Being in the right place at the right time

I had a great chat last week with an experienced investor who told me what frightens the hell out of him. It wasn’t the market, debt, speculators or anything like that. His biggest fear was looking back in a year’s time and not seeing himself grow. Life is all about growth. If we’re not growing, we’re shrinking and dying.

As an investor, I try to constantly reinvest my investment strategy and style to meet my goals. I’m old enough to know what I want in life and to stick to my lane. As I wrote a couple of weeks ago, I’m focused and always resisting the temptation of distraction.

Yet, I’m always looking to growth. I assume I know very little and always look to those who have achieved what I want to find lessons. One of those mentors is Raoul Pal, an investment expert who spent many years at some of the world’s leading investment banks and now runs the very successful investment advice platform called Realvision.

This tweet stood out to me:

So I decided to study myself the meaning of Metcalfe’s Law and how I, still many years younger than Raoul, could use this advice and apply it to my own investments.

What is Metcalfe’s Law

I’ll spare you the backstory (check out the proper explanation). Metcalfe's law states that the value of a telecommunications network is proportional to the square of the number of connected users of the system (n2).

Two telephones can make only one connection, five can make 10 connections, and twelve can make 66 connections. The more telephones, the greater the value of the network. This explains why so many high growth technology and communications businesses focus on expanding their user base and the network effect quickly and rapidly, disregarding short term profit.

Microsoft was a perfect example in the late 1990s. Having Windows installed on every new PC meant with each new computer sold, the value of its ecosystem grew exponentially, eventually making it one of the most valuable companies in the world. The number of businesses using Xero for their accounting becomes exponentially more value for each business that joins as accountants, developers, banks and almost every other stakeholder plugs into that same network.

