If you must panic...panic early

Our emotions of fear and panic are part of making a good decision. If you don’t know that there is some bad outcome which you should avoid, you cannot act on it. Some fears are bad — others are necessary. Generally I’m worried about things which have large exponential qualities and not too worried about trivial things which are linear.

Pandemics like Covid are multiplicative and contagious. Car accidents are not. If my next door neighbour catches Covid, the chance of me catching it increases. On the other hand, if my neighbour dies of a car accident, the chance of me dying in a car accident don’t necessarily increase.

Some things are worth worrying about. In fact, some things are worth panicking about.

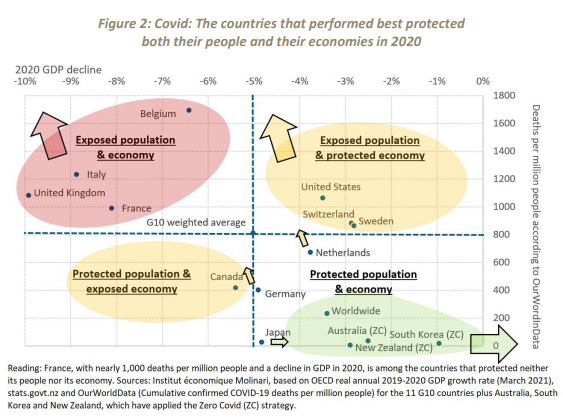

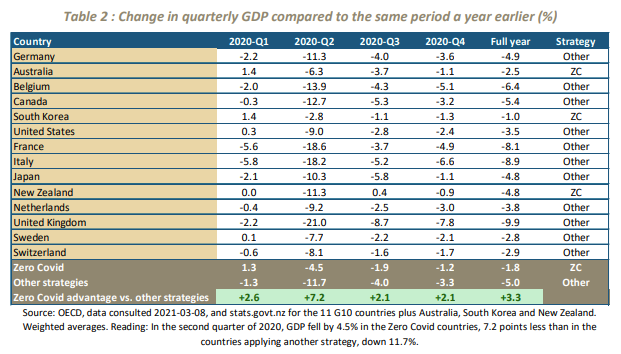

This is illustrated brilliantly in a recent French study I came across by Cécile Philippe & Nicolas Marques published this month. The study looks at the relationship between different Covid strategies around the world and how they impact subsequent economic performance.

The study categorised each country into three different groups - countries which sought mitigation, countries which sought elimination and countries which did nothing.

Countries which panicked early did better

France experimented with a strict lockdown early in the epidemic due to hospital saturation in March 2020.

Since then, longer-term measures to reduce contacts (wearing of masks, closing of bars, cafés, restaurants, performance venues and so on) and short local lockdowns in heavily contaminated areas were imposed in the hope of keeping the number of people hospitalised within acceptable limits.

Australia and New Zealand, on the other hand, imposed a strict lockdown at the start of the epidemic to eliminate the virus from its territory. They then reopened society as a whole while maintaining strict mobility controls at entry points along with active surveillance, which led occasionally to local lockdowns in areas where the virus was detected.

Recently, Auckland and Brisbane were put back on lockdown for seven days.

The study showed that Australia, South Korea and New Zealand all had lower mortality and smaller declines in GDP. They have all done much better than the G10 average. This full-scale test, conducted on 82 million people, is very conclusive.

Restrictions, whether imposed by the authorities or self-imposed by people seeking to limit the risk of contamination, were less severe in the Zero Covid countries in the second quarter. In the fourth quarter of 2020, these countries had almost returned to normal economic activity.

Their GDP was down slightly (-1.2%) compared to 2019 due to restrictions on dealings with countries still in the grip of the virus and subject to local lockdowns linked to specific outbreaks.

Meanwhile, the decline in GDP was greater (-3.3%) in countries that had not eradicated the virus, with restrictions on movement arising from individual choices as well as from health policies.

