French resistance a warning to everyone else

I’ve been keeping a close eye on the protests in France. They aren’t necessarily anything new, but the timing is interesting and perhaps more important, these protests imply what other nations need to do down the line.

France's President Emmanuel Macron has boldly orchestrated a seismic transformation of the nation's pension system. This comes amidst a backdrop of relentless protests, fiery clashes with law enforcement, and allegations of constitutional betrayal.

This audacious move is poised to raise eyebrows throughout the international community as countries worldwide grapple with the urgent need to rein in their fiscal liabilities. Traditionally, French labourers enjoyed the legal right to retire at the age of 62, albeit with the condition that they accumulated sufficient work experience and contributions to secure a full pension.

However, Macron has defied expectations by skilfully pushing the retirement age to an unprecedented 64 years, thereby challenging the very foundations of established retirement norms.

Throughout history, pensions have been an enduring cauldron of political strife in France. Today's high-stakes standoff between the government and the labour force stands as a testament to the explosive nature of this long-standing issue.

The atmosphere remains as volatile as ever, fuelling an intensifying clash that could reverberate far beyond the borders of France, compelling nations worldwide to confront their own fiscal obligations head-on.

France's liability burden much better than US

France had a debt-to-GDP ratio of around 115% compared to the United States at 127%. In a recent interview with Kiril Sokoloff, legendary investor Stanley Druckenmiller pointed out the difference between the French and American approach to the fiscal gap.

Druckenmiller estimates “the amount you would have to raise taxes today to maintain the generosity that you've promised future seniors is around 7.7% of GDP…that mean that means if you wanted to fix this situation today, without touching entitlements you'd have to raise taxes 40% tomorrow morning, or cut spending by 25%…”

Druckenmiller goes further to point out that the 7.7% in the United States compares to a fiscal gap of only 2% in France. This comes at in interesting time as the United States is also contemplating raising its debt ceiling to avoid a default situation.

France is doing the hard, painful work while the United States fiscal situation has never been worse. But at what point does France’s hard pill eventually trickle through into other G20 nations and prompts them to get their economic house in order, so that they can avoid the inevitable?

No pain, no gain

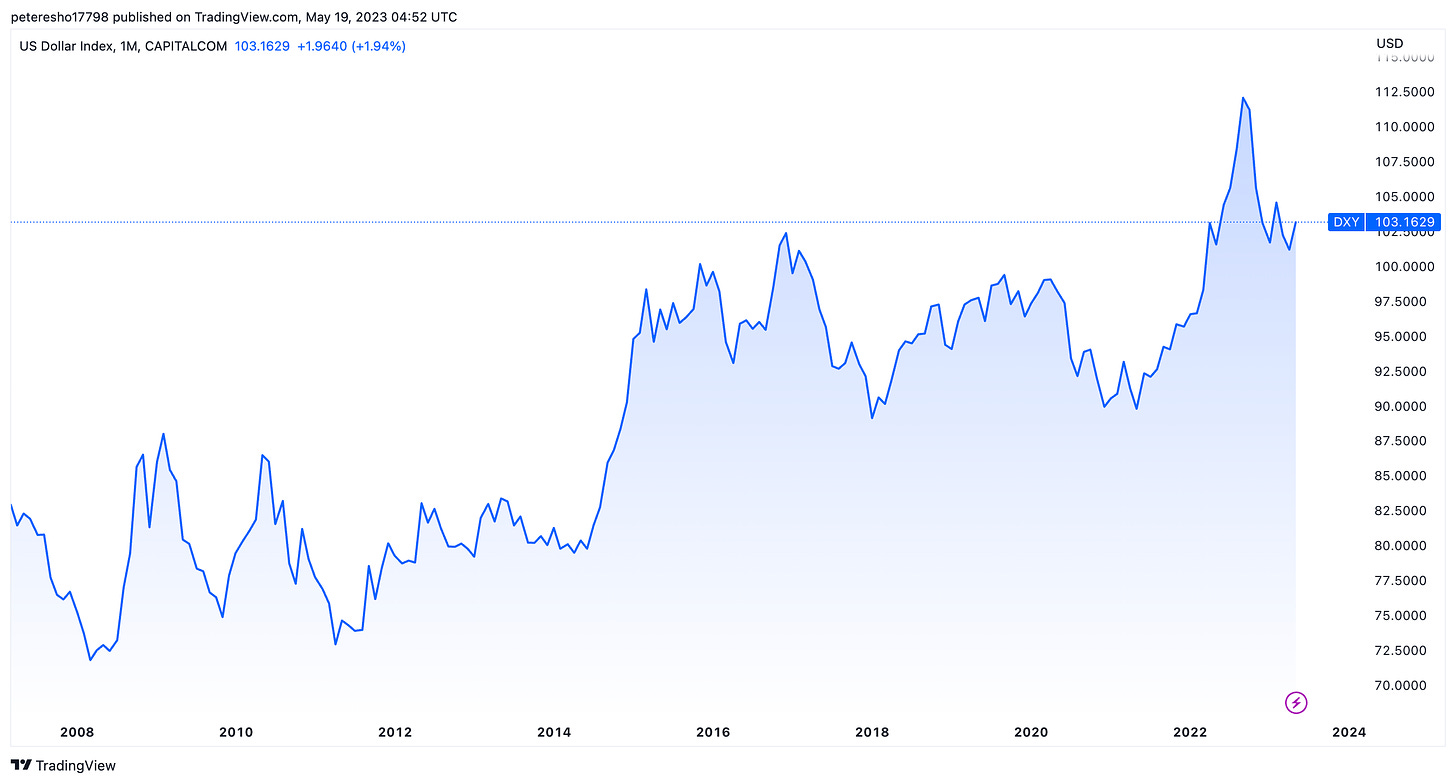

The debt ceiling debate is an incomplete one, because raising the debt limit only kicks the can down the road for the United States. We don’t see any sudden change to the status quo or the dollar’s status as a global reserve currency in the short term.

But we do think that in the long term, other G20 nations will follow France and a bridge will start to open between the United States and other nations on how to best clean up the fiscal situation. Britain has already felt the brunt of a market response to irresponsible fiscal decisions.

For this reason, I think rates will eventually peak in this cycle sometime late this year and eventually a hard landing looks more likely, as discussed last week.

Peter Esho is an economist and Founder of Esho Group. He has 20 years of experience in investments and markets.