Crazy markets are the new normal

The rage in markets this week is wallstreetbets — a group of young traders using online apps like Robinhood who are about to break Wall Street and some of the biggest and most sophisticated funds going around. While gains and losses are normal on stock markets, what’s really caught my eye this week is the power shift and the implications it will have on the future of investing.

Quick backstory

Wallstreetbets is a group on reddit (also called subreddit). At last count, they comprise more than 7 million members. Most of these are young retail traders with a couple of thousand in their stock broking accounts. Not sophisticated, not backed by any major names. Just a dedicated group who have a common goal and mission.

Last week they went to war with large wall street hedge funds who were betting on certain stocks like GameStop going broke (called shorting). The group successfully managed to push the GameStop stock price to new highs, forcing the hedge funds to take big losses.

Wallstreetbets, as a collective group, managed to push the stock up from around US$40 to a peak of around $500 before Robinhood was forced to freeze trading and an all out war has ensued ever since.

How did this group of un-sophiscated, unorganised, decentralised stock traders cause so much havoc on Wall Street and capture the global headlines of money managers shuttering in their boots over the future implications?

The best explanation I came across was one from Chamath Palihapitiya, ex Facebook exec and founder of Social Capital. Here’s the punchline:

What happens this week? I’m not really sure, nor am I concerned about the price of GameStop or other US stocks at the forefront of this battle. What I do know though is that the investing game has changed. The future of investing is decentralised.

Largest shift of wealth in history

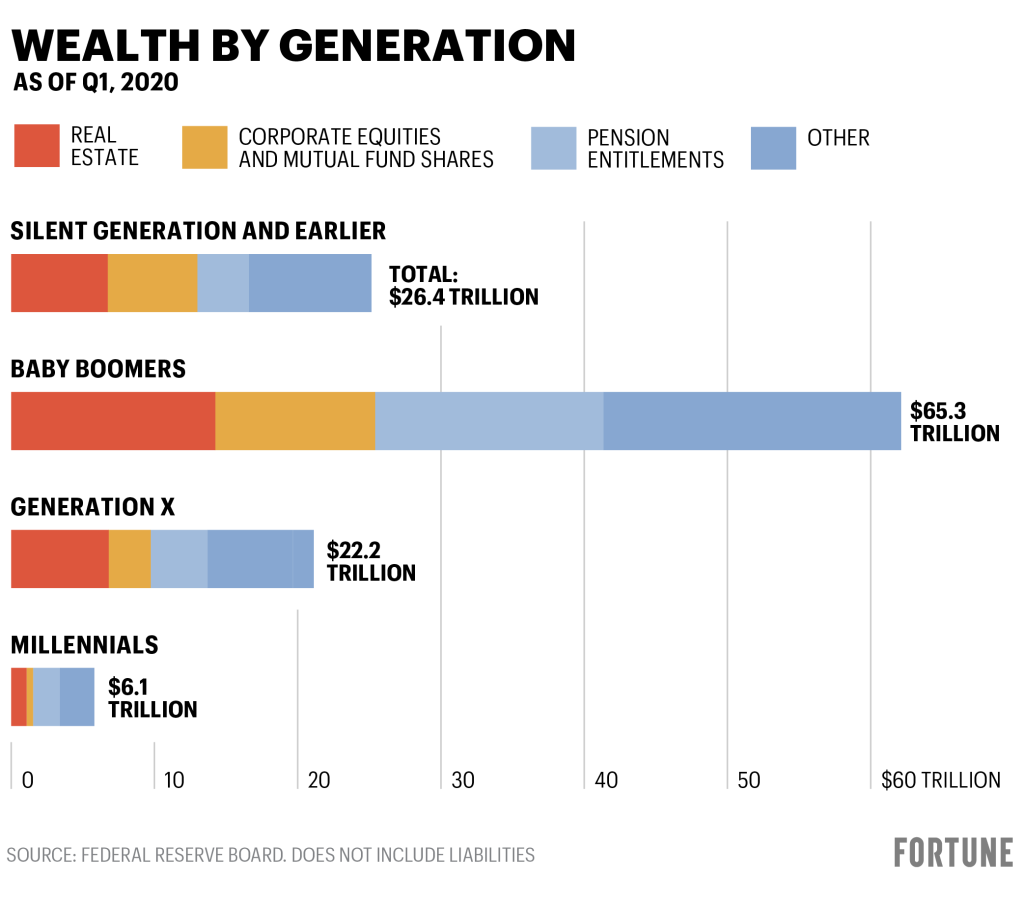

In the next few decades, we’re going to witness the largest transfer of wealth in history from Baby Boomers to Millennials — estimates are somewhere in the order of around US$60-70 trillion just in the United States.

Many of these millennials grew up and witnessed the disruption of the 2008 crash and then the 2020 pandemic crisis. They saw how a few made billions while many, including their parents, friends and relatives, suffered large financial losses.

Many of these millennials have hundreds of thousands of dollars in outstanding student loans while youth unemployment has continued to rise. Those without a qualification have seen almost little or no wages growth.

What we are seeing take place on Wall Street is a battle between the elite and the millions of millennials who want to disrupt and take back their piece of the wealth pie.

Decentralisation is the new normal

Wallstreet bets managed to organise themselves on Reddit and pool together more capital than sophisticated hedge fund organisations. They did it quicker, cheaper and in a much more agile way. Robinhood spent 7 years building a brand only to lose it all within 7 hours after banning many of these traders for opening new positions against the hedge funds.

Decentralisation is the game. Millennials don’t want middle men taking their wealth and ripping them off. They want control, they want to be able to trade peer to peer on their terms, in a fair and reasonable way, without being told what to do.

This is one of the main forces behind the growth in cryptocurrency markets. Bitcoin, being the largest global digital currency, has seen its market capitalisation rise to around half a trillion dollars because many see it as an attractive alternative to the global wealth trap.

Bitcoin has a limited supply but more importantly, is not issued by any government, company or middle man reaping profits. The blockchain technology is completely decentrlised, open, fair and transparent. Millennials such as those on wallstreetbets were among the early adopters and now institutional investors such as Ray Dalio are starting to move into Bitcoin as an alternative asset to allocate their funds.

The decentralised trading crowd is no longer following, they’re leading.

Crazy is the new normal

Some might see the stock gains in GameStop as crazy. Others will think a global community of 7 million traders, unorganised, unlicensed and moving in one direction on an open forum is crazy. I don’t think either are crazy, to me they are the new normal.

What’s really crazy is the huge amount of money that has been created in such a short period of time by governments and central banks desperate to fend off the Covid economic shock. In the past couple of weeks, I’ve written about the money printing and the repercussion.

In the next few weeks, I’ll bring you my outlook on key assets like to benefit from the disruption and shift from centralised (government, corporate, elitist) assets towards decentralised (open source, liquid, 24 hour, no middlemen). One thing I suggest you keep an eye on is how decentralised exchanges are already changing the way cryptocurrency markets function.

DiFi (decentralised finance) is a major thematic, in its infancy, which is likely to impact the way we allocate capital and store wealth into the future. Im watching closely how firms like Andreessen Horowitz and Draper’s Boost VC are investing in this space.

Don’t miss the next few pieces I publish, make sure you subscribe below to get access.