Baby boomers set to push property prices higher

One of the long term themes I’m watching closely is baby boomers and their relationship with the housing market. Most real estate commentary is focused on millennials getting into the market and government incentives to help increase home ownership.

However baby boomers are just as important to watch. There are two main areas I think the media has completely forgotten about.

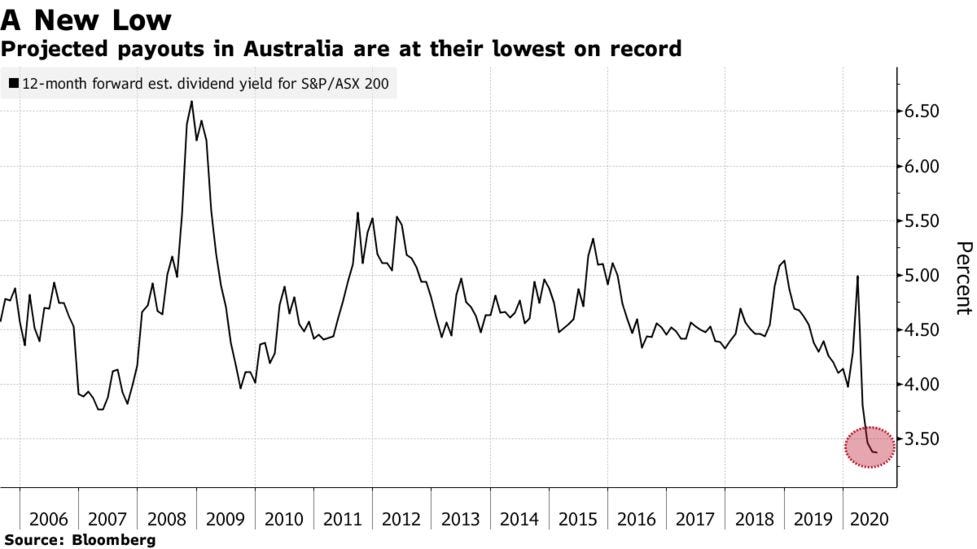

1) Investment Yields: Falling interest rates are a big problem. Self funded retirees have generally preferred term deposits and shares for their dividends. However low rates over a long period of time is forcing many to buy investment properties instead.

2) Baby Boomers & Retirement: There is a move by governments to promote self care. Due to a shortage to adequate retirement and nursing home facilities, more boomers might retire within this existing homes with government support.

Both these factors will cause upward pressure to house prices over the next 10-15 years.

Boomers buying real estate for yield

Australian Self Manager Super Funds (SMSF) poured $39bn into real estate in the year ending 30 June 2020, a rise of around 7.5% compared to the previous corresponding period. SMSF assets held in Australian shares fell by 12% over the same period.

I’m also hearing and seeing anecdotal evidence of more mature aged investors buying residential real estate in Sydney and Melbourne as they move cash our of their term deposits, now lucky to be yielding anything above 0.5%.

By comparison, it isn’t difficult to get a 3-4% investment yield in Sydney or Melbourne metro markets without much value add. Apartments have some income risk, due to lower migration. Houses have been solid performers, so they might have some price risk due to the premium being priced in.

Either way, self funded retirees will be looking to alternative income sources. The Reserve Bank of Australia has already said that it expects to leave rates at record lows for at least a few years. Rates on investment have been declining for retirees for more than a decade now and many are losing patience. They see residential investment as an illiquid investment, yet stable and secure enough with a superior yield to cash and shares.

The way we retire might be about to change

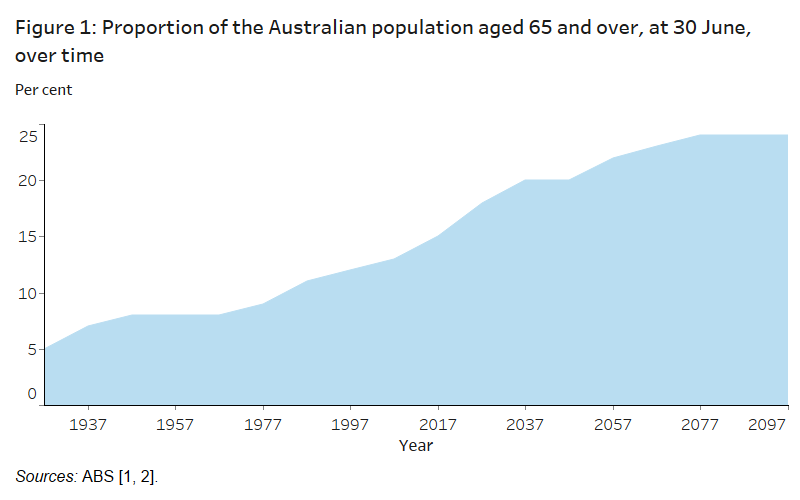

The Australian Government increased its investment for its Commonwealth Home Support Program by another $125m this year. It’s a move which I believe will continue into the foreseeable future. As the population gets older, so too does demand for aged care.

Developing new housing for seniors is expensive and timely. Fiscal budgets are already constrained and the looming ageing population problem is set to strain government expenditure even further.

A logical solution will be to fund as many people as possible to stay within their existing homes, with government funded health care professionals providing support as an alternative to aged/nursing care.

More than 1,400 organisations are funded to deliver Australian CHSP home support services to around 840,000 seniors, worth around $6bn.

More boomers staying at home, with government assisted care, means less homes coming on to the market for sale and less new aged care supply coming into the market. Government subsidies could also see new investment opportunities emerge, with entrepreneurs looking to repurpose existing housing inventory to a more suitable hybrid home styled care service.

Bottom line: demand pressure grows

One of the greatest risk to residential real estate prices in Australia over the next few years is falling rents due to lower migration. This pricing risk is already factored into apartment prices, which trail house prices. However as the borders open and migration grows, apartments and houses are set to benefit from low rates, a strong economy, limited new supply and a flood of new and older buyers each interested in their own wealth strategies.

The way older Australians manage their assets and use their home will change in the future, shifting fundamentals behind housing demand and supply. In the medium term, the fundamentals for metro housing remain solid.