A historic week in Switzerland

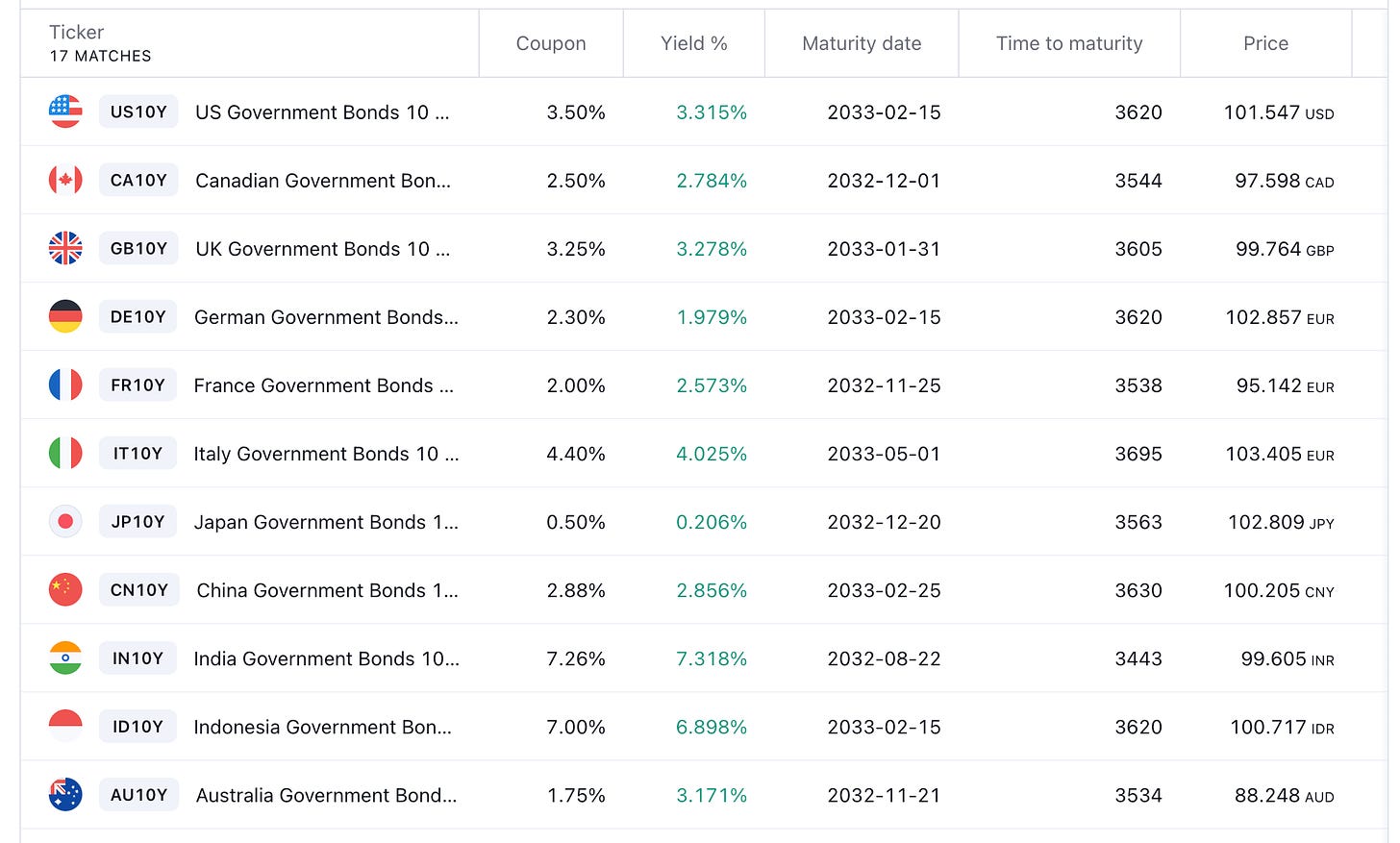

Credit Suisse has fallen, and once again, it seems like the Swiss central bank stepped in before the inevitable, with UBS taking over. Our real estate focus this week is on the ramifications, with bond yields continuing to slump meaningfully.

Investors are seeing something ugly on the horizon. We are now in the midst of a global banking storm, there’s no doubt about it.

By the time you read this note, most of the numbers above would have changed. Whether they go up or down depends on swift central bank action. Despite recent efforts, we think that it’s now too hard to contain the contagion and the best case scenario is more turmoil until a significant pivot in rate policy eases market concerns.

The biggest near term risk we see, outside an unknown event, is problems in the commercial real estate market. We have been stressing this point over the past couple of weeks.

The shadow nature of the commercial real estate market, particularly in large and diverse economies like the United States, means that short term issuance will start to roll into concerns. With Credit Suisse now history, everyone will be watching over their shoulder to see where they have counterparty risk.

Here’s how we think the next week will play out for real estate:

Credit default swaps start rising with issues in regional banks continuing.

Unease around the office subclass of commercial real estate comes to surface

Central banks get uneasy and start to slowly abandon the recent rate hike narrative.

Financial stability takes over price stability

Bitcoin, gold and other “rare” assets rally while oil and industrial commodities struggle

The Yen rallies as safe haven buying takes place

Residential real estate starts to move higher in anticipation of lower rates and investors moving their money from banks into bricks and mortar.

History has taught us not to predict markets, we could very well be humbled in a few days with something completely contrary to our view. But it’s hard to see, as of the time of writing, how commercial real estate in the United States escapes this fallout.

Each week we use classical artwork in our thumbnail links as a source of inspiration. See this week’s artwork here.