Missing the forest for the trees

One of the most important lessons in investing is not to get too caught up in the day-to-day market movements. Information is constantly being thrown at us at an ever-increasing rate.

But there is such thing as too much information, too much noise. Nassim Taleb calls it noise bottleneck, in that often, too much information is bad for us and causes us to make unnecessary mistakes.

I’ve written about rates and the looming commercial real estate problems over the past couple of weeks.

My focus this week is on things that haven’t been in the headlines, but could have an impact on investments in the next 5, 10 or 15 years.

ChatGPT was in development for a long term before it became a mainstream topic. So too were electric cars and crypto markets.

As a passive (barely) golf fan, one of the things that caught my eye over the past month was the LIV Golf tournament in Adelaide. Golf was always a boring sport to watch, but suddenly, LIV is breaking the mould and I see it as an attractive entertainment product. I actually enjoyed watching. PGA fans will probably scold, but many taxi proponents also wrote off Uber. Disruption comes in stealth mode.

LIV is an interesting experiment by Saudi Arabia. Despite the negative publicity, I actually think it’s proving to be successful. The strategy fits into an overall Saudi diversification plan which I think is even more intriguing from an investment perspective.

As I watch oil prices plummet (despite the European war), I can’t help but think that the Gulf states have already started their diversification away from fossil fuels, but this time in a much more serious way.

As Prof Scott Galloway says in a recent note “The secret sauce in the Gulf State pivot isn’t the oil money itself, however. That’s the bait. The prize is other people’s money. Specifically, rich people’s money.

The plan, distilled, is to become the global headquarters for the mega-wealthy. This strategy increasingly makes sense as wealthy people continue to weaponize even democratic governments whose policies crowd more of the spoils into the top .01%.”

The Saudis have launched their own ultra-luxury hotel brand, the Boutique Group, and Qatar owns The Plaza Hotel in New York and The Savoy in London. According to Galloway, these weren’t property or even hotel acquisitions but brand acquisitions.

Middle Eastern interests now own many of the world’s most iconic football clubs, including Manchester City, Paris Saint-Germain, and Newcastle United. Qatar spent $220 billion on the FIFA World Cup which was more than the last seven World Cups combined. The Qatar World Cup had the highest-ever attendance in the tournament’s history, as well as one-fifth of the world population watching the final.

The Gulf emerging as a financial centre

The Gulf is also evolving into a population destination for fundraising efforts. Venture firms including Andreessen Horowitz, Tiger Global, and IVP have held high-profile events in here.

“The Four Seasons in Riyadh,” according to one prominent venture partner, “is basically Palo Alto.” An executive in the UAE’s investment company said, “We came to San Francisco looking for them in 2017. Now everyone is coming to us.”

Some are coming to stay. Ray Dalio is setting up a branch of his family office in Dubai, and big-name hedge funds, including Millennium, ExodusPoint, and BlueCrest, all have offices in the Gulf already.

The UAE registered a net inflow of 4,000 millionaires in 2022, and in Dubai, $57 billion in real estate changed hands, up 80% from 2021, including 86,000 residential properties and 219 homes worth over $10 million.

