Is a market correction around the corner?

One of the most interesting and insightful quotes I heard this week was from an experienced money manager saying “the best way for central banks to stop inflation is by creating a crisis”. It would have sounded ludicrous a year ago, but not as outlandish today.

There is some strong merit and it could explain why central banks have continued to increase rates despite inflation data showing strong signs of moderation. Do central banks actually want to push things to the brink, cause cracks, so that a crisis kills the inflation dragon?

It’s a question I’ve been thinking about very closely. I wrote last week about the importance of standing back from the market and observing bigger themes and trends that can sometimes go unnoticed.

My focus this week however has been on the market, watching the short term movements and hints around what’s likely to come in the next few weeks and months.

The chart above shows the US Purchasing Managers Index (PMI) relative to two year interest rates over the past 25 years. While no chart is perfect, we can see that a dip in the PMI is usually followed by a dip in rates.

There can be a lag of around 1-1.5 years and I think we are now in that lag period. The PMI is a fairly strong economic indicator and it shows that things are starting to soften, mainly because of the steep elevation in interest rates.

The gap between the blue and yellow line always crosses over. This time it will either be the blue rising, the yellow falling or both. For the blue to rise, we need to see a shift in economic activity. There doesn’t seem to be anything significant in the horizon that would indicate that. In fact, if we look at oil prices, the opposite is probably true.

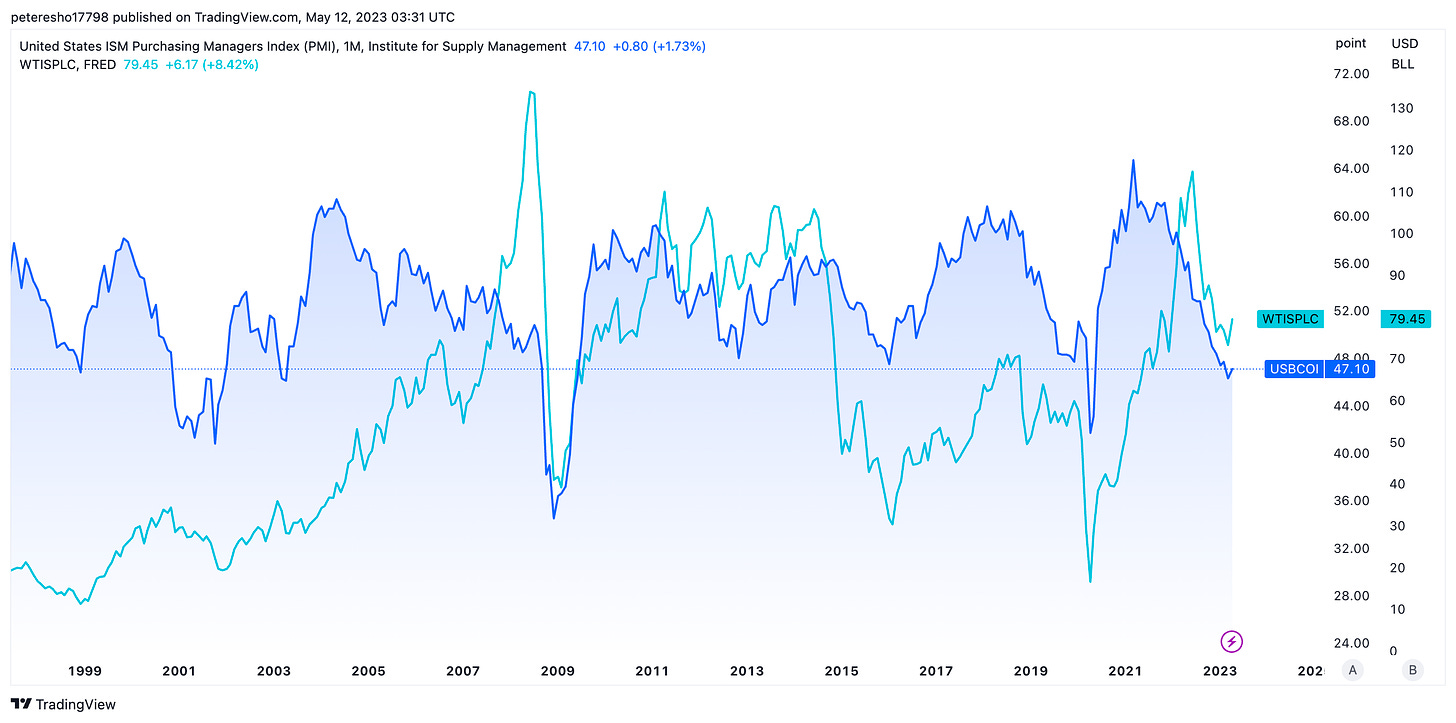

Oil is indicating the same type of information we get from the PMI in that economic activity and the outlook for that continues to soften. I’ve added oil alongside the PMI in the chart below, the correlation is strong.

This week’s US data shows inflation continuing to soften and an early (perhaps very early) deterioration in the US employment market with initial jobless claims rising. I’m not sure on timing, but the price action in oil seems to suggest that we might be a few months away from a trend deterioration in economic activity.

We’re also on the brink of more bank collapses and a Mexican standoff in commercial real estate, which will crack at any moment.

Finally, a small but important anecdote which caught my eye. There are reports that an investment firm (Royal Group) controlled by a top Abu Dhabi royal has built a short position worth billions of dollars in US stocks. According to Bloomberg, this compounds growing fears over a recession will pressure markets.

I would normally pay too much attention to a single investor taking positions on the market. In fact it’s probably very insignificant to the overall global market daily activity. But I’m curious given the UAE’s vantage point as a growing investment hub and correlation with oil production within the region.

Is Royal Group seeing energy softness as a lead indicator of a hard landing to come? We’ll have to wait and see.

How I’m playing it

I’m a buyer of stocks and in particular technology if we do see a market selloff. I think central banks will always come to the rescue party if the economy does go into a hard landing and that will be the catalyst for a continuation of the pattern we have seen since 2009.

The residential real estate market in many metropolitan cities has already stabilised and in some instances, prices are rising again. I think real estate prices will perform strongly if the stock market falls and rates get cut to avoid an economic hard landing.

Constant, revolving bailouts which debase currency and push asset prices continuously higher.

Peter Esho is an economist and Founder of Esho Group. He has 20 years of experience in investments and markets.