Investment outlook for the next six months

One of the things I look at closely is the cost of money. Most assets rise and fall in value, not necessarily because of their qualities, but usually because the cost of money is tracking one way or another. Many investors think real estate investing is about the real estate itself. This couldn’t be further from the truth. Real estate investing is about understanding the direction of interest rates.

As an Australian based investor, I look at two key rates every six or so months to realign and set my investment expectations. These are the Australian and US 10 year bond yields respectively. Both are currently sitting in the 1.20-1.30% rate range, down from their March highs.

The Australian rate is important because it sets my local expectations but the US 10 year rate is perhaps the single most important financial indicator you will ever need to watch.

If you could only base your investments on one single number, it would probably be best to stick to the US 10 year bond yield. The rate represents the cost of US government debt, as traded in the market. This interest rate sets expectations for almost all other rates around the world. The world’s largest investors base their asset allocation and global investments based on this number. It’s not the only number, but it’s the most important number.

And here is what’s happening to it.

Where are rates going in the next six months?

Rates recovered as we came out of the pandemic. Things were starting to look up in the first half of this year, but as I predcited a couple of weeks ago, the impact of the Delta variant could pose a significantly threat to the global growth recovery and it seems like interest rate markets agree with me.

Many investors are now doubtful of the deflationary impact of the Delta shutdowns, which in Europe and the United States, are yet to take effect.

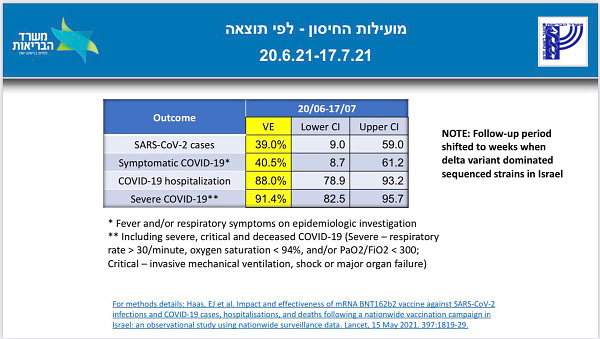

I’m watching news coming out of Israel which shows vaccine efficacy against the latest variants of concern (VOCs) are perhaps lower than what we could have expected and there will need to be some more time for the full health impact of the pandemic to work through the global economy.

One of the things that were unclear to me when Sydney (where I live) went into lockdown one month ago was if we were behind the curve or ahead. Our vaccination rates are low in Australia and at first there was a thought that we were late to the game and paying for our vulnerability. But as each day goes by, I’m starting to feel more confident that what we’re experiencing in Australia is a pre-cursory of what Delta could look like overseas.

If that’s true, bond yields and interest rate expectations will continue to come down and we could see more money printing from central banks. There will be some hesitancy from governments to through fiscal stimulus quickly because their ability to do so is running out. There’s only so much money they can pull out of thin air.

Hoever if Delta and other VOCs persist, governments will have no choice but to hand out more money.

Investing over the next six months

I’m not a health expert and I have no idea how Delta or other VOCs will play out. What I do know though is the smart money is betting on interest rates remaining lower for longer. As an ordinary investor myself, my criteria remains to look for yield generating opportunities that can withstand tough times.

I love residential metropolitan real estate in markets where I can get a 4-5% yield and utilise cheap debt. I think small is beautiful and there’s nothing wrong with going against the grain if you can find opportunities that don’t necessarily fit inside the mainstream box. Apartments are a perfect example, I wrote about them here.

If rates remain low, I doubt gold or other metals will continue to rise, so there could be some downside risk. Crypto is in the too hard basket for me until we get some type of regulation and some of the hot air comes out, which has been the case in recent weeks. I hope that continues so we can make more informed decisions on new, exciting projects.

The carbon concious theme will continue to push ahead and there will be some new market leaders being created in the next few months, so I’m watching stock markets for exciting opportunities in this space. I’m also looking to add some Ali Baba stock to my diversified stock portfolio.

The worst place to be is cash a medium term investment, but in the short term, it might be wise to keep some cash on the sidelines until the dust settles.

If you want to get new ideas as I release them each week, I encourage you to subscribe below and they will be delivered directly to your inbox.

Stay safe and God bles xx.