Australia could become the Saudi Arabia of the Pacific

Our property investment focus is a little different this week. We spend a lot of time focusing on movements in certain markets, clearance rates, facts and figures. But sometimes we need to sit back and look at the big picture.

Like the FIFA Football World Cup.

One of the most interesting themes playing out is the surprises, both Saudi Arabia and Japan shocking traditional heavyweights Argentina and Germany in the first week. Football is a world sport and often a microcosm for everyday life.

We can’t read too much into first round results and as you can see, things are quickly changing in the second set of games. But football results remind me that we typically live in a very western, insular-focused bubble. The entire world is constantly changing. Every nation has its own unique aspirations and realities. The World Cup shows us that rate of change.

We are reminded that the world doesn’t revolve around us. So are these results really surprises?

Saudi Arabia has one of the world’s fastest growing populations under 40 years of age. Two thirds of the population are under 40. There has been a huge amount of economic and social reform in the country, which will no doubt continue. Most of the change we will never see or understand. But it is happening.

Japan is also a significant global player, although the demographics are not as favourable to Saudi Arabia. Probably the exact opposite. Still, Japan is the world’s third-largest economy (larger than Germany) and home to 125 million people.

My point this week isn’t a football analysis or comparison. Instead, an opportunity to stand back and look at thematic changes that are likely to dominate investment markets in the decades to come.

Possible ones that we often miss because we live in a confirmation bias, blinded and clouded world. Particularly real estate.

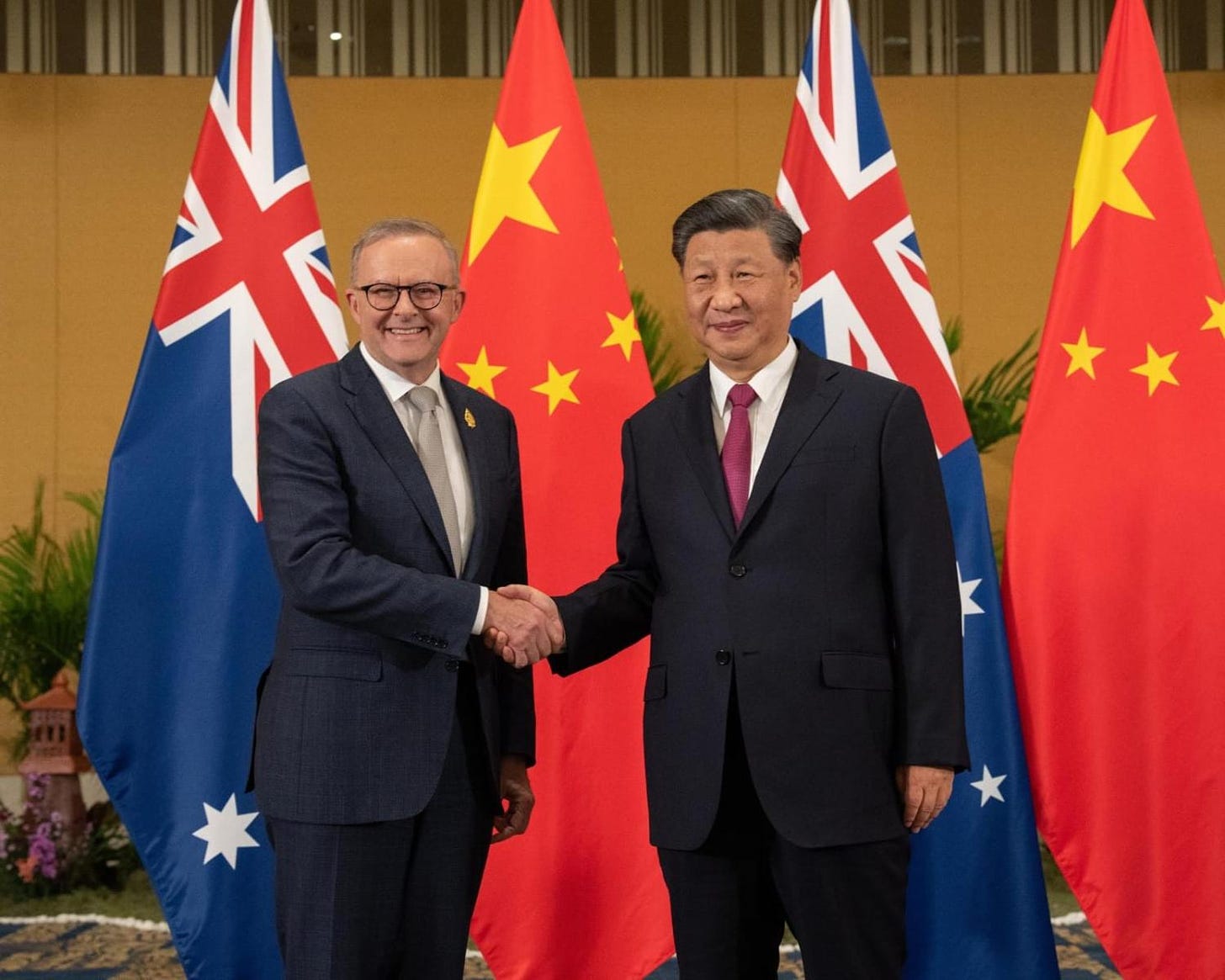

Australia & our relationship with China

The recent G20 summit could be an important pivot point for Australia and China. We perhaps saw some signals of what to expect next year as China, on its own terms and within its own sovereignty, decides to relax lockdown measures. There’s a sense of change in the air and being in Australia, we perhaps see these things sooner than others.

China and Western relations really started to deteriorate in 2018 when the former Trump administration initiated the computer chip wars. That sent things into a spiral and we are now entering the fifth year of the impasse.

