Policy changes see return of foreign students

According to the Australian Financial Review (AFR), Chinese students have been told to return to face to face learning by their government officials. This could lead to many returning to Australia as online learning is no longer acceptable or recognised back home.

In an official announcement published last week, the Chinese Service Centre for Scholarly Exchange said academic degrees and diplomas would no longer be recognised if the study was undertaken online.

“In order to effectively protect the interests of students who receive overseas education and maintain the fairness of education, our centre (CSCSE) will no longer provide certification/accreditation for foreign diplomas and degrees obtained during the spring semester of 2023 (Autumn semester of the South Hemisphere) and beyond,” the directive says.

“Whether the school/university term/semester has begun or not, students to return ... as soon as possible.”

The AFR notes that around 700,000 Chinese students travel to overseas universities to study each year, mainly to the US, UK, Canada and Australia. A total of 150,000 were enrolled in Australian institutions mid-last year, of which the lion’s share were university students.

This will all have a significant impact on the US, UK, Canada and Australian domestic rental markets as students add to an influx of migrants, business travellers and expats returning home post pandemic. Rental markets are already tight with limited supply due to the pandemic and cost pressures across the building industry.

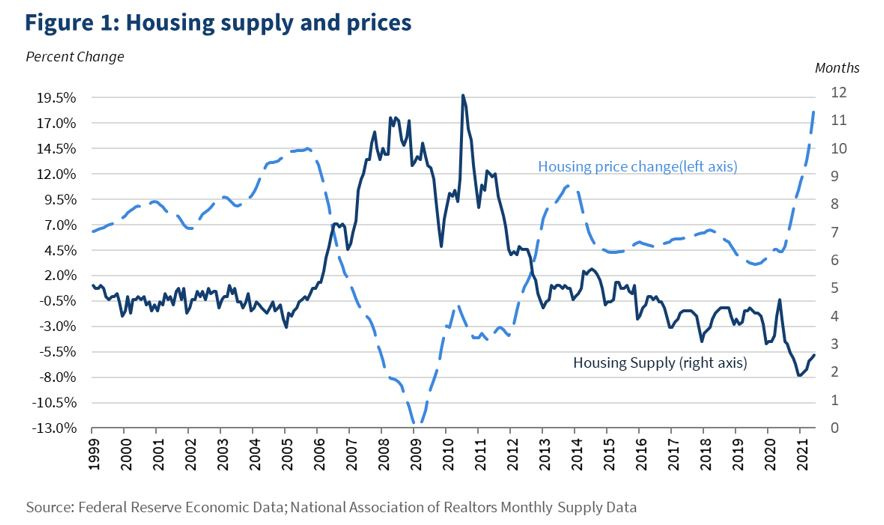

The chart below shows US housing supply relative to prices going back more than 20 years.

We wrote about the impact of higher interest rates as having a freeze on real estate last year (see Outlook for real estate 2023). In that note we said “…housing supply in the US is nowhere near the 2008 peak and has a pandemic lag built in…”

In Australia, SQM research estimates Sydney rents increased across all homes by 2.2% during the December alone and an eye-watering 30.1% for the year. Melbourne rents rose 1.7% in December and 24.7% for the year while Brisbane was up 1.7% for the month and 23.8% for the year.

The key takeover for property investors is this — rising interest rates are being offset by rising rents. It will take at least 5 years before any meaningful supply can offset strong rental demand due to the nature of the building cycle and time it takes for zoning and applications to complete.

As the impacts of migration and the pandemic adjustment work through the global economy, housing will continue to find a balance. An ageing stock of supply complicates the problem. This should buffer house prices against rising interest rates.