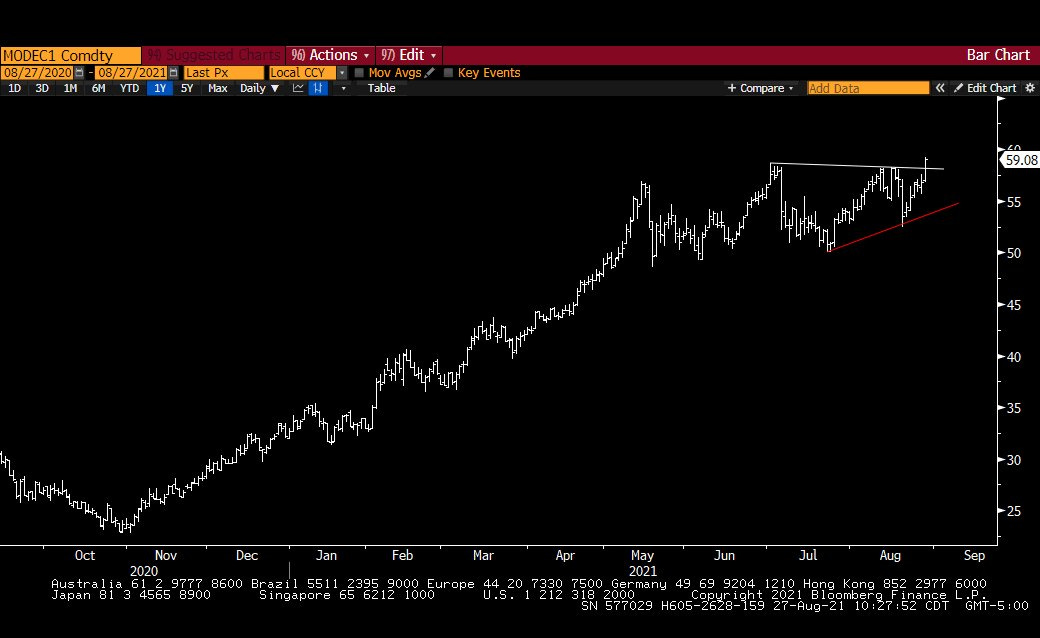

Carbon credits the best performing commodity so far in 2021

The price of carbon credits continues to rise, hitting new highs after I first write about them in late June (We could be at the tipping point of carbon concious investments).

According to Bloomberg, carbon credit prices are up around 78% so far year to date, making it the best commodity traded on markets. I think there is still room for upside.

My investment thesis hasn’t changed since late June and I’ve continued to add to the KRBN ETF which is giving my portfolio some great excess returns. I don’t like predicting markets and I have no idea what will happen in the next few months.

I do however have more confidence today than I did in June that carbon prices will continue to rise, perhaps approaching double current levels.

The market is too tight for oil companies, so they are pursuing their own initiatives.Woodside Petroleum (which I wrote about last week upon news of their acquisition of BHP’s oil assets) has been busy buying up farms to create its own offsets.

But I don’t believe this is sustainable once governments and activist investors demand a standard, regulated and certified carbon trading system. The big talking point among individual investors and family offices is how to get exposure to the asset class.

This will see more innovative, new ETF’s and companies which provide access to carbon conscious investments.

The market will be a lot larger, in depth and breadth, in the next 6-12 months and with that, more money will flow into the sector. I was expecting to share with you my Money Magazine podcast on this topic this week, but it’s not yet ready and likely to be published in the next week or two according to the editorial team. Once that happens, I’ll make sure to share it here.

In the meantime, if you’re interested in knowing more, I suggest you check out Realvision’s analysis here and this great interview which I have previously shared also.