Quicknote: Aussie and Canadian growth rate slips

We tend to study both Australia and Canada collectively because they have similar economic fundamentals and leverage to interest rate sensitivities, particularly in their domestic housing markets. With that in mind, Australia’s quarterly GDP growth came in at 0.5%, below expectations while Canada’s quarterly growth of 0% was well below market estimates.

There’s a slowdown starting to take place, though GDP numbers are probably the ones that lag the most. These are early signs that both the Reserve Bank of Australia and Bank of Canada’s interest rate tightening regimes are starting to work in taming inflation. Australia’s monthly CPI indicator came in at 7.4% which is high, but again below expectations.

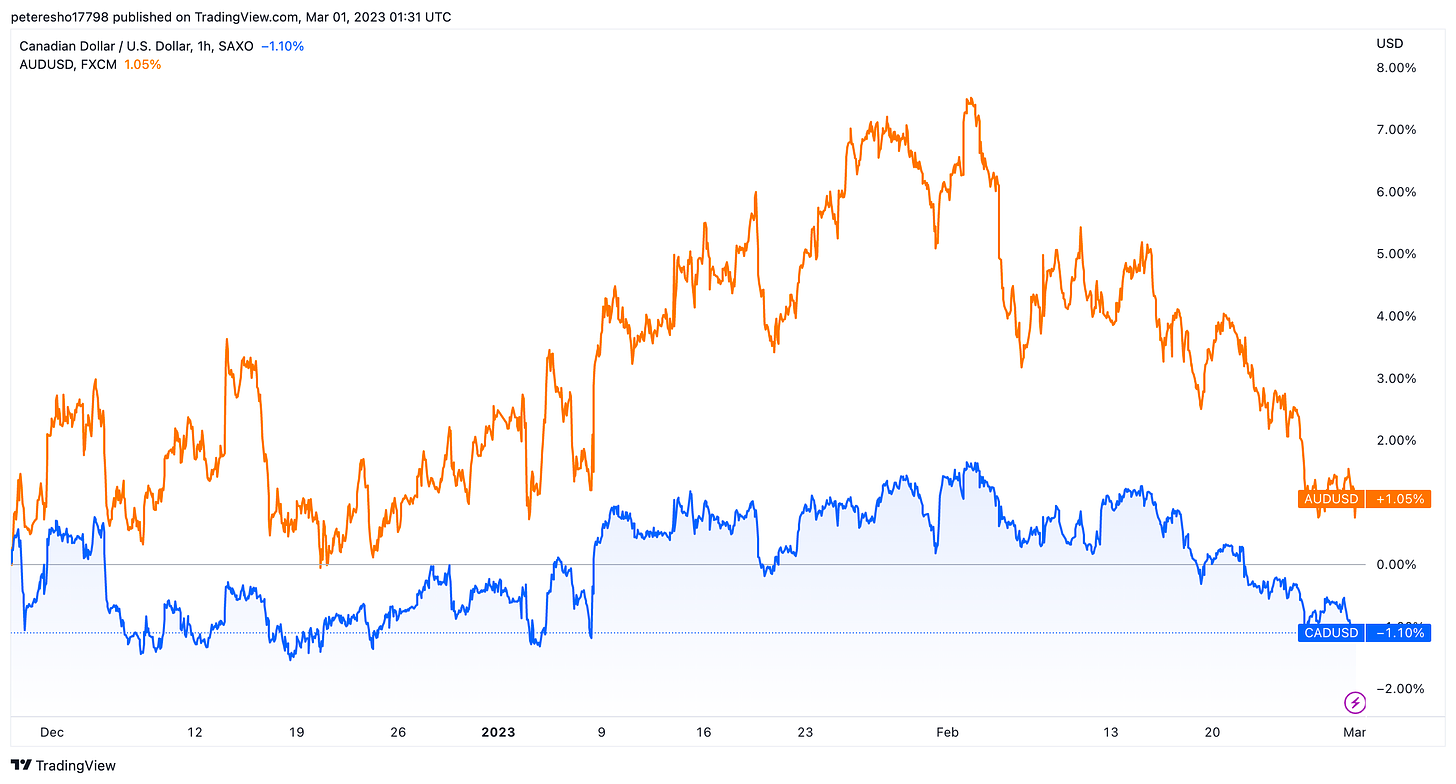

Bottom line: Both the AUD and CAD are down in recent weeks against the US dollar as the gap opens between monetary policy expectations within all three economies. Australia and Canada are slowing and we think central banks will be very mindful of data, perhaps somewhat concerned that they don’t want to overtighten. They won’t say that in public though as inflation is still a problem that needs to be addressed.

The US Fed seems to be in another world, with the inflation fight still not yielding any meaningful results. So we could potentially see a soft landing in Australia and Canada, while the US hopes it doesn’t have a hard landing cliff somewhere in the horizon.