How much higher can oil prices go?

Oil prices are rising to levels we haven’t seen in a long time. In this note, I don’t intend to discuss the ongoing threats between the West and Russia. I want to explore the fundamentals and the flow of demand and supply which is likely to impact prices.

Overnight the US and UK have banned Russian imports of oil. That’s not necessarily the big story as you will see below. The bigger story to me is the counter measure by Russia to ban all exprots. Russia exports a range of energy including oil and natural gas. The later is perhaps more important than the former.

Oil prices are driven to extreme levels whenever there are fundamental shocks to the system. We saw prices slump during the pandemic. We’re seeing prices rise now because of the situation in Europe. The thing about oil though is that it tends to bounce off these extremes. Just when everybody thinks they know what’s going on, it often goes in the opposite direction.

Here is a long term chart with key shock events highlighted.

Russia is a major producer, but its not the largest

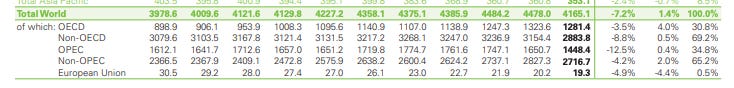

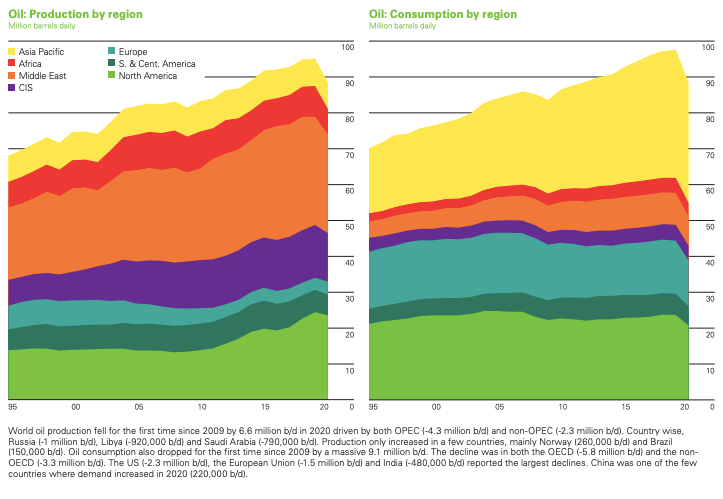

According to the BP annual review which comes out each year, Russia produces around 11m barrels of oil a day. We can increase that to 14m when counting Russia’s neighboring countries. Saudi Arabia and the United States produce around 11m and 16.5m respectively.

Total global production is around 88m barrels of oil. So Russia is a significant chunk of total global production.

The production numbers have changed in recent years. Many western producers have been buying back their shares rather than investing in exploration and production capacity increases.

There is a shift towards more sustainable energy and ESG investment has caused pressure toward this theme. At the same time, the Russians and Saudis have continued to increase their production capacity.

Meanwhile Asian consumption has been growing at an exponential rate. India and China’s consumption has almost doubled over the past decade. Western economies are drastically reducing their consumption of oil, however, it's not happening at a fast enough pace to offset any short term supply shocks from Russian oil disruptions.

Oil has a self correcting mechanism built in

The other thing about oil is that it has a self correcting mechanism. When oil prices rise, it creates pressure on economic growth and we usually see consumption and investment activity slow down.

Oil price rises are painful, sometimes more than interest rate rises because they are immediate and sudden. If we continue to see higher oil prices for the rest of the year, this will be followed by slower economic growth which will put downward pressure on oil consumption.

So my bottom line is this: oil prices are extreme because demand is still widespread while supply is concentrated to a few large global producers. Shocks in these geographies have a big impact on prices. It’s one of the reasons why we should continue to seek alternative sources of energy. But that takes time.

Oil is likely to stay high in the event of war in Europe, but if there is some form of resolution, we could see a significant correction lower to more normal levels, as we have seen many times in the past.

In the meantime, the US and UK will continue to explore and fund aggressive investment in alternative sources of energy so they can once and for all reduce their energy reliance on oil. For themselves and their allies. We’re likely to see a renewed push toward nuclear energy and I’m expecting uranium prices to go higher with that trend, regarless of what happens to oil prices.