RBA will be forced to cut earlier if commodity prices keep falling

The RBA meets next week as part of their new calendar regime. I’m expecting they’ll say something similar to February. Europe, America, UK, Australia and Canada have all been saying the same thing. Rate cuts are coming, but they need to wait and see to make sure inflation is coming down. Don’t worry, it’s happening. Cuts coming late 2024.

The biggest risk to the Australian economy is now materialising — a slowdown in commodity prices, particularly iron ore. We’re already getting government signals that the budget will be weaker. Less taxes from mining and higher unemployment. The government is giving us an early indication that rate cuts are coming.

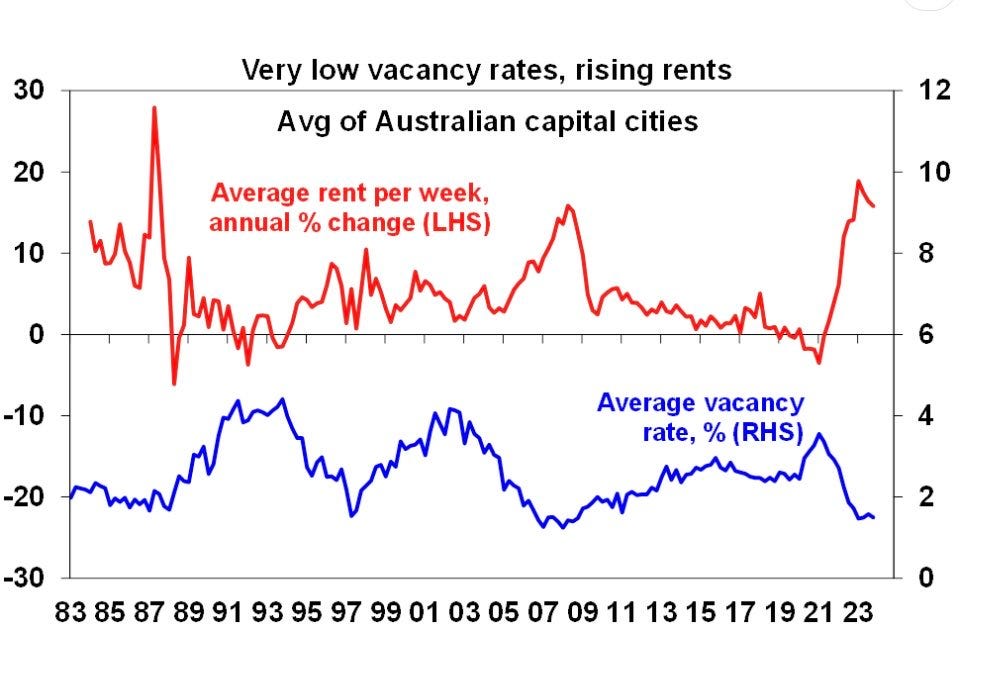

Residential property prices have held up pretty well so far this year, mainly due to low supply and rising rents. Landlords are offsetting higher rates with higher rents. Less supply on the market means homeowners are making more money by holding on than selling and trying to rebuy. The market is frozen, a Mexican standoff.

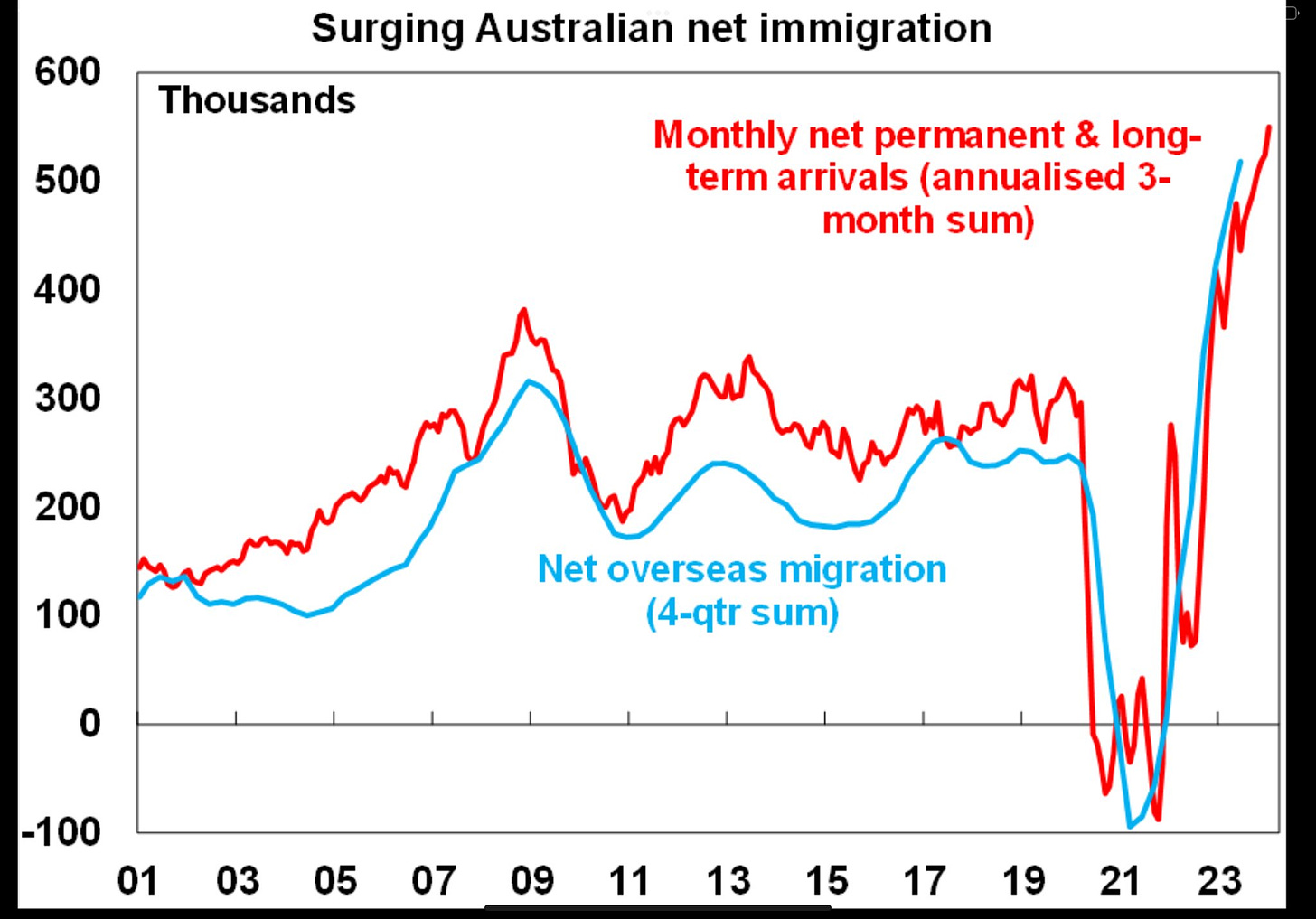

The big variable is migration. If it wasn’t for the flood of migrants into the country, housing would have pulled back. But despite all the government rhetoric that they’ll cut migration, the numbers seem to suggest that net migration into Australia is still, very high.

Bottom line: The RBA statement is a big non-event next week. Don’t expect the script to change from last month. Expect more “we need to wait and see” kind of comments.

In the real world, they’ll need to start cutting soon.

The real story isn’t happening in Martin Place. It’s happening at the ports. Commodity price falls have the ability to really push Australia back into a recession by the end of the year. Migration and limited property supply will insulate capital city prices.

Peter Esho is an economist and Founder of Esho Capital. He has 20 years of experience in investments and markets.