Australia and Canada could emerge in better shape than US

Both the Reserve Bank of Australia (RBA) and Bank of Canada (BOC) surprised markets this week with more dovish policy statements. The RBA did increase rates, as expected, while BOC rates remained on hold after rising swiftly last year.

We’ve written about the relationship between Australia and Canada previously and often see both countries, taken together, as a potential precursor for the much larger US economy.

The outlook for both Australia and Canada is currently clouded by a number of challenges, including slowing growth, high inflation, and declining household spending. Both countries have relatively short term lending markets, which means rate movements are felt quicker and sharper among the residential real estate segment.

Another key factor that has historically linked Australia and Canada is their reliance on commodity exports, particularly to China. Both countries have benefited greatly from the Chinese economic boom of the past two decades, with rising demand for raw materials driving up prices and boosting their export revenues.

Reliance on commodity exports has also made both countries vulnerable to fluctuations in global demand and prices, as well as to shifts in Chinese economic policy. The Chinese recovery is taking a little longer than expected, as we wrote two weeks ago.

So the contribution to GDP from commodities and timing is uncertain.

The main dovishness from central banks this month has been around the implications for housing. In recent years, both Australia and Canada have also experienced significant housing booms, with rising prices and high levels of household debt.

While these booms have supported economic growth and consumer spending, they have also created risks of financial instability and a potential housing market correction. Rate rises have started to bite and there is somewhat of a lagged effect yet to flow through.

The modest decline in housing prices in both countries is a key concern for policymakers, as it could lead to a sharp contraction in household spending and a broader economic slowdown. In Australia, supply of housing is very tight and has provided somewhat of a cushion to falling demand, limiting house price declines.

Aussie building permits slumped by 28% in January, their biggest fall in more than 25 years. The RBA acknowledge “Rents are increasing at the fastest rate in some years, with vacancy rates low in many parts of the country.” That’s due to supply problems.

Tight jobs markets

The jobs market still remains strong across both countries, despite reported job losses starting to ramp up. This is where central bankers will be focused on in coming months. The US is struggling with this exact same issue, but is willing to push rates much higher to solve the problem.

Australia and Canada are a little more cautious and see pain on the horizon. This is where the RBA, BOC and US Federal Reserve are now shifting away from each other. The RBA notes “Many firms continue to experience difficulty hiring workers, although some report a recent easing in labour shortages. As economic growth slows, unemployment is expected to increase.”

The BOC didn’t note job weakness in its statement, but did say “Restrictive monetary policy continues to weigh on household spending, and business investment has weakened alongside slowing domestic and foreign demand.”

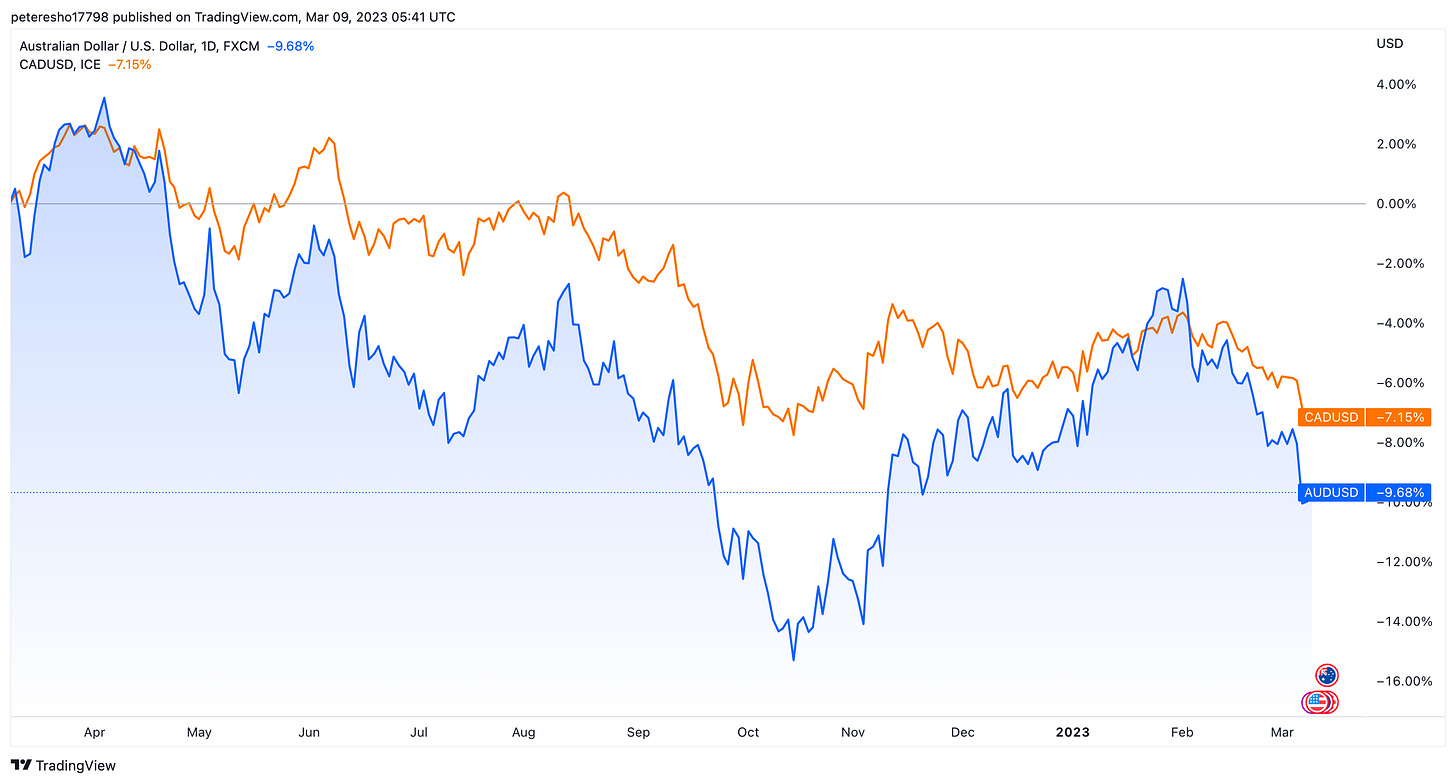

The Aussie and Canada dollars took a dive this week against the US dollar based on this narrative. The Aussie admittedly hit much harder.

