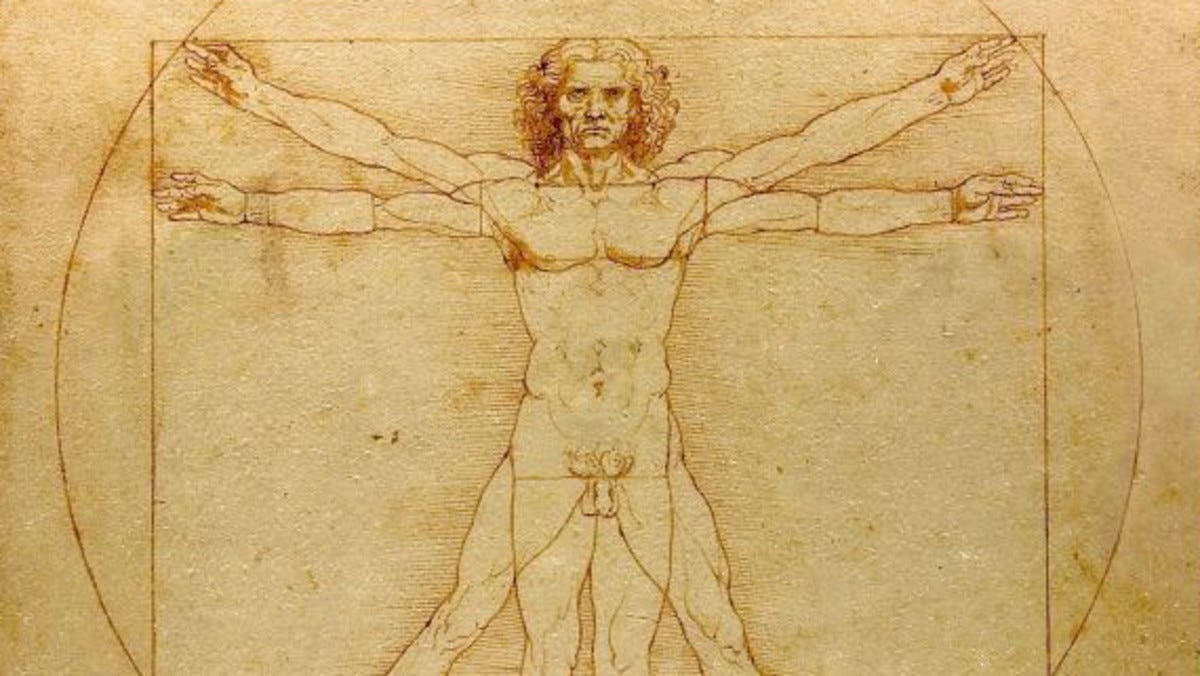

Simplicity is the ultimate sophistication

Da Vinci said simplicity is the ultimate sophistication. We tend to complicate things, particularly when it comes to investing. But we don’t need to. It’s a bad habit. As I stand back and look over the horizon, I see two things which matter most — interest rates and risk appetite. Both are moving higher.

The biggest reference point I and many other investors look at is the 10 year yield on US government bonds. This is a great reference point for future interest rate movements. It’s not necessarily the rate that matters (this has already been priced into the market), but the direction which matters most.

Rates are starting to move higher from ridiculously low levels. It’s no cause for alarm, but it shouldn’t be dismissed either.

Rates rising from rock bottom

Rates in 2020 hit levels we hadn’t see for more than 600 years. Most of the developed world still has central banks setting rates at low levels. The pandemic fears are still on the front burner, the economic problems haven’t gone away.

However investors are starting to look forward and last week’s movements in US interest rates markets have many rattled. As rates rise, risk appetite does also and large institutional investor who were holding onto risk free bonds are now selling. They’ll need new places to move their cash — stocks, real estate, commodities and cryptocurrencies.

Back inflation hedged assets

The reason why tech stocks grew so rapidly in recent years was investors found solace and certainty in their business models and despite ridiculously high valuations, many institutions parked their money in these well known names in the absence of better alternatives.

The game has now changed.

The best assets will be those who can grow their earnings as interest rates rise. The old world economy benefits most — rising rates are a reflection of higher inflation and higher demand. Businesses which can increase their prices are the best placed. Manufacturing, commodities, B2B services and the like. Banks and insurance companies should do well too — assuming they are in strong market positions.

In the real estate space, residential is still very attractive. Rising rates aren’t good news for home owners, but for investors, rates aren’t a problem so long as landlords can increase their rents as demand from the economy and job prospects improve. The best real estate assets are those close to jobs and major cities. The regional and lifestyle properties which done well during lockdown will probably pull back a little as the old way of doing business comes back.

Keep it simple

It’s time to start ditching the BS and focus on the old economy. Rates are rising from ridiculously low levels, but they’re rising. Lock in fixed rates on investments and only pick assets which can increase prices in the next 5-10 years without losing volume.

Avoid fancy and confusing tech and biotech names that have rallied her during the recent boom. Go old fashion. Crypto markets are undergoing a bit of a selloff as I write. Bitcoin remains my number one pick and only serious holding. There is a very limited supply, mainstream adoption and higher inflation means more investors look for alternatives to low yielding dollars.

Subscribe to get each update as I publish them directly to your inbox.

In the next few weeks, I’ll bring you some more interesting individual opportunities. For now, sit back and start planning on how to position into superior assets for a different 5-10 year period coming right up.