New data suggests we could be at a tipping point

Successful investing is about picking trends and sticking with your intuition no matter what short term market movements do. This is also called market conviction. There’s a lot of noise in the market, everyone has an opinion. But as my old boss used to say, it’s important to go with your “gut feel”.

Your gut feel gets better with experience.

The more mistakes you make, the more time you stay invested, the better you become in following your initiation/gut. You don’t learn about gut feel in business school, there’s nothing in the CFA program about it, you learn about it in markets. The school of hard knocks.

If you’re investing for some time now in real estate, stocks, crypto, forex or commodities — you know the feeling. Sometimes you just sense something and six to twelve months in the future you see that thing happening. You tell yourself I knew I was right.

But often you didn’t act, because you were frightened by the thoughts and opinions at the time.

Mid last year, I formed a view that inflation will eventually start to moderate. I based this on two reasons — oil prices were coming down and secondly, central banks starting to move rates aggressively. Emphasis on the word aggressively. The recent raising regime has been brutal.

I went on record to say that inflation will peak and then moderate (see August 2022 note “Interest rates will rise but cap out pretty quickly”).

We’re now starting to see confirmation that inflation may have peaked. I’m not yet proclaiming inflation is over, but I’m seeing very early signs that we could be at a tipping point. If I’m wrong, I’ll update in the coming weeks and months.

Last week, I wrote about a fall in US inflation during December. This week we saw inflation fall in Canada and rise less than expected in the UK. I’ve been glued to the screens watching the data come through. Absolutely fascinating how quick things are moving, particularly the recovery in the British pound.

We also saw producer prices fall in the US yesterday. Europe is still lagging, I don’t expect things to change there for a few months. But even there monthly, inflation fell this week by 0.4%, more than expected. There is enough momentum now to suggest that inflation is under control. Not dead, but tamed. In prison awaiting a death sentence.

It’s only one month, but that’s how trends start.

Again in the US, producer prices fell 0.5% last month, compared to market expectations of a 0.1% fall. It sounds small, but these numbers are a big deal. A lot of money that flowed into the US dollar on the back of interest rate rises is now starting to reverse.

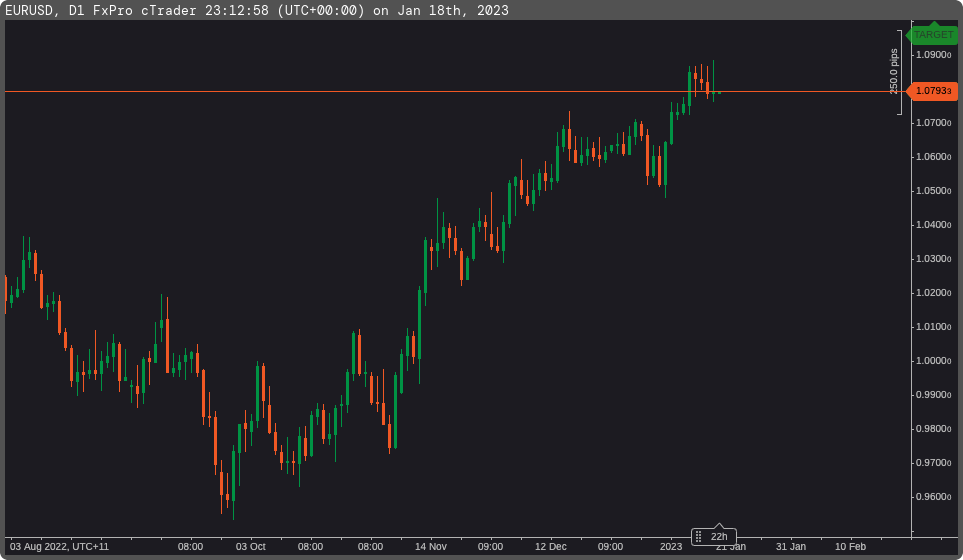

The Euro is now back above parity and trading comfortably within the 1.05-1.10 range. The big movements have been in US bonds and in particular the 10% yield, which is the mother of all inflation and growth indicators. The 10-year yield is down from above 4% to just under 3.4% as of the time of writing. That’s a huge move in the space of 6 weeks.

In Australia the unemployment rate remained flat at historically low levels but 15k jobs were lost. We could see more signs that inflation is under control and falling in the next few weeks, and that will snowball into a market consensus that inflation is no longer the immediate threats to markets.

Market bottoms are very difficult to predict. Many of the smart traders and investors who I know well admit that they missed the 2009 market bottom. They didn’t believe the bounce that followed the onslaught of the 2008 crash. Those same investors were sceptical of the 2020 pandemic recovery. Smart investors usually miss the recovery because they get sucked into the bad news echo chamber.

On Wednesday, US home building giant KB Home announced that its buyer cancellation rate in the fourth quarter of 2022 spiked to 68%. That's up from 35% in the third quarter of 2022, and up from 13% in the fourth quarter of 2021.

These are the kinds of numbers that you see at market bottoms. Home buyers are scared in the US and rightly so, their central bank has been relentless in raising rates to put a pause on inflation. But that’s the whole point of rate rises and rate cuts. It’s to impact consumer behaviour.

We’ll keep getting headlines of job cuts and a worsening economy this year. But the real story you should be watching is what happens to inflation and bond yields. This will indicate how central banks react and as the market is always forward-looking, now could be the best time to get in on the action ahead of a market shift and rally later this year.

Markets move according to future interest rate expectations.

I’ll have more next week on commodities and which way they’ll go as China opens up. I’ll also discuss the impact of Japan’s economic recovery and how that will impact investment flows around the world, particularly in the US where Japanese investors have been parking their funds for some time.

Rates will need to rise in Japan and when they do, there will be many investors who repatriate their funds back home to more decent yields. Watch this space.

Remember to subscribe to make sure you get each week’s update delivered straight to your inbox.