Interest rate pivot could come in 2023 as data starts to soften

I’m continuing to look through the valley to see what the macro economy looks like next year, not necessarily what it looked like three months ago. Inflation data is coming in pretty bad, but in line with expectations. Its much worse in certain parts of the world like Europe and emerging markets which have seen their currencies smashed against a stronger US dollar.

Inflation hit record high levels in Canada overnight, coming in worse than expected. The chart below looks like the loch ness monster emerging from calm waters. Most of the increase was energy and food driven, much like the rest of the northern hemisphere.

Meanwhile in Australia, things are starting to even out. Today’s Aussie unemployment print was flat at 3.5%, but around 8,000 jobs were lost. Its not a huge number, but its a sign that recent rate rises are starting to bite and if central banks aren’t cautious about the future, they could really blow things up next year.

Here are two year Aussie interest rates compared to the US. The rate differential has seen the Aussie dollar fall to US$0.62 and really struggling to find much traction or momentum. It could continue to go lower before it goes higher.

The real question is at what point does the US economy start to turn and turn hard. I suspect its going to happen over the next few months and when it does, the US dollar is going to start reversing aggressiely. US 10 year government bond yields — the holy grail for economic indicators — are now well above 4%. That’s huge considering it was half that level earlier this year.

US unemployment is yet to fall, the economy continues to add jobs. But I continue to think this is all rearview vision and backward looking. There’s a big lag in the data.

The huge rise in US interest rates will have its desired impact and the economy will suffer, perhaps immensley. It’s just a matter of when and by how much.

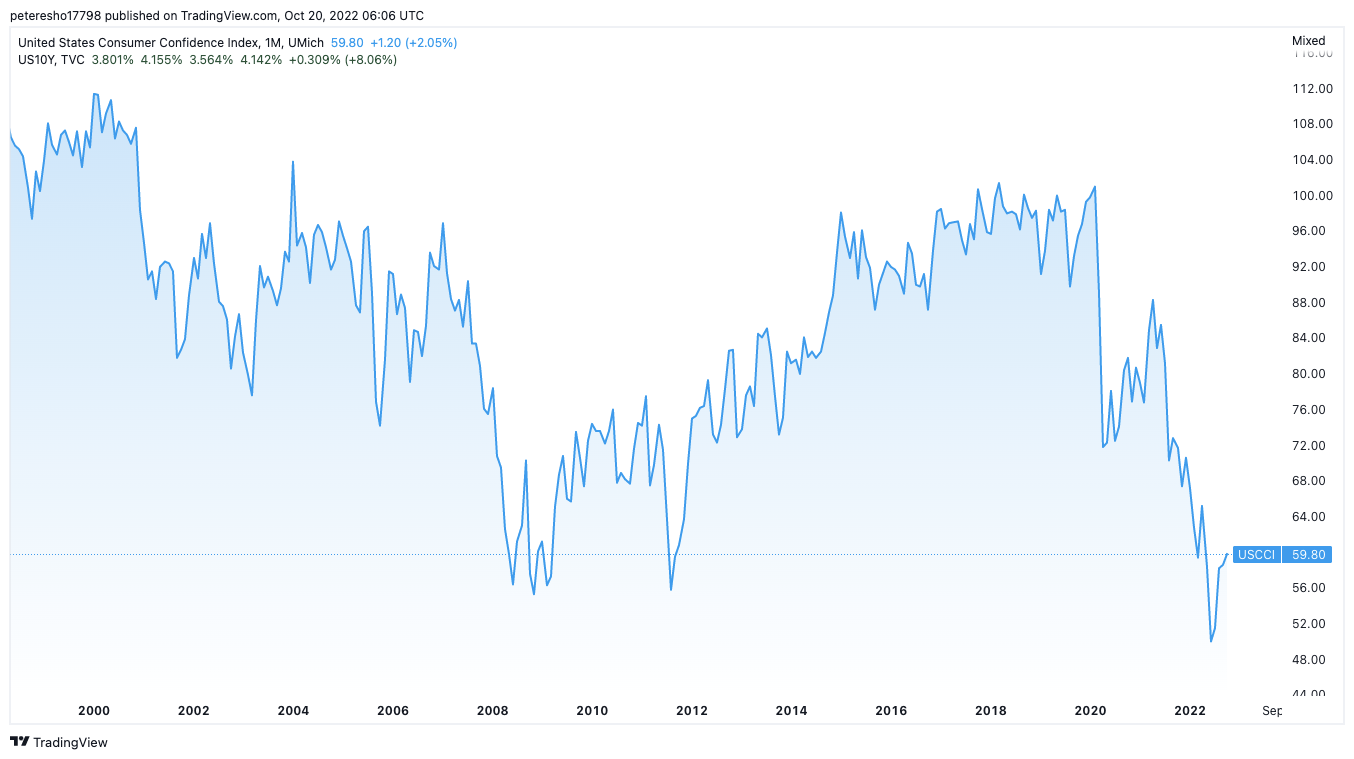

The chart below shows the steep decline in US consumer confidence since the begining of the year. Even though the jobs market is strong, rising rates, the lagging impact of inflation and the war in Europe is hurting consumer confidence massively.

At some point this all starts to add up and will start showing up in the data. I suspect in early 2023 we’ll start to see job losses in the United States. The market will move before the data prints.

Remember, markets move ahead of the economy. We could be on the cusp of a major reversal in stocks first and then real estate later.

Now back to Asia. The reason I started off with Australia is because I believe the Australian economy is a great forward indicator of what happens next to other developed economies.

The Reserve Bank of Australia (RBA) led global central banks this month when it moved to increase rates by 0.25% compared to the expected 0.50%. There’s something very important in that move. A nice hint. The RBA has probably read the situation much better than its US peers and sees the risk of rising too hard and too fast to future growth.

The other issue which has gone unnoticed in a world and market obssessed with the US and Europe is the situation in Japan. The Bank of Japan (BOJ) today conducted emergency bond-buying operations, extending efforts to put a floor under bond prices, as the yen nears a 32-year-low against the dollar.

This is very signigicant. Japan is still the world’s third largest economy. It goes to show that what’s happening in Asia could potentially be a good forward indicator of where things go in the US and Europe in 2023. Asian economies are reeling, the high US dollar is blowing things up and demand is starting to come off.

Commodity prices have already started to come off and are now trending back to their 10 year average as demonstrated by the chart below.

Bottom line: I think inflation is under control and recent rate rises across developed economies will kill it off. I also think they’ll kill off growth and most of the data is backward looking.

Asia is showing signs of weakness, commodity prices are moderating and next year we’ll probably be talking about completely different risks to the macro environment. It’s not a bad time to start adding stocks which have been sold off in the recent pullback. It’s too early to bet against the dollar…for now.