I explore the implications of China’s economic rebound more in my audio post last week, which looked into this in more detail:

The key premise is that China will make a comeback on the world stage and it comes at a time when we’re also going through a one in a lifetime energy transition. There are around 1.4 billion vehicles in the world currently powered by fossil fuels. In comparison, we estimate 6-7 million electric vehicles in the world and the number is expected to rise to 150-200 million by 2030. The adoption curse is enormous.

China is the world’s largest manufacturer of electric cars and a major player in the supply chain for critical components. Every new car will need raw materials.

And that’s only cars, the ramifications for our entire energy ecosystem are enormous. Iron ore, lithium, nickel, copper. The transition to a cleaner economy will require all of these inputs.

That’s why we’re so bullish on Australia. Not only do we have world-class resources, but also a cultural and geographic connection to Asia unlike Latin America or Canada. Around 6% of Australia’s population have Chinese ancestry and the recent political tension has highlighted a sense of unease among the social and business community fabric, which policymakers are aware of.

In some parts of metropolitan Sydney and Melbourne, Chinese language is spoken by 10-15% of the population.

Australian property is underpinned by strong economy

An investment in Australian real estate is really an investment in the country’s future economic fortunes. We can look at the weekly auction rates, price movements here and there all we like. At the end of the day, Australia is perfectly placed to become the Saudi Arabia of the Pacific, a term I learnt from a key mentor of mine when I was starting out in the investment space 20 years ago.

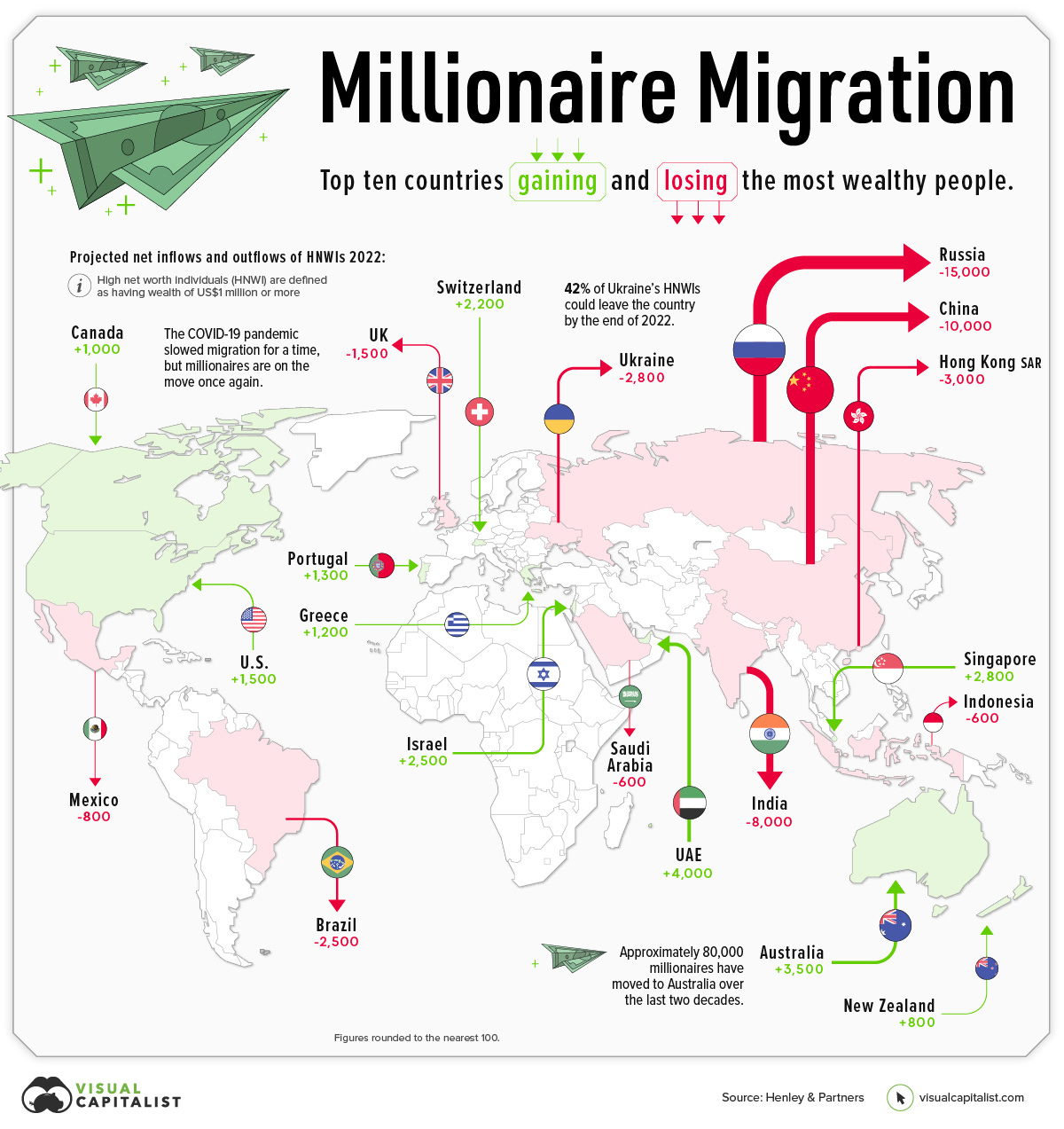

Australia attracted the second-highest amount of millionaires migrating out of their home country. The smart money wants to come here.

A normalisation of Chinese relations, coupled with a weaker US dollar and higher commodity prices, is one of the most compelling investment themes to drive Australia (and to a lesser extent New Zealand) economies over the next decade.

That could be the cushion to provide a soft landing from rising rates. Australia might not be winning at the football world cup, but it is competing and we always punch above our weight.