Over the last few weeks, I’ve started to bring you the four key investment themes I’m watching for 2022. I discussed Commodities a few weeks ago, if you missed it you can read the note here. The last theme and my focus in this note is on Disruption.

I tend to think of disruption and innovation separately. To me, disruptive technology is innovative and much cheaper than the existing alternative. Sending an email was much more effective than sending a letter or telegram. Spotify was a much better and cheaper alternative to buying $30 CD’s for each artist you like and the same goes with Netflix vs. Blockbuster or cable television.

Disruptive technology is 10x better and usually 2-3x cheaper (at the minimum). My belief is that disruptive technology is a huge offsetting factor against rising inflation. The cost of 1TB of cloud storage today is much more easier to access and cheaper than a hard drive or computer server 10 years ago.

In the next 5-10, I believe we will see the largest swath of disruptive technology we have ever seen. Energy is the biggest opportunity, followed by food, healthcare and education. Paying $50k per year for a University degree is ripe for disruptive…as is a $5,000 overnight stay at a hospital for a minor procedure that would cost $50 in a developing country.

Better and significantly cheaper

To reiterate, I’m not watching technology or innovation. I’m watching the pace of disruptive technology and adoption. Here’s another example. I recently had coffee with a senior banking executive. He works for a large global bank, extremely well credentialed and highly regarded. We tend to meet pre Christmas for a catchup every year.

Last year I was trying to convince him that Bitcoin will become a mainstream investment. This year he explained to me his recent investments in a DAO project which pays 80,000% pa in annualised interest. He explained to me (not the other way around) how he purchased Avax on Coinbase, sent it to his metamask wallet, swapped it at Traderjoe and then staked it with the DAO.

Imagine where we’ll be in a year’s time. We’ll be talking which probably haven’t even been created yet.

How I’m managing my investments

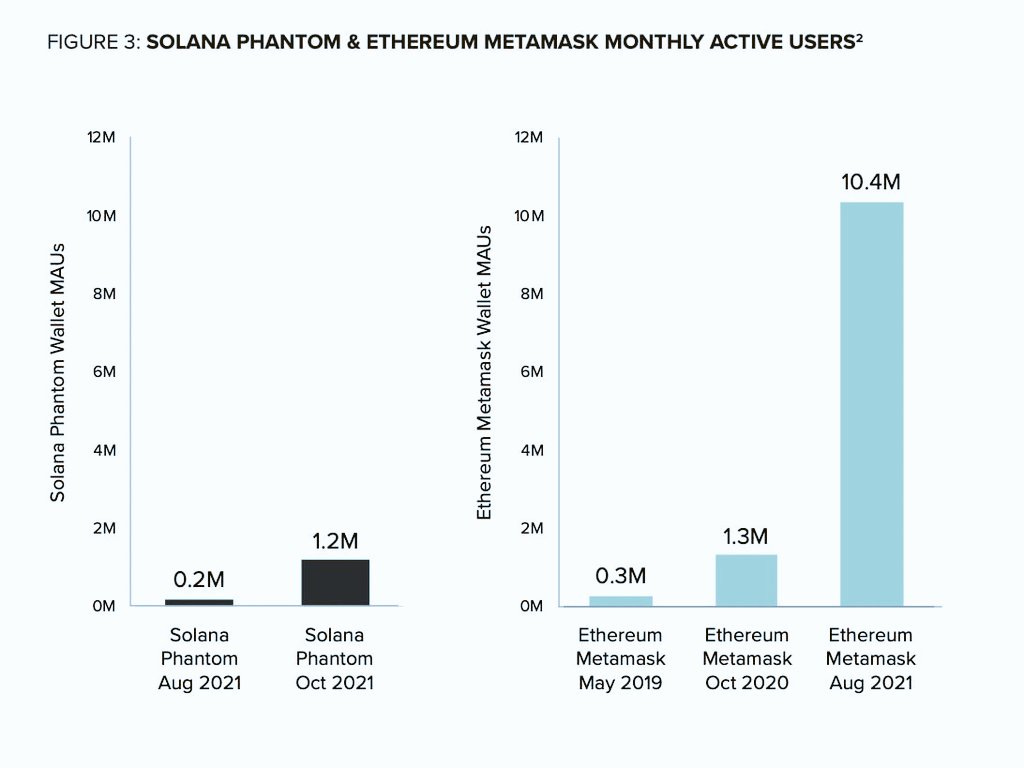

I recently added some Solana to my very well diversified crypto portfolio. Solana is a perfect example of disruptive innovation. It was merely recognised a year ago, trading for a few cents. Today its worth more than $50bn with millions of developers and investors buying into the platform. I like backing investments which have network benefits. The more projects that are built on Solana, the more valuable the network becomes.

The other thing with Solana is the cost advantage. A simple transaction on Ethereum costs around US$8 in processing (gass) fees. Transactions generally cost around $0.00025 each on Solana. The technology isn’t the same, but the cost is so much cheaper that an entire ecosystem is building around the platform.

When it comes to stocks, I’ve had some good calls and bad. I’ve mentioned 4 main stock additions to my portfolio this year - Ford, Peloton, Roblox and Carbon Credits via KRBN. They’ve all done exceptionally well (40-80% up) except Peloton which is down around 50% since I added. You win some, you lose some.

Disruption is difficult to predict, in fact you can’t predict it by its very nature. That’s why its so disruptive. But the key is portfolio diversification. My stock portfolio is up 46% this year despite getting smoked on Peloton because it is very well diversified.

So my final thought for the year is this. Remember that the most important factor in investing is capital preservation. You can get your entire story right, but your timing can be entirely wrong. Things happen outside of our control. But if you manage risk well, you’ll sleep better and generally perform much better in the long term.

Its not dumb to make a risky investment. It’s only dumb when you put a large amount of $ or % of your portfolio into it. If I was to summarise everything I have written and learnt this year, or in the past 15 years, into two words, it would be: Risk Management.

I want to wish you all a very Merry Christmas and Happy 2022. Enjoy the good times and embrace the bad times as a character building experience. Thank you to all those who subscribed and wrote back to me this year xxox.