Australian house prices show signs of bottoming

The beauty of real estate is in its simplicity. Yet many times forecasters and economists form basic assumptions about the real estate market which don’t materialise. The assumption for most of the past year has been that real estate prices will fall by x% because of rising rates. It’s true that rising rates have dampened price growth, but what many have failed to understand is that supply and demand are not as straight forward to forecast.

Take for example Sydney auction clearance rates over the weekend which jumped back into the mid 70% range. That’s in a month following a ninth consecutive interest rate hike and scrutiny of the Reserve Bank of Australia’s actions which led its governor to front a panel scrutinising his actions. The main driver behind Australian house prices holding up in recent months has been the limited supply environment.

We’ve written about this over the past few weeks, including our note last week which touched on building commencements as lead indicators. We draw on a comparison with the US market and showed that Australia’s supply pipeline has been trending down for some time.

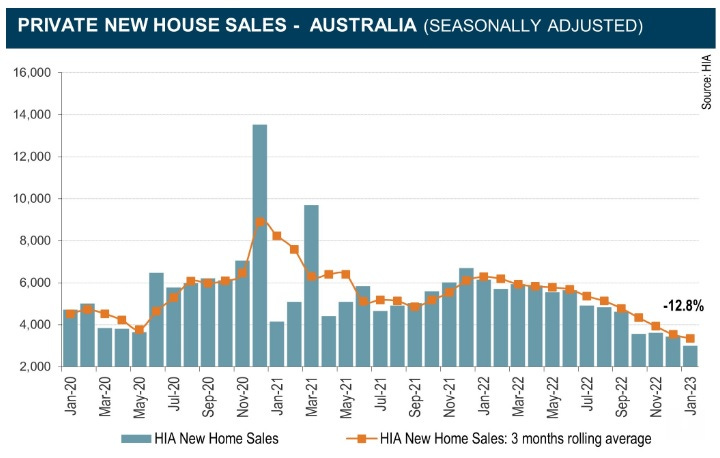

According to Australia’s peak housing industry body HIA, new home sales (not permits which we discussed last week) are down around 50% compared to the same period last year. New home sales are now averaging around 3,000 per month compared with 12,500 per month during the peak of the pandemic. We won’t feel the most recent pullback in sales for another 12-18 months.

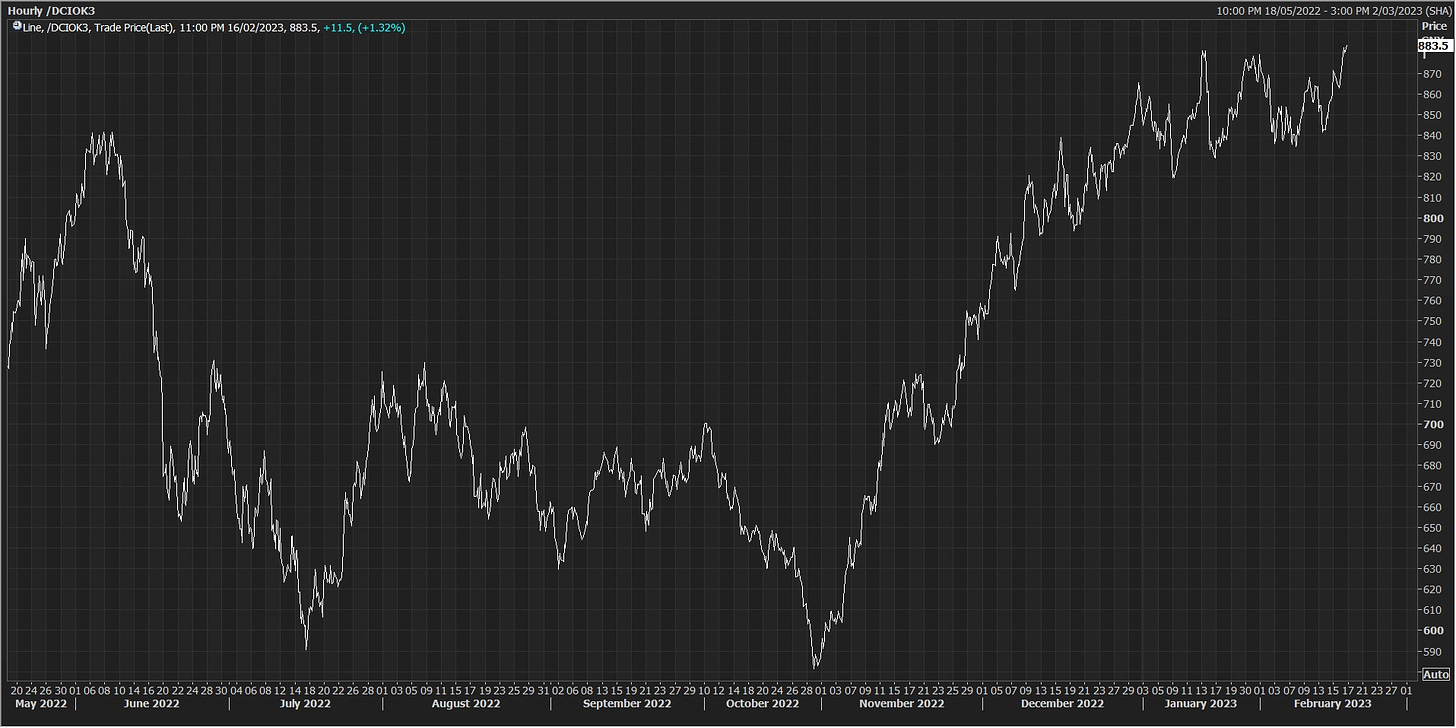

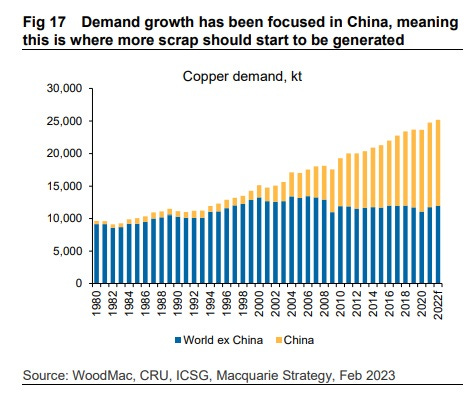

Another factor to watch in housing supply is material costs, which have been trending down in recent months but are at risk of inflating again as China opens from its long lockdowns. Commodities like iron ore are good lead indicators for Chinese demand and Australia is a major iron ore exporter.

The iron ore price is now back up from its mid-year lows last year as Chinese industrial activity starts to ramp back up. Copper demand is also rising, a lead indicator of what’s to come in other commodities.

We can go on and on about the different types of commodities and how they are expected to perform. But our point this week is to highlight that housing is a function of both demand and supply. Many people miss the supply problems, focusing only on the demand. What the data shows is that supply is falling off a cliff and becoming a lot more expensive.

This has a direct impact on house prices, despite rising interest rates. Housing is one of those assets that we can’t live without. You can live without BHP, Apple, Bitcoin or Gold. But you cannot live in a civil society without housing and shelter.

We continue to think that house prices have bottom, or very close to bottoming and that any interest rate rises in the near future will be driving by strong jobs and incomes, which in turn a key housing drivers. Commercial real estate has similar fundamentals, but with a lot more volatility. We’ll be talking about that next week.