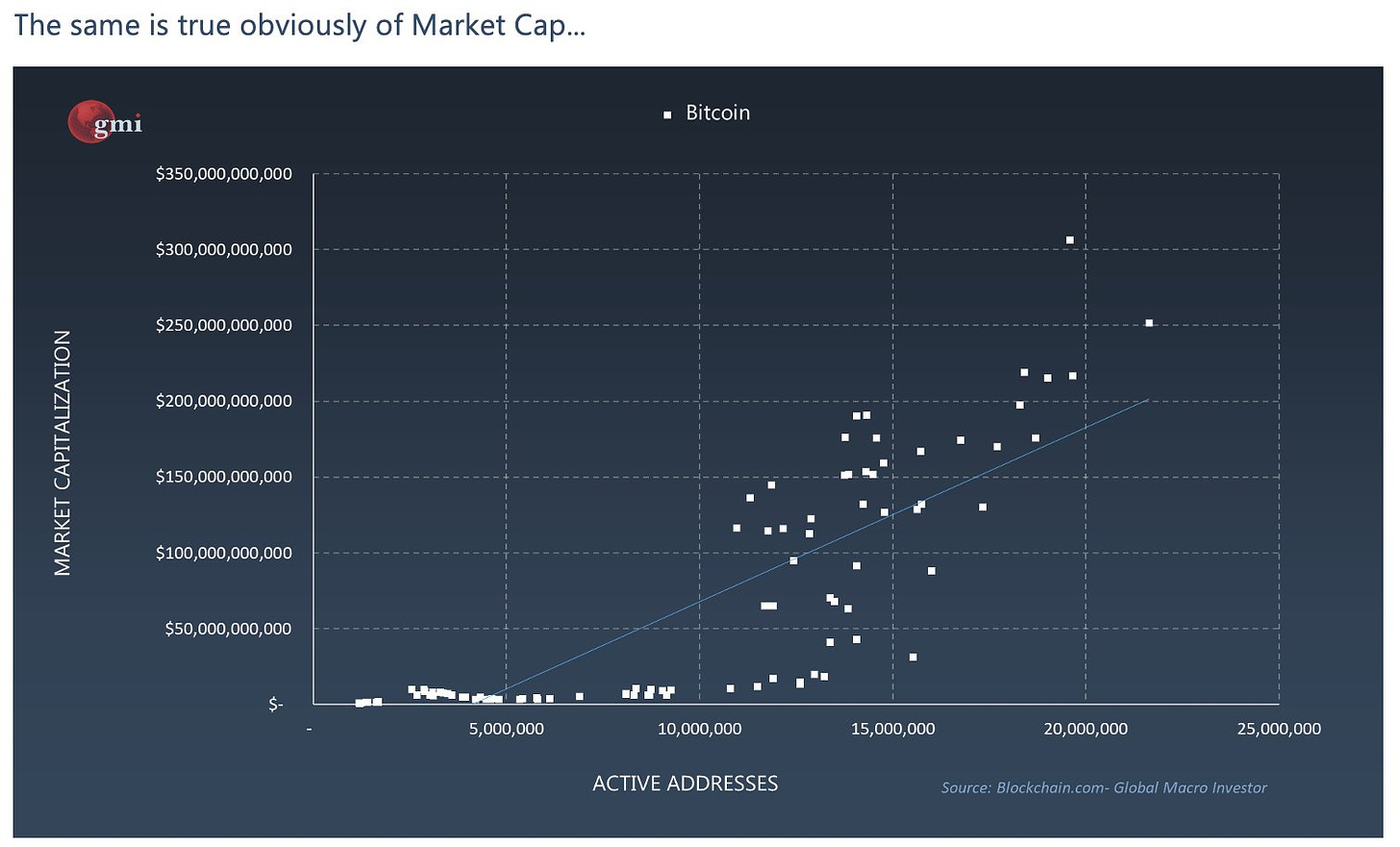

Bitcoin is a perfect example that follows Metcalfe’s Law. The growth in the number of addresses (users) has an exponential impact on the increase in the value of the Bitcoin network, driving up the price of each coin as supply is fixed.

Picking trends that follow Metcalfe’s Law

It’s almost impossible to know what will and its always easier to look back and point to the winners. Usually by then, it’s too late to buy in as the price would have grown astronomically.

The secret is this: start with a diversified basket, exposed to scalable technology and large networks, then double down on the winners as they show results.

There are many investments which cannot utilise this method of growth because they physically cannot grow their network or user base without high amounts of capital. It takes a lot less money to sell software than it does selling telephone services.

Some thoughts on Electric Vehicles (EVs)

Energy, food and health are three of the biggest investment themes in our lifetime. Electric vehicles (EVs) are likely to become more prominent in the coming years. It’s hard to see fossil fuel powered vehicles lasting for much longer. The biggest the EV network gets, the more valuable.

Tesla is now worth around US$650bn in market capitalisation. It sounds crazy when you look at earnings, because they don’t exist. But it makes sense when you consider the value of the network — around 150k new drivers each year transitioning from petrol to EV cars falling in love with Tesla’s product and sneezing to their friends who will be in market for a new car soon too.

Will Tesla continue winning? Most likely, but what’s unclear is if the value of its network is worth US$650bn.

Ford has recently caught my eye. I read an article last week that the oldest motor company in the world has moved to allow their staff to work from home forever. Keep in mind that Ford invented the industrial production line. Our 9-5 work culture comes from that very innovation. So it’s rather romantic to see how progressive the once old, boring and archaic company has become.

Ford manufactures around 10x the amount of cars as Tesla, yet its stock is only worth US$50bn or around 1/12 of Tesla. Ford invested around US$7bn in its EV capabilities last year and is on its way to investing a total value of $22bn by 2025. That’s a lot of money.

Around 7 million electric cars are already on the road around the world. China and India are leading the growth, the US is not far behind. There’s a lot more to the network trend than Tesla and having Ford as part of the portfolio mix wouldn’t be a bad idea. After it, despite all its historical problems, the business is still alive. That must count for something.

Being in the right place at the right time

When it comes to investing, being in the right place is about looking and exposing yourself to scalable investments which can follow Metcalfe’s law. There are opportunities outside of these types of investments, but scalability is key here. If you want to make super normal returns, you need to focus on super normal types of investments.

The right time is impossible to predict, that is why diversification is important and constantly monitoring network/user growth to find the opportunities that are best at growing quickly and cheaply in large, valuable markets.

Energy, food and health are the three areas I’m watching closely, outside of my passion for real estate and existing exposure to the cryptocurrency space which has already shown the benefits of Metcalfe style returns.

In fact, when I think of it, Metcalfe’s law explains why cities like London, New York, Shanghai, Hong Kong and Sydney have some of the world’s most valuable real estate markets.

I hope you find this useful, please remember to subscribe to get each weekly note in your inbox as they are released. Have a great week ahead and God bless.