Is it time for India's next economic growth boom?

It’s been a relatively quiet week in markets with most of the data that has come out already confirming many of the assumptions already in place. We’re still waiting for any signs of an inflation peak in the US to be the trigger moment, while US 10 year bond yields rise above 4%.

We use quiet times to focus on bigger picture, long term investment themes that can somewhat go missed. Thematic investment requires longer time horizons, patience and a lot of trial and error to ensure that you get your execution correct.

One of the themes we have been watching for many years is the Indian economy and the constant false starts, as the world awaits India’s ascension into the major league of economic growth.

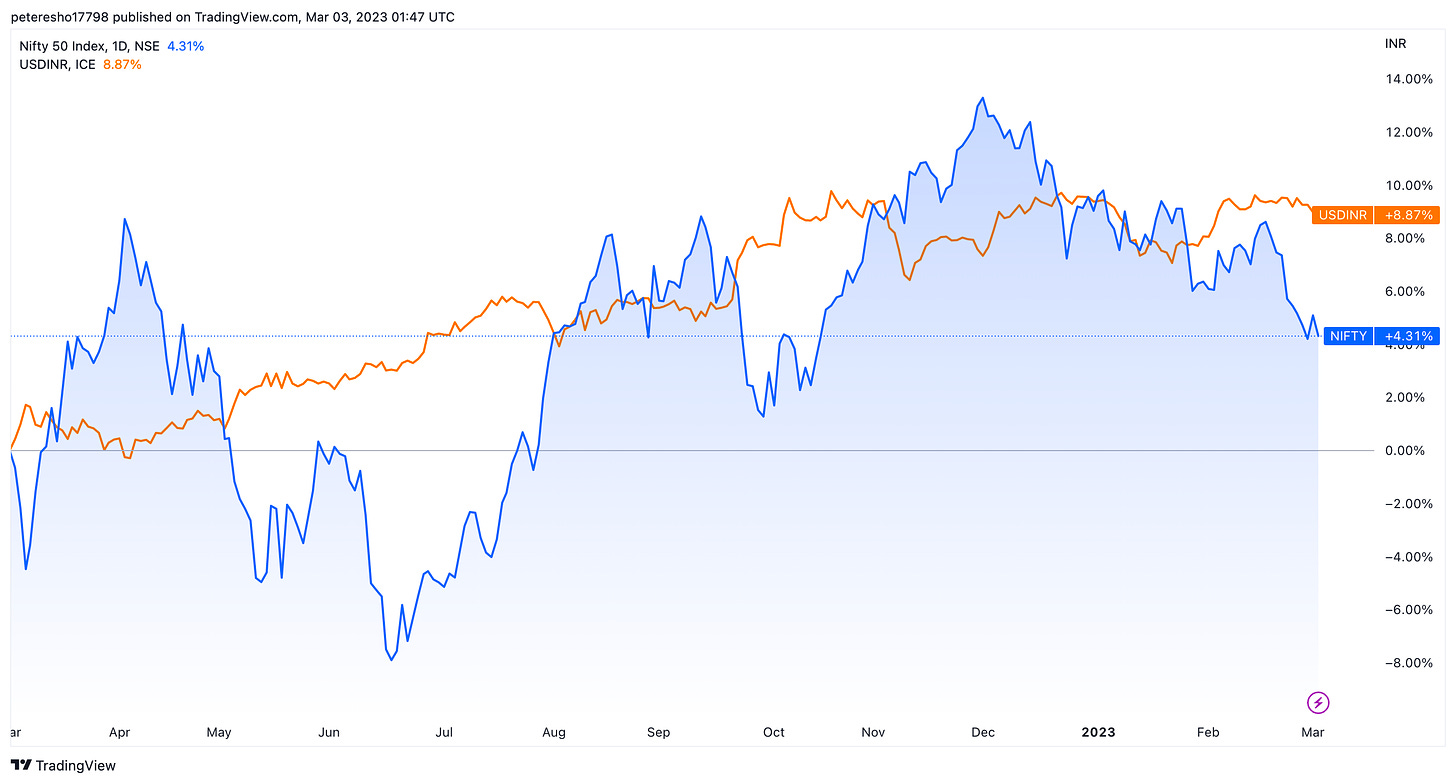

India’s stock market has been relatively flat this year, up around 4% in local currency terms. However, the local currency is down 9% against the US dollar over the same period, so local gains are offset in US dollar terms.

Still, the Indian stock market return in US dollar terms is in line with the S&P500 return so overall its not a bad outcome. Indian stocks have come under the spotlight in recent weeks due to the Adani scandal which gripped markets. Shares in Adani Enterprises are down around 60% year to date following allegations of fraud tabled by a Hindenburg Research report.

With this in mind, Indian stocks would have fared better and outperformed US stocks in US dollar terms had it not been for the Adani allegations and subsequent share price fall.

The allegations have also brought to light the development of India and vulnerabilities that a few large companies, such as Adani, could have on the overall growth stock and global reputation for the nation. We think the current G20 meeting in India, occurring as of the time of writing, could become a watershed moment.

India may use this opportunity to learn from the Adani experience and see that there is an even greater prize of awakening, with the West and China continuing to fracture their relation. India could emerge as a reasonable middle ground for business relations.

India’s unique position

The G20 meeting highlights another key position facing India, the issue of Russian oil. India has continued to trade with Russia despite a Western embargo. In return, the West led by Washington have sought assurances from India that it will maintain is price cap on Russian oil.

Herein lies an opportunity for India to negotiate a stronger economic development position in its favour, in return for meeting embargo terms.

According to the AFR “The officials described India’s purchases of Russian oil as a constant topic of discussion between Washington and New Delhi. They said it’s good for both the Indian economy and for stabilising oil markets that India is buying crude at deep discounts from the cap.

In return, India’s demands for a seat at the table are getting listened to. It has long argued the UN Security Council needs reform.

India wants to join the five nations – the US, the UK, France, China and Russia – that are permanent council members. President Joe Biden supports this ambition (he also backs similar bids from Japan and Germany)…”

India is also building closer ties to Australia, which it knows has a somewhat complicated relationship with China. After this week’s push by Education Minister Jason Clare, next week PM Anthony Albanese will arrive in the country, along with Trade Minister Don Farrell, Resources Minister Madeleine King, and a high-powered business delegation.

There will be general elections in India next year but with the opposition in disarray, Modi’s BJP party is expected to win another term. As the global economy improves and inflation is addressed, India’s economic development and investment returns will be closely watched.

We’ll continue to monitor the pace of the Rupee depreciation and performance of key Indian stocks over the coming months. Emerging markets are on the radar for many global money managers and India could find favour with those looking for value.

Adani is probably still a too risky basket, but as we have learned with many things in life, time tends to heal all wounds. Adani is probably too big to fail, but not too big to reform and split into smaller parts which could form important parts of the Indian economy.

Each week we use classical artwork in our thumbnail links as a source of inspiration. See this week’s artwork here.