Outlook for real estate prices in 2023

I’ve been closely watching the largest real estate companies and their commentary around real estate prices as interest rates rise. This helps me form my base case view for where we track in 2023. I’ve also been listening and paying attention to conversations on the ground and within our businesses to see what’s happening.

I’m starting to form a view, inspired by others, that real estate is going into a “freeze”, particularly residential real estate across the developed world. I’ll explain more about the implications of a freeze below.

The temptation is to think that rising rates will automatically see a flood of sellers coming to market. But we haven’t seen that yet.

There’s an old saying that the housing market “is” the business cycle. It’s true not only because construction is a large employer but also because of the multiplier effect on spending. People moving homes often buy more stuff, creating more jobs etc. The opposite is true when things slow down.

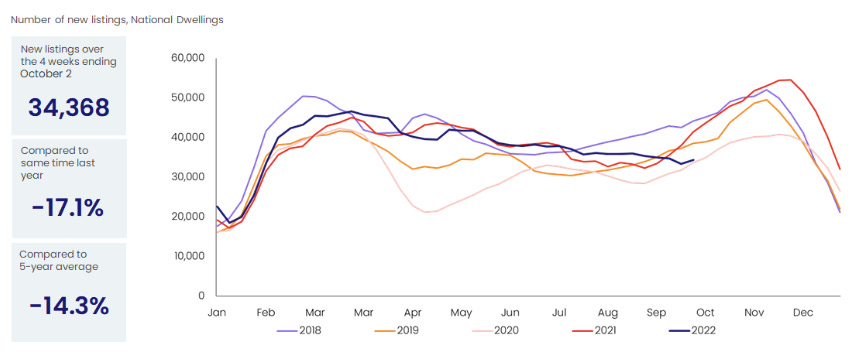

What I’m starting to see in the market isn’t necessarily a selloff, but a freeze. Sellers are frozen, if they come to market today they won’t get the price they would have hoped for. So many who can afford to hang on are delaying, this is causing a reduction in supply, particularly along the east coast of the Australian property market where I’m situated. Listing volumes are down around 20% compared to the same period last year.

Sellers are also frozen because borrowing has become harder. If a seller tries to apply for the same loan that they currently have on their property, chances are they wouldn’t qualify, particularly if they purchased or refinanced when rates were half of what they are today. So the freeze provides an incentive to stay put for the time being until rates either come back down or incomes rise by a large enough factor.

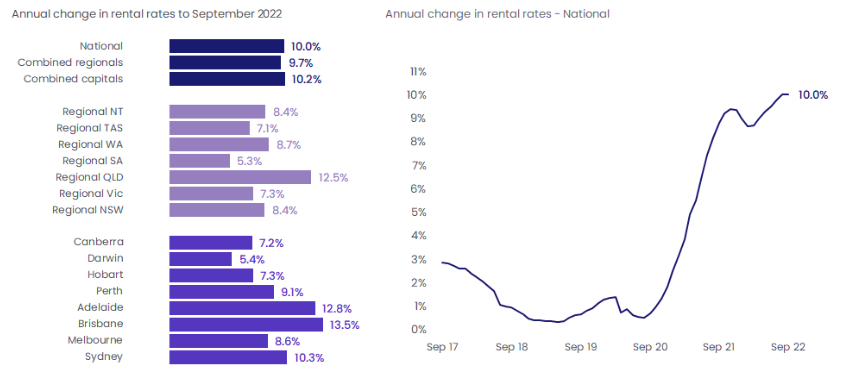

Buyers who need to purchase will buy anyway because the rental market is heating up and there aren’t too many alternatives, particularly when stock levels are low. The underlying problem in the rental market is very tight supply and an aging of housing stock, particularly apartments. There’s also a shift back to city life, post pandemic, which is causing increased demand for rentals in large metropolitan markets.

During the freeze, prices will remain relatively flat. Rising construction costs will put a floor to house prices in most major metropolitan cities. We’ve now formed a new base for what an average house or apartment costs to build and that will provide support.

Governments who are fiscally strong will also play their part by trying to encourage home ownership through grants and concessions, again providing a floor to the market. Rising rents will help investors manage their relationship with rising costs of funding.

In essence though, there will be a big decline in housing activity. Construction employs around 9.2% of the Australian labour force. In the Us, housing related activity (brokers, construction, furniture shops etc) accounts for almost 20% of US GDP and ~12 million jobs.

The chart below shows the US home builders confidence index compared to 2 year interest rate expectations.

According to the AFR, Australia’s country’s largest listed residential developer (Stockland) said sales in the first quarter slumped to 845 lots from 1947 lots in the same three-month period a year earlier, and down from 1545 in the three months to June.

In Australia’s second largest city, Melbourne, new data from Core Projects showed there were only 2399 lot sales across over the September 2022 quarter – the lowest volume of sales since the third quarter of 2019, and a 44 per cent fall on the prior June quarter.

