Change in the air as we sail into 2024

One of the things I’ve been watching all year is the breaking point from rising interest rates. It hasn’t happened, most developed economies including the United States and Australia have weathered the storm very well.

I recorded an analysis on Australia last week, where I discussed the RBA’s subtle shift towards property and house prices. They’re no longer worried about the property market and now totally focused on bringing down inflation.

Most experts got the property market totally wrong this year, especially those who predicted a steep decline. I wrote in October last year that the property market will hold up relatively good as long as stock and supply levels are depressed.

“…during the freeze, prices will remain relatively flat. Rising construction costs will put a floor to house prices in most major metropolitan cities. We’ve now formed a new base for what an average house or apartment costs to build, and that will provide support…”

That has played out almost completely true.

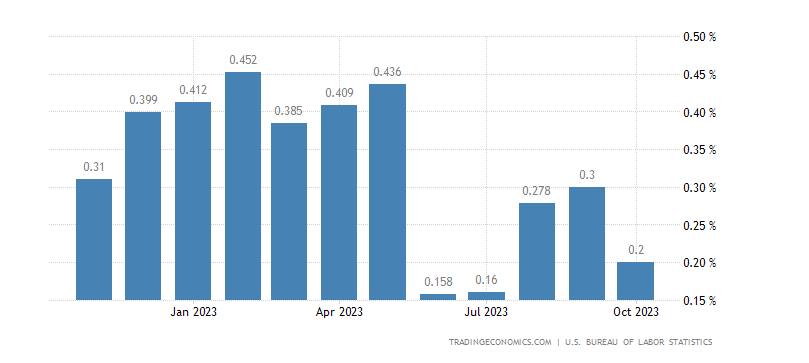

I’m now starting to see things develop even further in the United States, which I think will have implications for Australia next year. The big news this week was lower than expected US inflation. Yes, lower than expected.

It seems like the war on inflation is finally being won by the US Federal Reserve, and I wouldn’t be surprised if we start to get similar numbers in Australia early next year. October's inflation was just 0.2%, below expectations and now starting to signal a shift in market expectations for 2024.

We’ll need to see a few more months before the US Federal Reserve shifts its tone around interest rates. We haven’t yet seen a deterioration in the jobs market, which is the key piece of the puzzle. However, US jobless claims are starting to rise, and I think the narrative is, slowly, changing.

For Australian property investors, the recent RBA rate rises will dent sentiment, but I don’t think it changes the market due to two key reasons — very low supply and very high migration. In hindsight, strong net overseas migration really did provide a floor behind housing demand this year and helped cushion the impact of successive RBA rate rises.

That’s probably why the RBA thought it needed to push again last month, and there might be one more rate rise in the bag, although I think that comes early in the new year.

The RBA is of course always late to the party. We have a joke in markets that the RBA isn’t the Reserve bank, instead the Reverse bank. I think this will be true again. The RBA has been late to the game and is around 3-4 months behind the US Federal Reserve. That means that we will probably see Aussie inflation start to moderate around February-March.

December quarter inflation won’t be soft enough to stop the RBA from moving in Feb (if it doesn’t move in December). Yet I think March inflation will be a completely different story and the RBA will start to change its tone around April/May next year.

Bottom line: My base case now is that US rates have peaked. Aussie rates are near peak (thanks to the Reverse bank) and that we will see maximum one more rate hike, before the numbers start to shift mid next year and cause rate expectations to fall in late 2024.

If we continue to get strong migration over the next year and low supply levels, it’s hard to bet against Australian residential property prices, even in a rising rate environment. Sydney and Melbourne are my preferred markets, particularly at affordable price points.

Peter Esho is an economist and Founder of Esho Group. He has 20 years of experience in investments and markets.