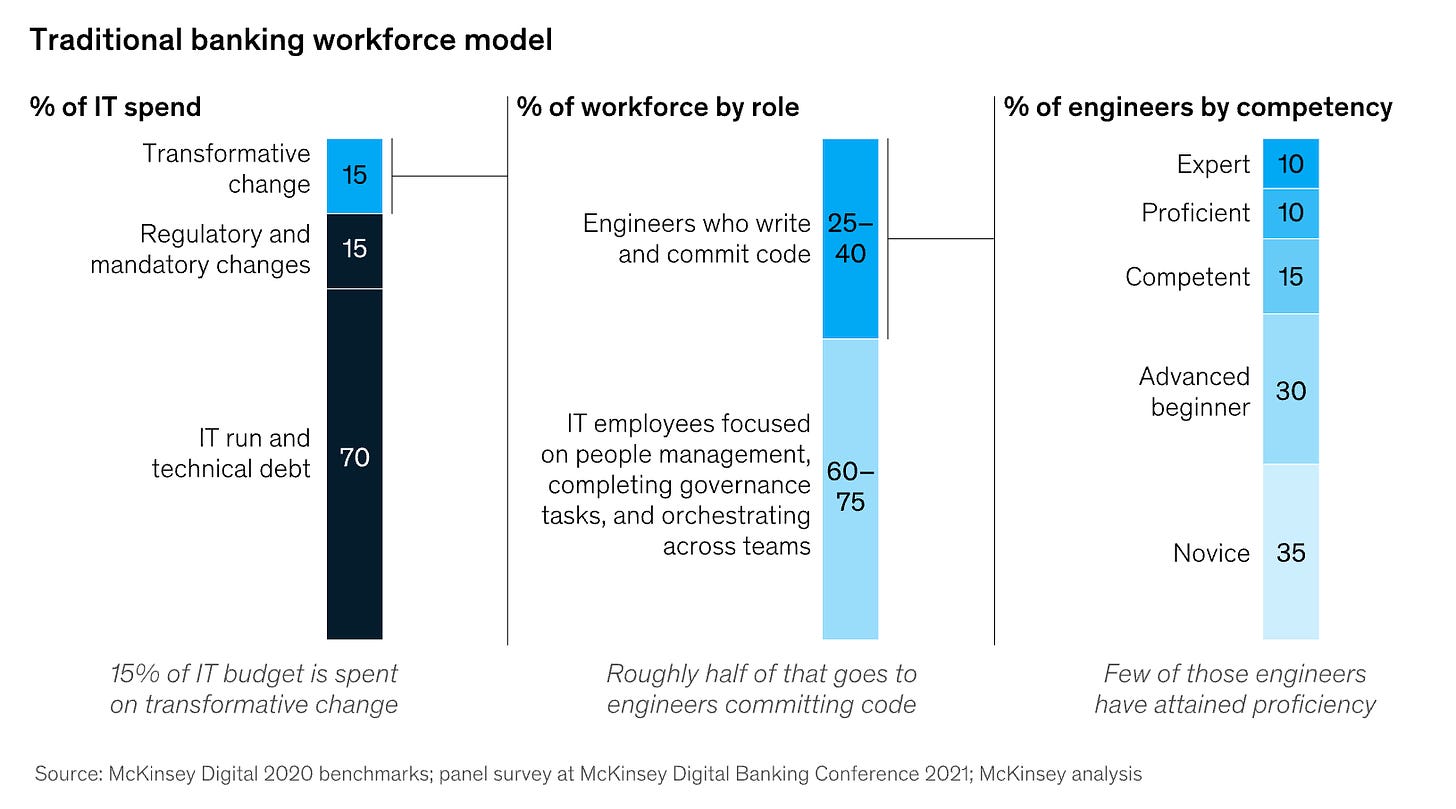

The problem for banking though is the shift in talent pool from bankers who generally understand risk and blow ups to engineers. Most of the engineers flowing into banking are relatively young and inexperienced, particularly in the context of banking and investment cycles.

As the tech/IPO boom faded last year, deposits stopped coming in at SIVB 2022. As rates started to rise, depositors started taking their money away and forced SIVB to realise this huge losses on bond investments to service deposit outflows. The concentrated nature of the deposit base and awful risk management meant SVB went belly up real quick.

This all happened at a bank with close ties to some of the world’s leading technology companies, building the world’s most impressive products and services.

Over optimised banking

Banking isn’t a technology business, it’s a risk business. Technology helps manage risk, but it cannot replace risk or become the business. Particularly not from a cohort of engineers who have barely experienced banking collapses and have very limited finance/risk experience.

We don’t for one minute disregard all the technological improvements in banking and wealth management. We welcome innovation in digital currencies and addressing finance inefficiencies. The world’s banking system is not perfect. Yet by the same token, we don’t think engineers make good bankers.

Many tech companies with embedded payment functions have become shadow banks and treasuries themselves. Stripe for example now controls around 20% of the online payments market, processing billions in daily payments for more than 300,000 businesses. Paypal processed more than $1tn in annual volume last year.

Central banks are not in the business of providing forecasts to the market. They are in the business of providing financial and pricing stability.

The fact that SIVB didn’t see the difference between the two and built an investment portfolio without adequate hedging has us questioning what else is left sizzling out there, hidden in bank balance sheets and yet to surface?

Each week we use classical artwork in our thumbnail links as a source of inspiration. See this week’s artwork here.

Agreed Pete. Buying bonds at a 2% interest rate for 30 years is just cray when you consider the environment we just came from. That is a lot of tied up liquidity at stupid low rates.

Agreed Pete. Buying bonds at a 2% interest rate for 30 years is just cray when you consider the environment we just came from. That is a lot of tied up liquidity at stupid low rates.