At the same time, India continues to expand

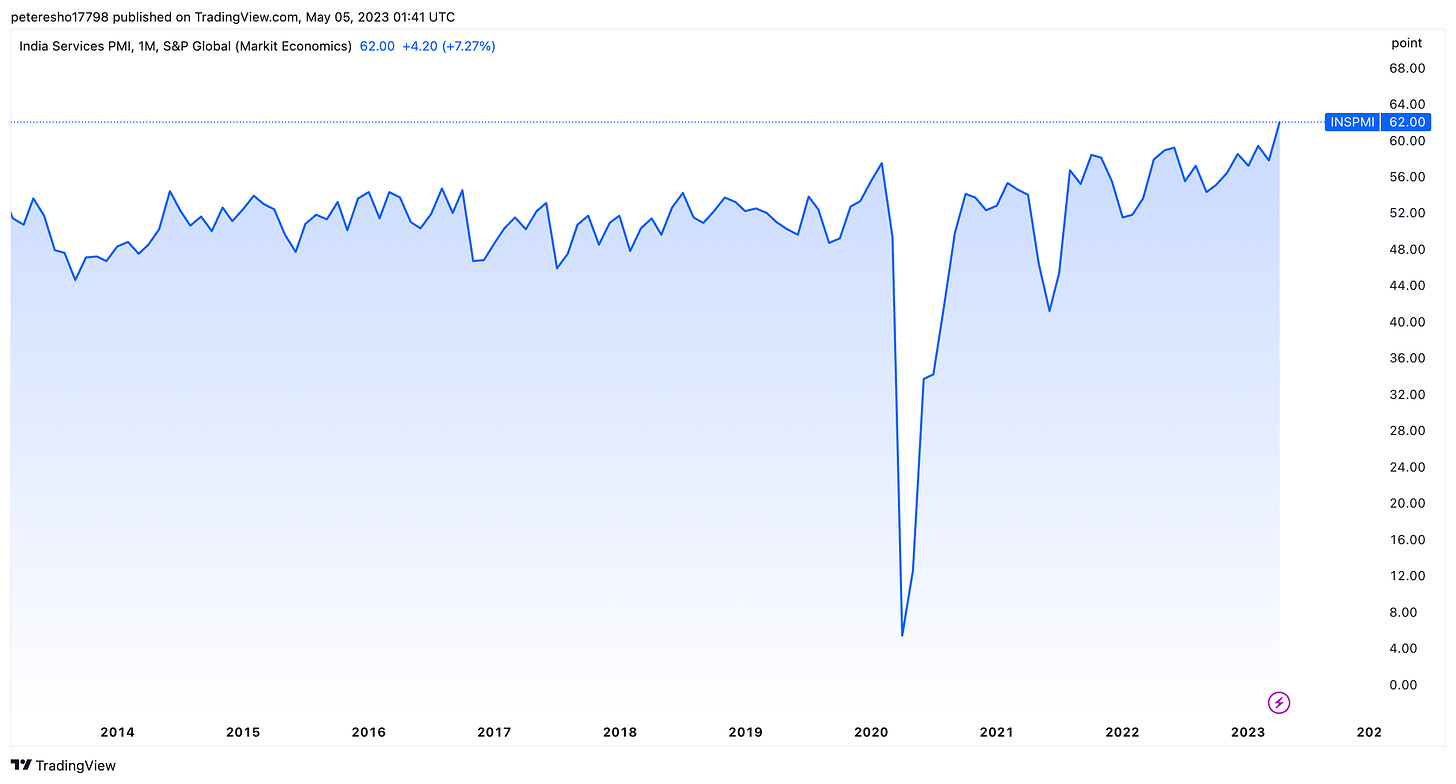

I’ve also been watching India very closely and I wrote about this back in March ahead of the G20 summit. One of the things that stood out to me this week was S&P Global India services PMI increasing to 62 in April. This is a 13-year-high in one of the world’s fastest growing economies.

In March I noted that “India may use this opportunity to learn from the Adani experience and see that there is an even greater prize of awakening, with the West and China continuing to fracture their relation. India could emerge as a reasonable middle ground for business relations.”

While it’s too early to make a judgement call on Adani’s future, I do think that the problem has been managed and contained from a brand India perspective. The markets have moved onto bigger short term issues, like rates and the looming second tier banking collapse across the US and Europe.

India’s recent tax reform initiatives means that the government is starting to reap the rewards of its economic growth with much-needed revenue. Collections rose 12% year-on-year to a record high in April of 1.87 trillion Indian rupees ($22.88 billion). The government collected 1.60 trillion rupees of GST in March, and 1.68 trillion in April 2022.

Bottom line – focus on the forest

There’s an old saying that sometimes, we miss the trees for the forest. Short term distractions and getting caught up in them can cause us to miss bigger themes, opportunities and threats.

What’s happening in Saudi Arabia or India may only manifest itself to Western investors through golf or politics, but it will have a profound impact on a large majority of the world’s population and economic power.

A new rising order is pressing for a seat at the international table as it seeks to increase self-reliance, reduce dependence on the increasingly-weaponized dollar, and create a set of rules that meet its own interests.

I’ll cover more on this in the coming weeks, all while the markets do their thing.

Peter Esho is an economist and Founder of Esho Group. He has 20 years of experience in investments and markets.