So where is the trade?

The housing freeze will cause a significant construction slowdown and alleviate some of the inflationary pressure already in the system. I also believe this will become a major part of the unemployment rate rising and completely slowing down rising interest rates, perhaps prompting cuts towards the end of 2023.

I think it’s still too early to put a number on it, but I wouldn’t be surprised to see the Australian unemployment rate rising to the mid to high 4% range and US job losses starting to flow through in early 2023 based on the state of the housing construction market.

This doesn’t mean house prices will continue to fall. In fact, housing prices are starting to show a lot more resilience than expected considering the extent of rate rises. Well priced real estate is always attractive as a long term buy, particularly in soft markets like this one.

Sure, we could see some ongoing softness in housing over the next few months but thats all before a bottoming out, which might take a year or two, until rates stop rising and the dust settles.

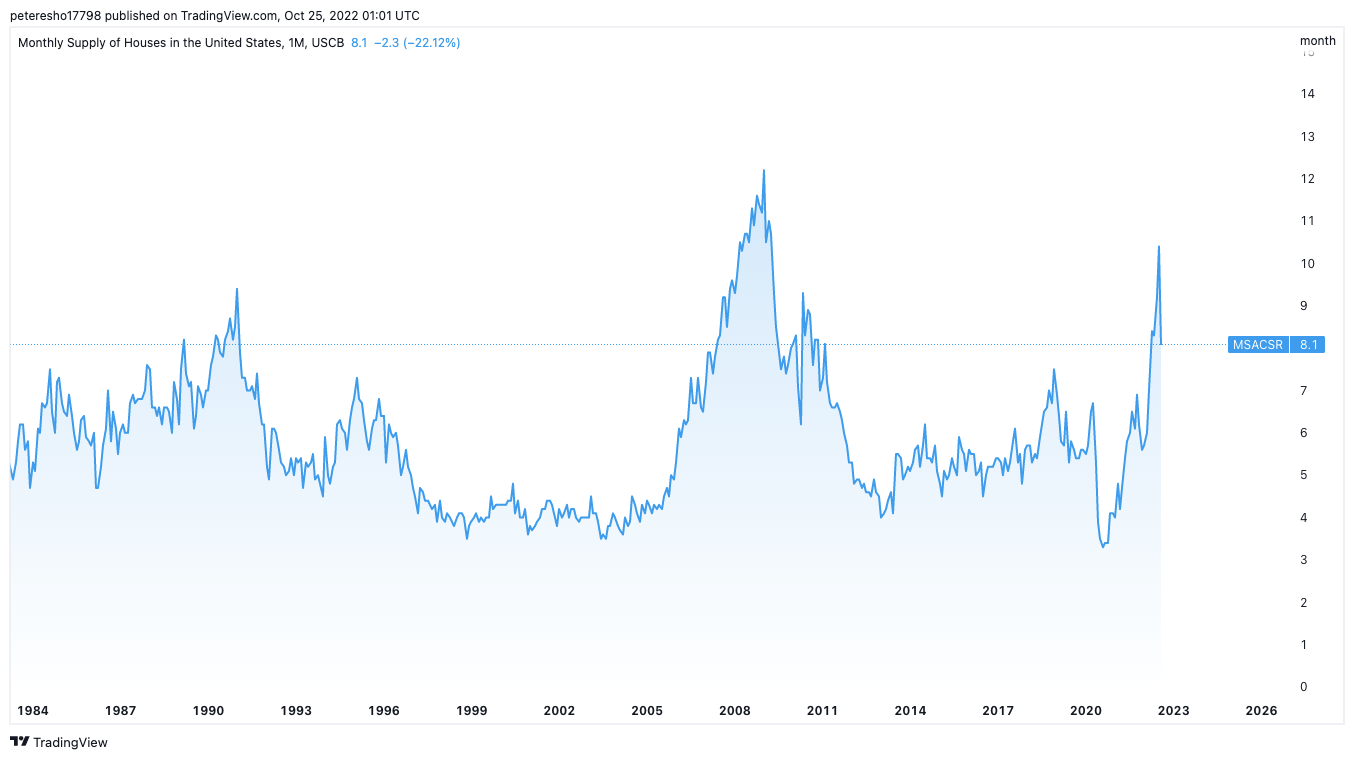

Housing supply in the US is nowhere near the 2008 peak and has a pandemic lag built in. US housing services names like Compass, Opendoor and Redfin are all already down 80-90%.

My underlying thesis, supporting all my macro views, is that employment has peaked and we will start to see job losses in the coming months. This will change the interest rate narrative. The stock market is about right for a turnaround as it looks forward to the future with a lot of bad news already priced in.

The US dollar is at crazy levels and will come back to reality as soon as the Fed pivots. The Aussie, Euro and Pound will all likely gain as the interest rate differential closes.