Banks start to cut rates ahead of RBA

More core thesis for most of this year has been that rates peaked and will choke the economy and spending. It’s taken a little longer than expected, but it’s now starting to happen.

Despite higher than expected inflation, I held my view in May that rates will fall towards the end of this year or early 2025.

The banks have now started cutting rates. It started a couple of weeks ago with a reduction in deposit rates, and last week we saw the majors reduce their fixed rates across the board.

Why banks are cutting fixed rates

Variable rates are yet to fall, they will adjust with the RBA in the coming months. But the fixed rate market is signalling three things:

Banks expect rates to fall over the next few months, that is why they are pre-empting the reducing fixed rates. They want to lock borrowers before variable rates start falling.

With most economic activity now settled through electronic payments, the banks have live data into the economy. They can see spending slowing or rising before anyone else. There is no doubt that they have seen a key slowdown in spending over the past few weeks that would signal a slowdown coming.

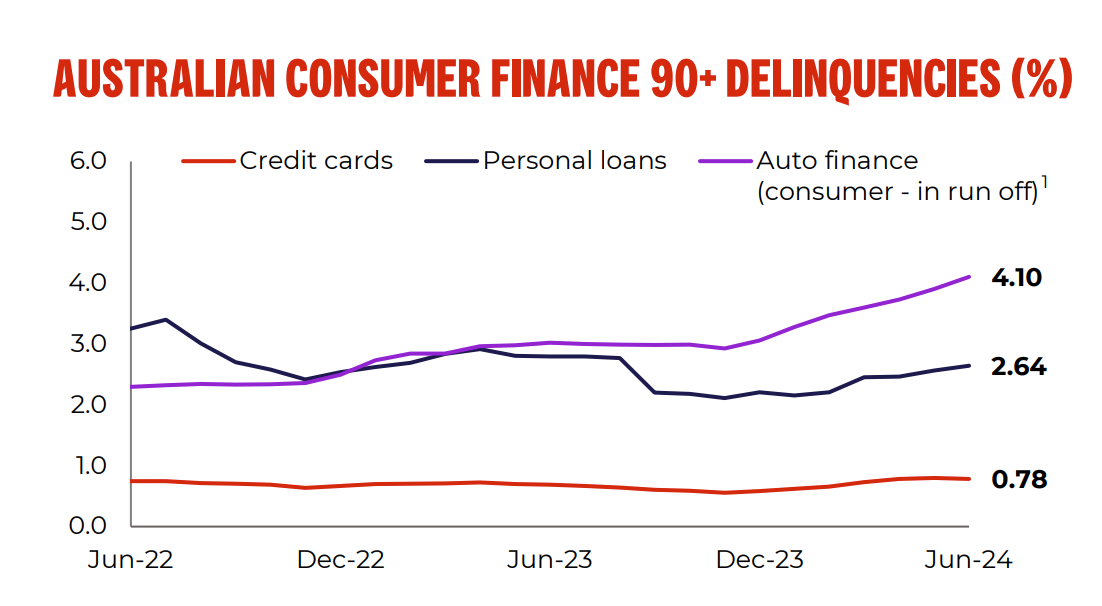

Banks are also seeing mortgage stress across their loan book, particularly outside of mortgages in car loans and personal loans. They know that the squeeze and choke is on.

Here’s my 60-second summary on Tiktok this week.

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

Clues from Westpac

Some good insights from Westpac last week, where we can see continued pressure in car and personal loans as the employment market starts to deteriorate.

Around 4.1% of Westpac’s car loans are in arrears by more than 90 days (delinquent) which is around double the rate of two years ago. Credit cards and personal loans are flat, but car loans are a good guide for me because they tend to be larger in value.

As I told The Guardian Newspaper last month, people tend to pay the rent and mortgage first and will defer the car loan when really stretched.

Westpac data also shows that business loans are being hit, the worst sector is wholesale and retail trade. That means discretionary spending is taking a hit. The consumer is cutting back.

Around 5.6% of Westpac’s loans to wholesale and retail trade are “stressed”. It probably gets worse in coming months as Black Friday and Christmas sales perform worse than previous year peak levels.

Bottom line: The big banks, who have a live plug into the economy, are starting to cut fixed rates in anticipation of reducing variable rates in the coming months.

Canada and the UK have already cut rates. The US is expected to follow suit next month. Australia will lag, but we’ll need to follow the same direction if we want to avoid a recession. I’m expecting to see more fixed rate cuts, to both deposits and loans, in the coming months.

Peter Esho is an economist and Founder of Esho Capital. He has 20 years of experience in investments and markets.