If you try to do everything, you'll end up achieving nothing

One of the most difficult things to do as an investors is focus. Yet, it’s the most important. We live in a digital era which means infinite choices, infinite options, infinite markets, apps, resources. Most of this is noise and distractions. Access to new opportunities is great, but when we don’t know what we want, more choice is actually a negative (also called the paradox of choice).

One of the things I really struggled with early in my career was digital trading. I would spend countless hours researching and picking stocks, making the right trades, but often taking profit or small losses too early before being proven right. My ability to log into my online trading account, whenever I wanted, was a big temptation.

I’m good at picking long term macro themes, but too impatient and tempted to sit it out.

The reason I love real estate is because of its illiquid nature. I can’t just wake up one day and decide to sell everything — there is a long process before I get my money, unlike stocks, crypto and most other digital and liquid global instruments. I also can’t buy on impulse, transactions take time, which allows for level headed decision making.

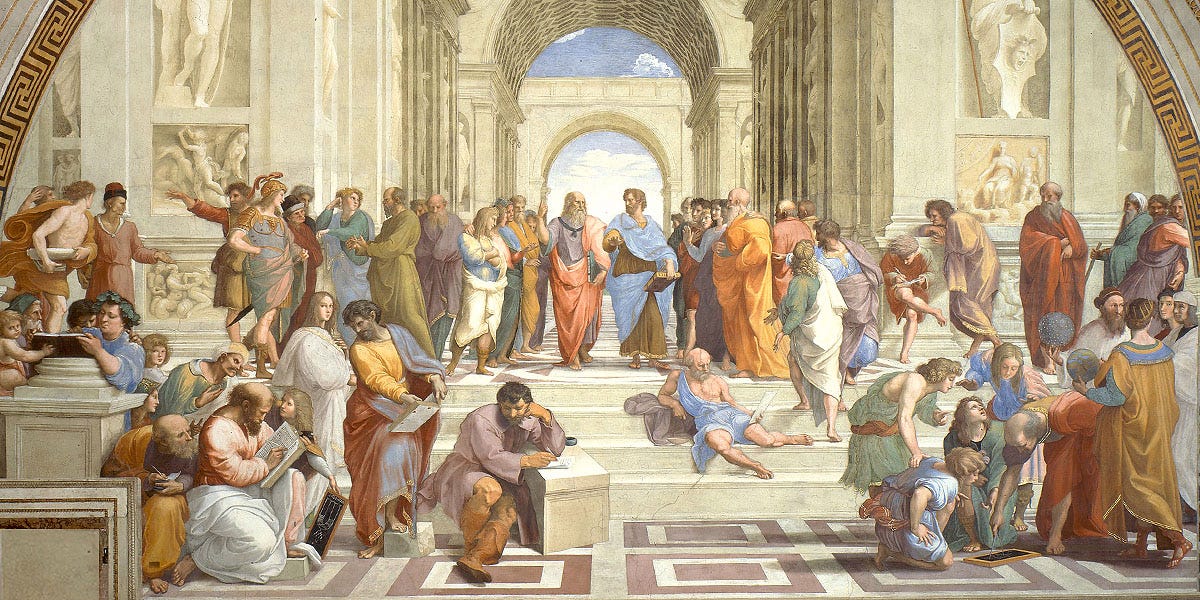

There’s something beautiful to the old school way of investing.

Eye opener during the 2009 crisis

I had an eye opening experience in the 2009 crisis. I was working as an Investment Analyst at Morningstar and as part of my role, I would regularly speak at events and conferences, meeting and interacting with investors from around the country. I would often be overwhelmed by people after my talks, all lining up to ask me about a particular stock or investment they were struggling with.

Often, investors were losing money and torn between selling at a loss or hanging on for a recovery. They would ask and usually not listen to what I would say. It was a cry for help. I could see the hurt in their eyes and it tore me apart.

What I realised was that people invested in things they didn’t understand. When the trend went against them, they were hopelessly stuck.

So in 2009 I learnt one of the most important lesson in my life — only invest in what you understand. For everything else, either invest time in understanding before you part with your cash or if you don’t have time to study, ignore and stick to what you know. It will save you a lot of stress, trouble and money.

Strategy is King

Most people don’t know what they want from their investments because they don’t have a goal, a plan or and understanding of what successful investment means for their lives. Imagine jumping into a car with no idea about where you’re going, no final destination input. You’ll either crash or run out of fuel.

That’s what happens for most investors. They start investing, things seem ok. Then markets do their thing. Prices go up and they come down. When things go down, the s***t hits the fan.

Without a plan, investors either increase their losses or give up and run away. That is the real tragedy. My best lessons have come from my losses. Once I built a strategy and a plan, I never gave up. I used my errors as feedback to improve my process.

I 2013 I wrote an article for Morningstar called “What Westfield can teach us about strategy”. Westfield had grown to become a global player in retail real estate from humble beginnings. Even at the time of writing this note, it has managed to navigate the pandemic and survive countless crisis.

Westfield still is one of the most successful investment companies because of one huge reason — it has a clear and simple strategy. Each time you open up a Westfield result release, you see their strategy. Westfield’s strategy is to build and operate the best malls, in the best locations. To allow customers the ability to shop, entertain and spend more time at their locations.

They have one clear purpose. They have focus. That is why they have been so successful.

Target misses its mark

At the same time, you can take a retail concept like Target and see how a lack of strategy and focus has resulted in multiple years of losses and failure. I walked past Target yesterday at my local mall and couldn’t believe they are still open.

Target lacks focus because it tries to be everything to everybody (which is rather ironic, because the name itself implies an object of attention). Not hitting the right Target!

In 2009 I told investors to avoid Myer on its IPO when the everybody else “loved it”. I repeated my view publicly for the next 5 years. The Myer stock price fell from its $4.10 IPO price to $0.28 at the time of writing.

The pandemic hit Target hard as it announced the closure of around 75 stores last year in Australia alone. Target’s Australian owners Wesfarmers booked a $120-170 million cost in relation to the closures and a $430-480 million loss on the value of the business.

Myer is in a similar position.

My 86 year old grandmother can tell you why Target and Myer struggle, we don’t need a fancy analyst at a big investment bank for analysis. They’re both mid-market retailers, trying to please everybody, but in that process, they appeal to no clear market niche or segment.

When you try to do everything, you end up achieving nothing.

Design it for you

My message this week is this — figure out what you want from your investments. Figure out what success looks like and then build the plan that suits your personality to achieve this success. Don’t do crypto just because it’s in the headlines. Do crypto/stocks/real-estate/business whatever if it is right for you, if you understand it and if it will give you the investment returns that work for you.

You might not need a billion dollars to live a wealthy life. Figure out how much and then work backwards. You’ll be surprised at how easy it is.

I review my strategy every year. I have a certain approach to stocks which works for me — I buy market based ETFs when the market sells off and I take profits once I’ve reached my target. I don’t do individual stocks anymore because it doesn’t work for me. I don’t have the patience.

I like crypto because of the possibilities, but I focus only on Bitcoin because it works for me. Everything else is noise, which I’ll read and investigate, but won’t put my money towards unless I see a fundamental reason.

And finally, when it comes to real estate, I’ve built a particular strategy which works for my and my family. I ignore opportunities which might seem great, but fall outside of this strategy. If I try to do everything, I’ll end up achieving nothing.

I update the strategy, not the other way around.

Strategy comes first and focus is the single most important piece of every successful investment process.

I hope this helps you figure out what you want and how to best achieve it. God bless.