Social and economic impact of the Delta variant which investors should be aware of

The Delta variant (also known as B.1.617.2) emerged in the Indian state of Maharashtra quietly in October last year and now the topic of discussion for many countries — those who have high and low vaccination rates respectively. In Sydney, we’ve been living in a buble for the past two years, with no overseas visitors and very limited outbreaks of the virus to date. But all that changed two weeks ago.

We’re in the third week of a lockdown with cases still yet to peak according to the health experts.

What’s facinating me about the Delta variant is just how different each country is reacting. In the United States and United Kingdom, which have admittedly had longer lockdowns last year and higher vaccinations rates than Australia, things are back to normal and it doesn’t seem like there has been any significant change to the way people are going about their daily lives.

In Israel, where vaccinations rates are among the highest in the developed world, there is a shift in mode and perhaps more prudence with how to act (see more here). My focus isn’t on the science — I have trust in our excellent health and government agencies to take care of that.

My focus instead is on what these latest variants mean for investment markets and the outlook for investment returns.

Rates to remain at ultra low levels

One thing I’m becoming more certain about is that interest rates are likely to remain low for a prolonged period of time. I was on the fence about rising rates over the past few months, not sure who to believe. On one hand we had those who said inflation was coming and rates could sky rocket…on other, very sensible investment managers adament that rates will remain low.

The pandemic isn’t over and we still have live with the potential of more health concerns in coming months and years. This means means that any inflationary pressure will be temporary and offset by lockdowns, which have a massive deflationary impact on the whole economic system.

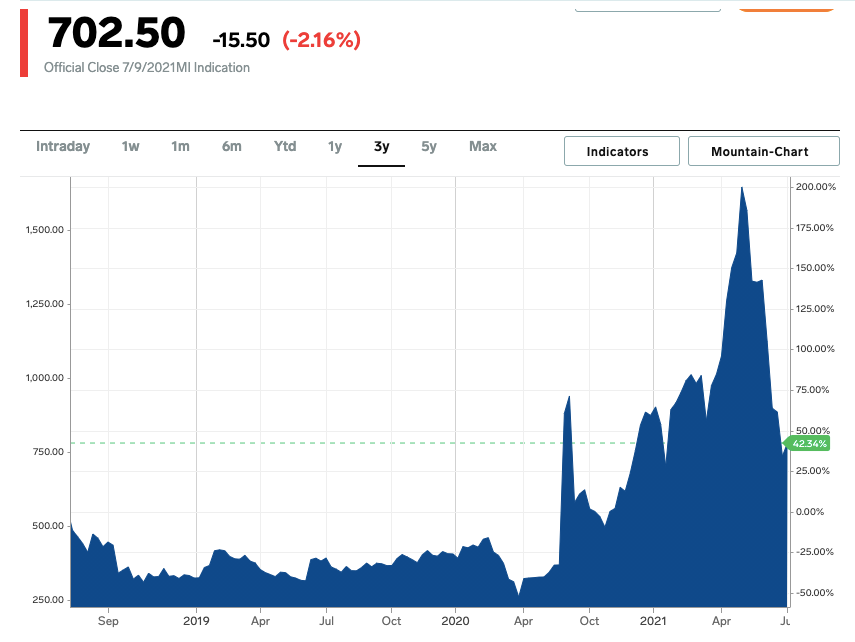

Government stimulus and record low interest rates are necessary to offset the impact of devastating lockdowns, the impact which is yet to be felt for many more months to come. Here’s a good illustration, showing lumber (timber) prices in the United States over the past year.

The big spike last year, mainly due to a supply backlog post Covid’s first outbreak, has now almost completely reversed, with prices coming back towards more manageable levels. We’re likely to see the same for cars, furniture and many other items which suffered until supply bottlenecks.

Interest rate expectations over the long term are also coming down. One of the things I look at closely is the 10 year bond yield in the United States, this generally sets rate expectations for the rest of the world. When the 10 year US yield is rising, its a sign that economic activity is strong and rates are rising to offset price growth. When the yield falls, the market is pricing in contraction and things coming back.

It’s not a huge decline, but its a change in direction and I’ll be watching this very closely over the next few weeks as the Delta variant grows across the world.

Yield is King

Irrespective of what happens with infection rates and government stimulus, investors around the world will continue to remain hungry for cashflow and stable investment yield in the coming years. Vaccines will come and go, new strains will emerge. It will take time for this to feed through the market.

Delta, debt, disruption and demographics will conitnue to keep rates low for many years to come.

Residential real estate will continue to offer solid yields to investors, particularly in large metropolitan markets where jobs and stimulus will be targeted to ensure lockdowns are offset by stimulus.

Countries like Australia have strong fiscal positions and the government can continue to do a lot more until the pandemic is brought under control.

My residential real estate preference is for major metropolitan cities and perhaps increasingly towards apartments where it isn’t difficult to get a 4-5% income yield in Sydney. The owner-occupied housing market is perhaps more vulnerable, because incomes used to service higher debt could become volatile in lockdowns. Prices in the mid market could come back in the coming months.

But real estate as an investment, supported by strong yields, remains a standout.

I’d also be open to take some profit off the table when it comes to stocks, particularly in the US, just incase there is a Delta re-calibration. The best time to buy US stocks is on panic selling and while a low probability event, it is possible in the coming weeks. So I’ll be ready to add if we get that opportunity.

I’m also looking for more carbon convcious investment opportunities which may come up in the next few weeks on any stock selloffs. It’s a multi-year theme which I think will continue to perpetuate as we come out of this pandemic and emerge in a more socially sustainable world.

Take care, stay safe, remain strong and we will all prevail through this together.