The key here is that Australia and Canada are starting to recognise weakness, albeit small. If data over the next few months confirms these worries, we could see the RBA move to a pause position like the BOC all while the Fed goes about its massive hike regime. Then, at some point, something will crack.

Cracks could appear in US

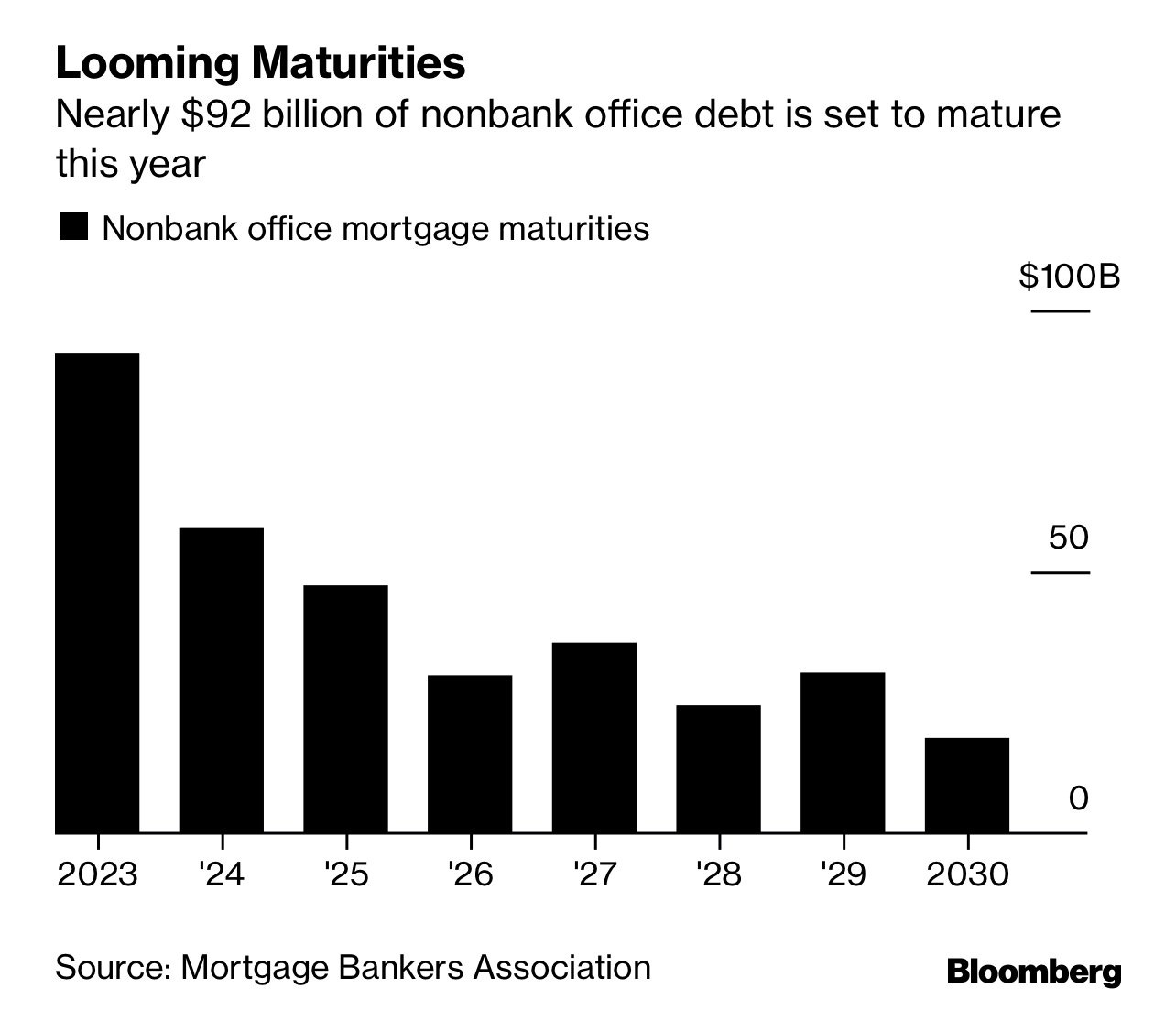

We’re already hearing anecdotal evidence of commercial real estate pressures mounting in the US market. This is before another 50 basis point rise, now being repriced by the market. We estimate that 48% of US commercial real estate loans are on floating rates and a large majority of them are due to expire this year and next year.

With all that in mind, our long term view is that Australia and Canada would weather the storm much better than the US should we see a hard landing scenario.

The short term interest rate differential might be negative relative to rising US rates and both currencies are likely to see selling pressure in the coming months. But the prudence at the RBA and BOC in holding back to see how data comes through could pay off into softer landings down the land, resulting in less cuts and perhaps even rallies late 2023 as the rate differential unwinds.

Australia and Canada are good long term bets, their currencies attractive long term plays relative to the very expensive US dollar.

The US Fed is in a completely different world, looking to re-establish its credibility. The only problem is, it might push too hard and cause a blow up somewhere, which brings pressure to cut rates again.

Each week we use classical artwork in our thumbnail links as a source of inspiration. See this week’s artwork here.