Quicknote: Rising rates finally cause large market cracks

One of the things I learnt in 2008 was the balance sheet never lies. The 2002-2007 accounting tricks were finally exposed in 2008. We’re finding ourselves back in a similar situation where everyone is scrambling to see who has the weakest balance sheet and which bank is the next at risk.

The biggest risk we see is not necessarily in the banking industry, which always gets bailed out, but in the US commercial real estate market which has its own shadow banking problems. See note here.

As I write it’s Credit Suisse, not for any new reasons, but for old concerns which are now under the spotlight.

The fact that US inflation came in line with expectations and retail sales below expectations this week doesn’t seem to matter much. The market is now gripped at the prospect of another banking domino effect. Bond yields continue to fall as investors scramble for safety.

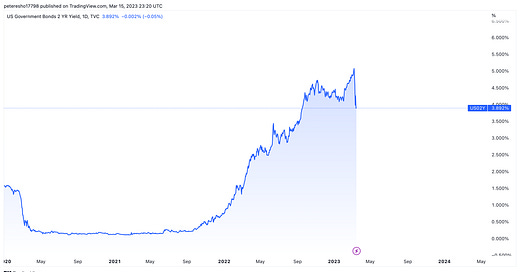

The US government is the least likely counterparty to default. Two year yields are now below 4% after rising above 5% only a few days ago. Things have cracked, and now the market is getting ready for what comes next.

Bottom line: The balance sheets of many banks and institutions have been exposed this week. The issues won’t go away anytime soon. We will continue to have a yo-yo (or W chart shaped) market, swinging between fear and relief.

But we don’t expect a trend to establish until we get firm evidence from the US Fed that they will pause and potentially start cutting to alleviate market issues. This is the week of the Fed pivot. Markets are now pricing in a peak in rates, and we think the wild times will continue for at least the next couple of weeks.

Australia and Canada are likely to weather any storm much better than the US and Europe.

Peter Esho is an economist and Founder of Esho Research. He has 20 years of experience in investments and markets.