Being sensible is hard, but it pays off in the long term

We’re in the midst of a very strange investment environment. The pandemic has wreaked havoc on billions of people across the world yet stocks, real estate and crypto markets continue to boom. Many have asked me wtf is going on, which I addressed in my note last week (Why everything keeps going up).

This note is about being sensible. The biggest risk is complacency. When markets rise everybody gets tempted. We cluster. We have the fear of missing out, the fear of falling behind our neighbours and the fear of not keeping up with the headlines that continue to tell us how rosy everything thing is. Greed kicks in.

When we let our guard down, let go of sensible investment decisions and chase the narrative, we usually make huge mistakes. It’s time to be sensible. It takes courage to be sensible, but it pays off in the long term

I’ll run through what I think about stocks, currencies and real estate below.

What is sensible?

It’s important to balance prudence, patience and skepticism with an open mind. We’re in a new world and the rules have been re-written by central banks and governments who are printing money like never before.

We can’t cling on to the past, we have to look forward. We have to open our minds to new realities — low rates, low returns and the possibility of some crazy inflation in the future…the timing of which nobody knows.

It’s not sensible to sit in cash — it’s time to be investing and moving out of cash, carefully, diligently, cautiously.

We need to understand the context of our technological change and how the digital world — including digital currency and the digital storage of wealth — is transforming the way we think about money.

We also need to seperate the structural changes from the bullshit. Parts of the stock market are very bubbly and dangerous.

Elon Musk isn’t going to transform the world just because a Youtube video says so. He is an amazing entrepreneur with a phenomenal track record, but at some point, the value of his companies becomes ridiculous and they’ll fall. Are we there yet? Probably not, but at some point, Tesla is a Sell. It can happen overnight.

Stocks are valued on earnings, period

I buy stocks when the market falls and sell them (usually too early) as the market recovers. I’ve never sold at the top or bought at the bottom. But in the past three years, I’ve always made money. My main objective is not to lose. I don’t want to get sucked in, I know what stock market falls are like. Devastating.

So it’s never emotional, I’ve learnt that stocks are purely a vehicle to back companies and leverage from their earnings. My preference is to buy ETF’s and stay away from single stock exposures. I want to go to sleep at night.

Here’s what the global stock market looks like in a single snapshot.

Global stocks are back to their 5 year highs. The V shape recovery is indisputable and the momentum is very strong. I think stock markets can go higher as long as governments and central banks continue to pump money.

If Biden’s Administration and incoming US Fed Reserve Governor Yellen open the door for more easing, its hard to bet against stocks. But at some point, we’ll see a correction. I’m not buying, but will do so if I see a 20 or 30 % sell off because of some bad news and knee jerk reaction.

Tech is an area of caution. Companies like Amazon, Facebook, Apple, Netflix and Tesla have solid earnings momentum and are the only sure things operating in a very uncertain world. But at some point, that narrative will go out the door. Nothing moves in a straight line over a long period of time.

Stocks are always about earnings — no matter what Musk or Bazos do. Ignore the BS and focus on the earnings. Take caution.

Currency and wealth storage

The US dollar is the world’s leading reserve currency — the storage of wealth in many parts of the world where paper money is (almost) worthless. With currencies, they get more attractive the more expensive they become, unlike stocks. Money flowing into a currency as a storage of wealth is a good thing, not a bad thing. Different mindset to stocks.