The chart above isn’t perfect, because economic shocks in the United States will impact each country different, depending on other factors. It is good enough though to illustrate the point which I want to make in that, panicking early has paid off massively for certain countries, while those who were complacent are still feeling the economic and health pain of the pandemic.

The study implies trying to kill the pandemic did not kill the economy. Shutdowns did have an economic cost, but the cost was small relative to the benefit.

The reward for early panic

The countries which panicked early have come out of the pandemic best. The investor who panics early about runaway government debt, money printing and swelling central bank balance sheets will also be best placed in the next decade as asset prices grow.

One of the things I’ve been writing about consistently, here in this newsletter and on social media, is the huge cost of government actions and the implications they have on movements in the price of stocks, real estate and crypto markets (see Why Everything Keeps Going Up).

We’re starting to see runaway asset prices relative to government currency across stocks, real estate and crypto markets. Prices have been accelerating in recent months and it doesn’t seem like they’re about to stop anytime soon.

If you're worried about stocks, real estate and crypto prices falling....you're thinking the wrong way. Prices aren't rising, the value of the dollar and government paper currency is collapsing relative to other assets. We've just gone through the biggest recession and economic shock in history, yet the price of everything keeps going up.

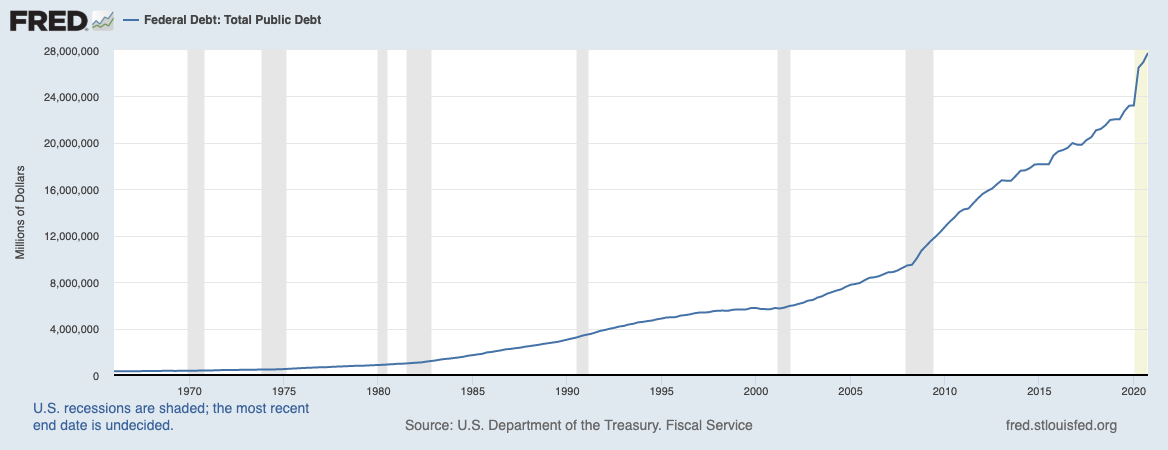

Why? Because central banks around the world have grown their balance sheets to unprecedented levels. Crazy levels.

It's kind of masked because we don't see it in currency swap rates because every government around the world is kind of doing the same thing. The AUD/USD is near its long term average because both countries have grown their balance sheets and printing relative to their base.

Everything seems normal, but again, it isn't. It's masked. Here’s a quick chart which shows US government debt, last sitting at US$28tn.

When we look at stocks, reap estate and crypto relative to government debt, they haven't gone up a lot. They actually look cheap. Think about the denominator every time you consider the price of something. People who have lived in Iraq, Iran, Lebanon, Venezuela, Argentina understand this.

In the next few weeks, I’ll bring you more insights and analysis on where markets are heading over the next 5-10 years. Subscribe to make sure you get each update as its published.

Countries who panicked early on the onset of the pandemic are now the strongest economically, my goal is for you to panic and adjust early as government debt starts to impact the price of all major assets around the world.