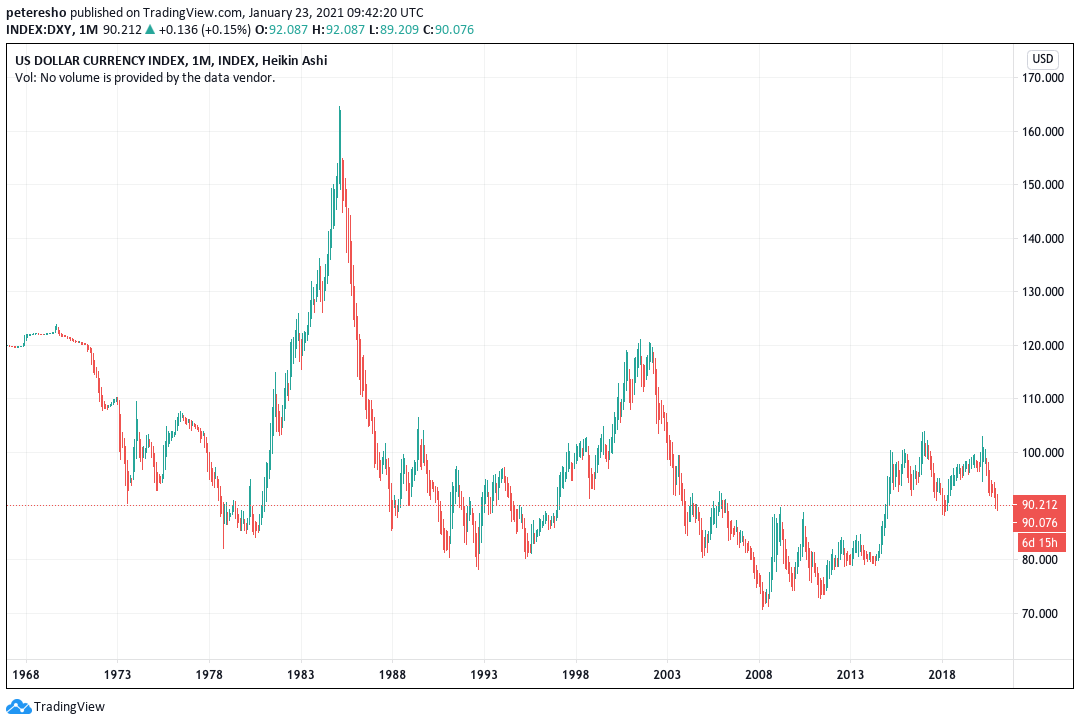

Here’s a long term chart of the US dollar vs. its trading peers.

The US dollar is losing its shine. The only reason it isn’t at all time lows is because its counterparts — Japan, Europe, Australia, Switzerland etc are just as bad in printing money, if not worse.

Here’s where it gets interesting….

Bitcoin as a means of wealth storage

Bitcoin becomes attractive the more it rises. It has no earnings, no employees, no assets, no CEO…it’s not about value. It’s about trust and wealth storage. Bitcoin is really a fixed, digital, perpetual currency which is decentralised (not government owned) and cannot be printed to pay government bills.

As I write, Bitcoin has a total value of US$600bn — greater than the total size of Sweden’s economy and just a touch smaller than Saudi Arabia’s. The higher it goes, the more serious it gets and as it becomes a serious asset, investors holding other wealth storage mechanisms (dollars, collectables, stocks) start to take note and switch.

The problem with Bitcoin is 1) Volatility and therefore 2) It’s hard and risky to leverage or borrow to buy it. Decentralised finance is a big area to watch (Google diFi), I think we’ll see banking and financial system completely change in the coming decade and this will change the way money works.

Real estate is boring but beautiful

With all the mind, the most sensible asset to be focusing on right now is residential real estate in large metropolitan cities. In Sydney and Melbourne, it’s not difficult to find apartments yielding 4% pre tax where major banks are lending to investors at or below 2%. There is a positive yield spread with residential real estate and investment rates.

It’s a similar story in many other major cities across the US, Canada, Europe and Asia. I believe the best residential real estate opportunities are at the extreme ends of the affordability curve — the very affordable where natural demand from new home buyers and rising building costs pushes the market up regardless and the affluent luxury market where investors continue to park their wealth as the look for cash alternatives.

Bottom line: keep it smart and sensible

Cash is the worst place to be investing in right now and every investors needs to be proactive in looking for other options. The stock market will be support by government stimulus and cheap money. Stocks will probably keep rising, but at some point, the part for tech and other “sure things” will come to and end. There’s no need to become a turkey, so you can probably stay away from the hype.

Cryptocurrency is the real estate and the more Bitcoin goes up, the safe it is as a storage of wealth. It sounds crazy, but it isn’t. A sensible approach would be to explore this further and invest some time into the mechanics of how money works.

And finally, residential real estate puts money in my pocket after paying all my bills and is likely to continue rising in the future as paper money becomes worthless, building costs rise and land becomes more scarce in major metropolitan cities.

If you haven’t already, remember to subscribe to get all these note delivered instantly to your inbox as I publish them weekly